- Israel

- /

- Construction

- /

- TASE:ASHG

Is Ashtrom Group (TASE:ASHG) Now Overvalued After Its Strong Rebound in Sales and Profit?

Reviewed by Simply Wall St

Ashtrom Group (TASE:ASHG) just turned in a much stronger third quarter, with sales and profit both climbing versus last year. That earnings momentum is now front and center for investors.

See our latest analysis for Ashtrom Group.

Yet despite this solid earnings beat, the latest share price of ₪72.55 leaves Ashtrom with only a mid teens year to date share price return and a high single digit one year total shareholder return, which suggests that sentiment is improving but still cautious.

If Ashtrom's latest results have you thinking about what else might be quietly gaining traction, now could be a smart time to explore fast growing stocks with high insider ownership.

With profits rebounding sharply but the share price only grinding higher, the key question now is whether Ashtrom is still trading below its true value or if the market is already baking in that earnings power.

Price-to-Earnings of 28.9x: Is it justified?

On a price-to-earnings basis, Ashtrom Group's 28.9x multiple at a last close of ₪72.55 looks rich relative to several benchmarks and peers.

The price-to-earnings ratio compares what investors are paying today for each unit of current earnings. This is a key lens for a cyclical, capital intensive construction and property group like Ashtrom.

Ashtrom's 28.9x multiple sits below the broader Construction industry average of 34.6x and well below the peer average of 40.1x. However, it still stands almost double the Asian Construction industry average of 14.7x. This points to the market assigning the company a premium price tag despite earnings having declined by over 30% annually over the past five years and only recently returning to profitability.

Compared with the Asian Construction industry average price-to-earnings of 14.7x, Ashtrom's 28.9x multiple implies investors are paying a markedly higher price for each shekel of earnings. Earnings quality has been affected by large one off items and long term profit trends have been negative, so the market appears to be pricing in a meaningful rebound in sustainable profitability rather than current fundamentals alone.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 28.9x (OVERVALUED)

However, lingering earnings volatility and sensitivity to Israel's construction cycle could quickly undermine the premium valuation if project pipelines or margins disappoint.

Find out about the key risks to this Ashtrom Group narrative.

Another View: DCF Flags a Very Different Story

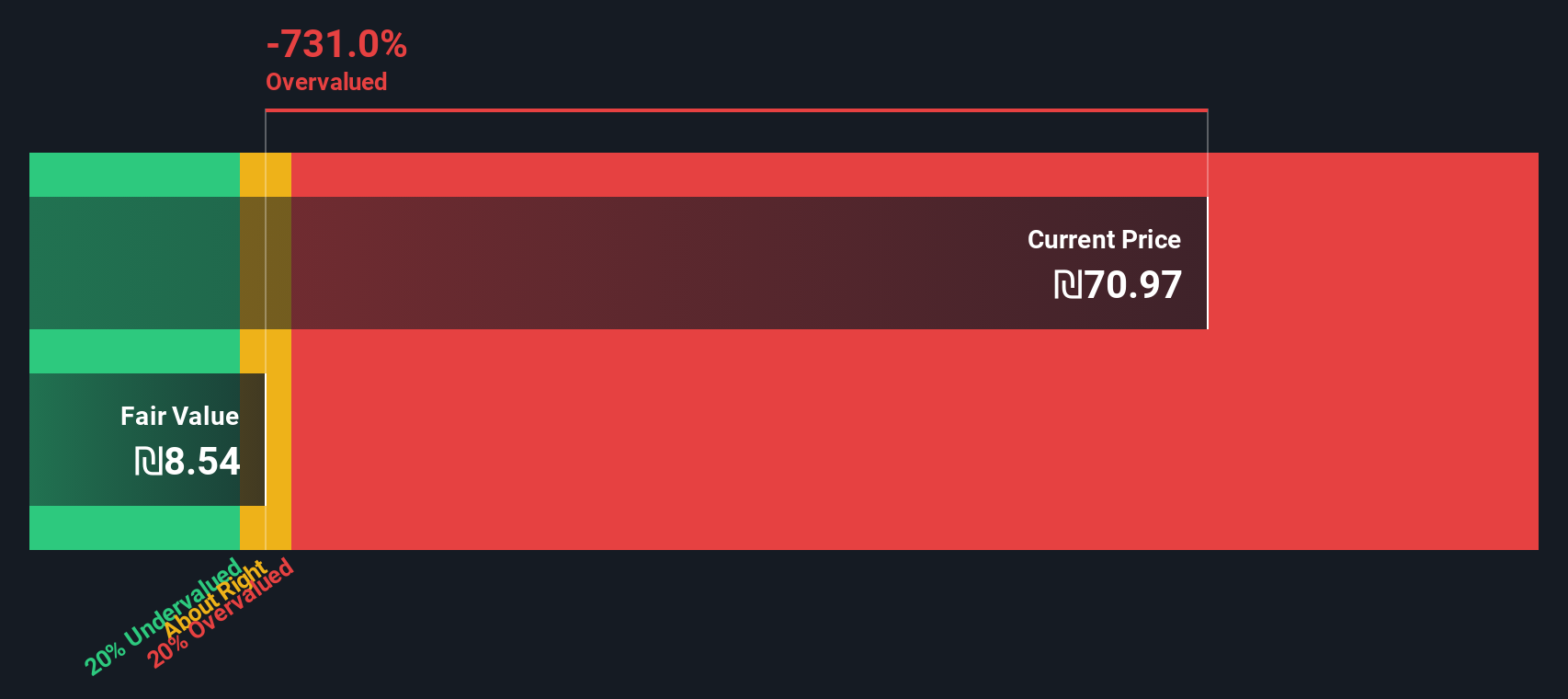

While the 28.9x earnings multiple already looks demanding, our DCF model paints an even starker picture. It suggests fair value closer to ₪8.55 per share, well below the current ₪72.55. Is the market paying up for a durable turnaround or simply ignoring downside risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ashtrom Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ashtrom Group Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Ashtrom Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single stock when smarter opportunities are waiting, use the Simply Wall St Screener now and upgrade your watchlist with stronger prospects.

- Unlock potential long term compounding by targeting reliable income payers through these 14 dividend stocks with yields > 3% that meet your yield and quality standards.

- Capitalize on rapid innovation by zeroing in on companies powering the next wave of intelligent automation using these 25 AI penny stocks.

- Seize mispriced opportunities before the crowd catches on with these 920 undervalued stocks based on cash flows that still trade below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ASHG

Ashtrom Group

Operates as a construction and property company in Israel and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026