Here's Why I Think Bank Hapoalim B.M (TLV:POLI) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Bank Hapoalim B.M (TLV:POLI). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Bank Hapoalim B.M

Bank Hapoalim B.M's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Bank Hapoalim B.M's EPS has grown 21% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

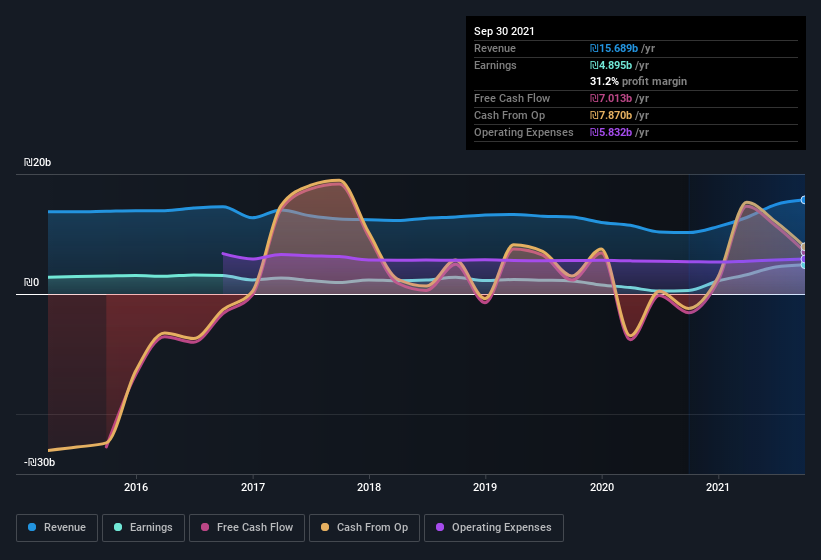

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Bank Hapoalim B.M's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Bank Hapoalim B.M maintained stable EBIT margins over the last year, all while growing revenue 53% to ₪16b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Bank Hapoalim B.M's forecast profits?

Are Bank Hapoalim B.M Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations over ₪26b, like Bank Hapoalim B.M, the median CEO pay is around ₪5.1m.

The Bank Hapoalim B.M CEO received ₪3.0m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Bank Hapoalim B.M To Your Watchlist?

For growth investors like me, Bank Hapoalim B.M's raw rate of earnings growth is a beacon in the night. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Bank Hapoalim B.M (at least 1 which can't be ignored) , and understanding these should be part of your investment process.

Although Bank Hapoalim B.M certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bank Hapoalim B.M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:POLI

Bank Hapoalim B.M

Provides various banking and financial services in Israel and internationally.

Flawless balance sheet average dividend payer.