Bank Hapoalim (TASE:POLI): Examining Valuation Following Recent Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Bank Hapoalim B.M.

It’s been a solid stretch for Bank Hapoalim B.M, with the latest share price holding at ₪67.32 and the 1-year total shareholder return climbing close to 1%. This signals steady momentum and resilience compared to many of its banking peers.

If today’s steady performance has you curious about broader market trends, now’s a great moment to branch out and discover fast growing stocks with high insider ownership

But with shares hovering near recent highs and only a modest discount to analyst price targets, the real question is whether Bank Hapoalim B.M is currently undervalued or if future growth is already reflected in the price.

Most Popular Narrative: 5.9% Undervalued

Bank Hapoalim B.M’s most tracked narrative places its fair value price modestly above the last close, suggesting investors see some upside if growth levers pan out. This view hinges on operational strength and digitization, and anticipates potential resilience through uncertainty.

*Robust investment in digital banking capabilities and cost discipline have driven a best-in-class cost-income ratio (33.8%) and positive operating leverage, suggesting operational efficiency gains will further enhance net margins over time.*

Curious what powers this upbeat valuation? The narrative banks on a unique mix of digital momentum, scale leverage, and a profit profile that breaks the mold for traditional banks. Explore the bold assumptions and forecasts shaping this price view in the full story.

Result: Fair Value of $71.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several factors could challenge this outlook, including one-off profit boosts or a slowdown in the Israeli mortgage market, both of which could impact future earnings.

Find out about the key risks to this Bank Hapoalim B.M narrative.

Another View: Earnings Multiple Suggests a Cautious Outlook

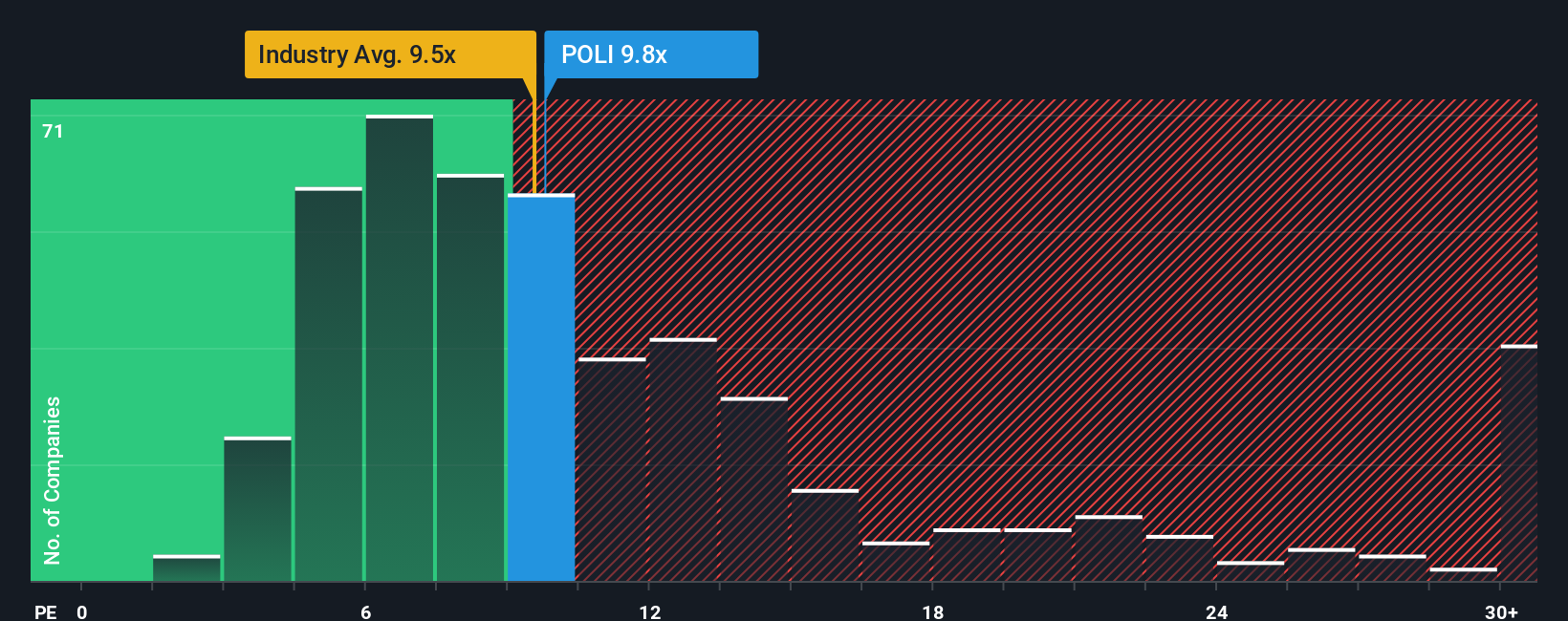

Looking at Bank Hapoalim B.M through the lens of its key valuation multiple, the shares trade at 10.5 times earnings. This is pricier than the industry average (9.6x), its closest peers (9.9x), and even above the fair ratio for the business (9.8x). This premium suggests that the market may already be factoring in much of the bank’s strengths, which could mean there is less opportunity for a significant increase in value if growth meets expectations. Could this signal limited upside, or is the market expecting something more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank Hapoalim B.M Narrative

If you have a different perspective or want to dig into the numbers yourself, you can piece together your own view in just a few minutes. Do it your way

A great starting point for your Bank Hapoalim B.M research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by checking out more investment opportunities. The Simply Wall Street Screener highlights real growth trends, smart value picks, and sectors that might just surprise you. Don’t let great stocks pass you by. Take action now and add more winners to your watchlist.

- Tap into fast growth with companies harnessing artificial intelligence by checking out these 24 AI penny stocks already reshaping entire industries.

- Capture income potential by scouting out these 19 dividend stocks with yields > 3% with strong yields and a track record of consistent payouts.

- Spot under-the-radar value with these 909 undervalued stocks based on cash flows that may be trading for less than their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Hapoalim B.M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:POLI

Bank Hapoalim B.M

Provides various banking and financial services in Israel and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives