Assessing First International Bank of Israel (TASE:FIBI) Valuation After Subtle Shifts in Investor Sentiment

Reviewed by Kshitija Bhandaru

First International Bank of Israel (TASE:FIBI) Catches Investors' Eyes After Subtle Moves

For investors watching First International Bank of Israel (TASE:FIBI), recent shifts in the stock might have caught your eye, even if the news is not tied to a dramatic event. Sometimes, a string of quiet price changes can be just as telling, especially for those wondering whether the market is in the early stages of revaluing the company. When well-known names like FIBI catch a bit of movement against a backdrop of silence, seasoned investors often ask if it is the calm before something bigger.

Looking back, FIBI’s stock has delivered a solid 58% gain over the past year and is up 21% year-to-date. While momentum has cooled a bit in recent months, with declines across the past week and month, longer-term shareholders are still sitting on healthy returns. This performance sits against a year of moderate revenue decline, suggesting some headwinds, but that has not erased the stock’s overall upward trajectory.

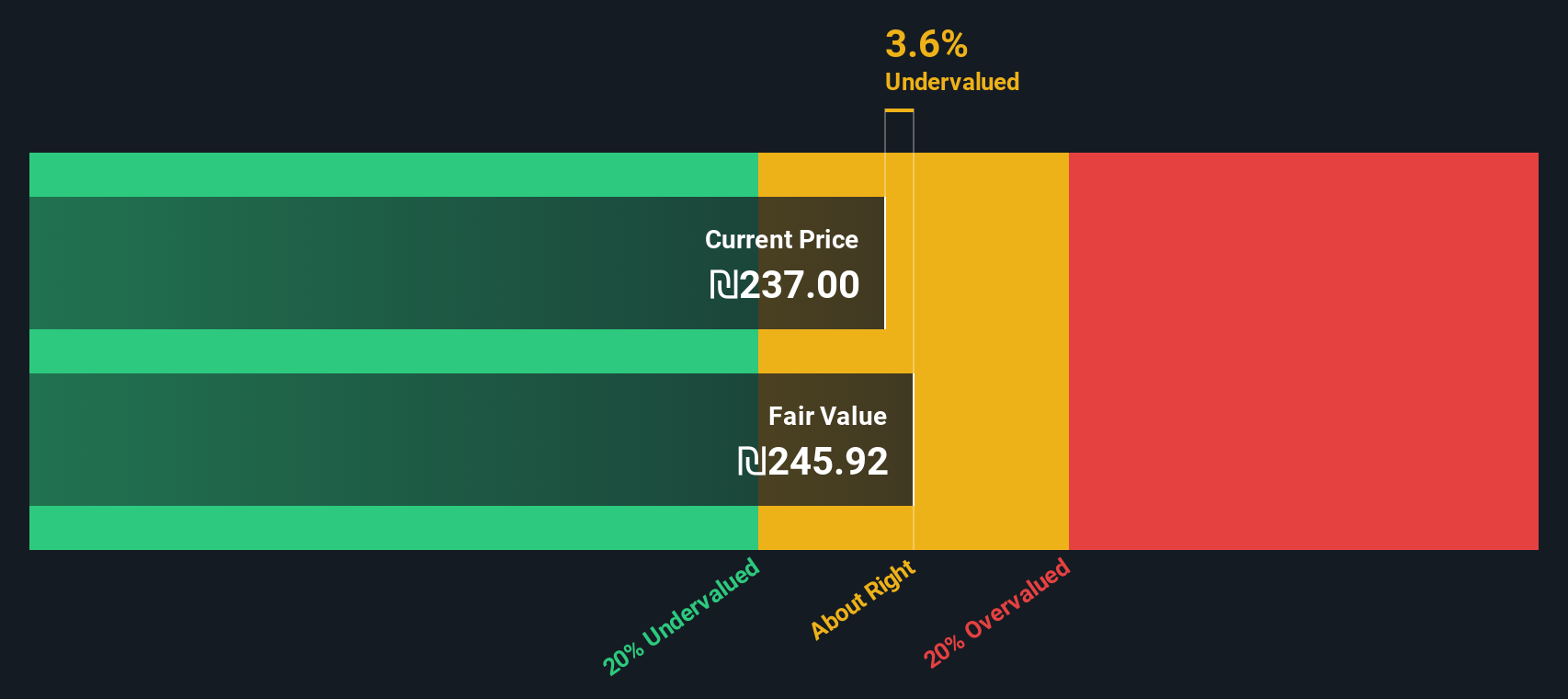

So, after this year’s run-up and recent cooling, is FIBI an undervalued opportunity waiting to be seized, or has the market already priced in the growth story?

Price-to-Earnings of 9.3x: Is it justified?

Based on the preferred price-to-earnings (P/E) ratio, FIBI’s valuation appears slightly expensive compared to its closest peer group, but reasonable against broader Asian bank averages.

The price-to-earnings ratio tells investors how much they are paying for each unit of earnings. For banks, a lower P/E often suggests the market expects slower growth or sees higher risks. FIBI’s 9.3x multiple is higher than its peer average of 8.7x, but a touch below the Asian banks’ average of 9.5x. This indicates it sits in the middle of the valuation range for its sector.

This suggests that while FIBI is not priced as a bargain in its peer set, its multiple could reflect market expectations for stable performance or quality, rather than dramatic outperformance. Investors may be signaling caution or waiting for clearer growth signals before justifying a premium valuation.

Result: Fair Value of ₪304.74 (UNDERVALUED)

See our latest analysis for First International Bank of Israel.However, slowing revenue growth and recent stock declines could turn investor sentiment quickly, particularly if broader banking sector pressures worsen.

Find out about the key risks to this First International Bank of Israel narrative.Another View: The DCF Angle

While a look at the company’s price-to-earnings ratio raises questions about whether FIBI is fairly valued, our DCF model tells a different story. This suggests there could still be upside potential. Which approach best captures the real value?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First International Bank of Israel Narrative

If you have a different perspective or would rather dive into the numbers firsthand, you can shape your own analysis quickly and easily with Do it your way.

A great starting point for your First International Bank of Israel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their options. The best opportunities sometimes hide where others are not looking, so use the tools that help you stay ahead.

- Spot untapped value by targeting high-potential companies trading below fair value and launch your search with undervalued stocks based on cash flows.

- Grow your wealth with reliable income streams, starting with a focused hunt for stable businesses offering attractive yields. Check out dividend stocks with yields > 3%.

- Jump into the cutting edge by finding companies at the forefront of quantum breakthroughs with quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FIBI

First International Bank of Israel

Provides various financial and banking services to individuals, households, and businesses in Israel.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives