Middle Eastern Penny Stocks Under US$40M Market Cap: 3 Companies To Watch

Reviewed by Simply Wall St

As Gulf bourses experience a downturn ahead of key U.S. economic data, investors in the Middle East are navigating a cautious market landscape. Despite current challenges, penny stocks remain an intriguing area for those seeking growth opportunities at lower price points. Often representing smaller or newer companies, these stocks can offer significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.22 | SAR1.29B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.63 | ₪188.56M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.24 | AED670.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.90 | SAR980M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.22 | AED369.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.75 | AED15.86B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.84 | AED498.77M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.612 | ₪205.04M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ihlas Gazetecilik (IBSE:IHGZT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ihlas Gazetecilik A.S. engages in the publishing, selling, distributing, and marketing of newspapers, books, encyclopedias, brochures, and magazines both in Turkey and internationally with a market cap of TRY1.34 billion.

Operations: The company generates revenue primarily from its newspaper publishing segment, amounting to TRY1.90 billion.

Market Cap: TRY1.34B

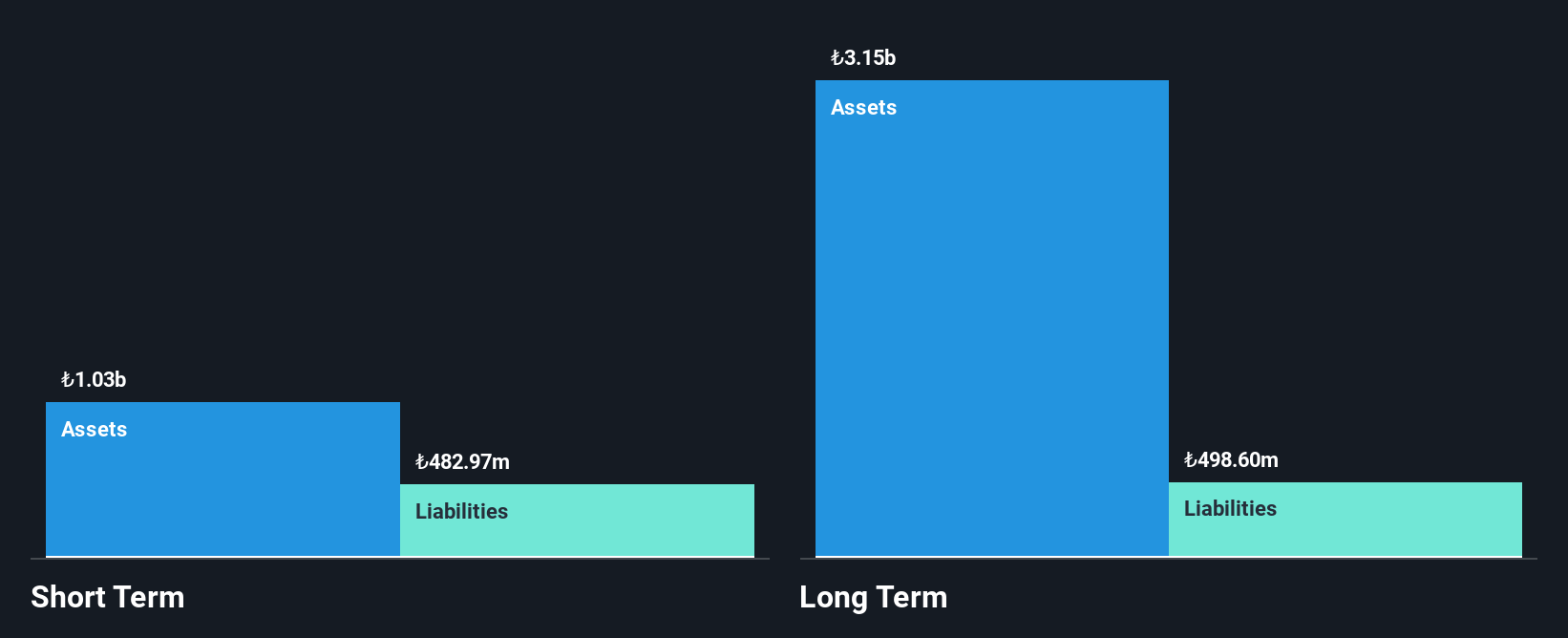

Ihlas Gazetecilik A.S. has shown progress in stabilizing its financial position, becoming profitable over the past year despite a large one-off loss impacting recent results. The company is debt-free, with short-term assets exceeding both short- and long-term liabilities, indicating solid liquidity. Its Price-To-Earnings ratio of 4.8x suggests it may be undervalued compared to the broader Turkish market. Recent earnings reports highlight improved sales figures, though net losses persist but have narrowed significantly from previous years. The board's experienced tenure and lack of shareholder dilution further support its potential as a penny stock consideration in the region.

- Click here to discover the nuances of Ihlas Gazetecilik with our detailed analytical financial health report.

- Learn about Ihlas Gazetecilik's historical performance here.

Allmed Solutions (TASE:ALMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Allmed Solutions Ltd develops, manufactures, and markets minimally invasive medical products across various disciplines both in Israel and internationally, with a market cap of ₪32.77 million.

Operations: Allmed Solutions Ltd has not reported any specific revenue segments.

Market Cap: ₪32.77M

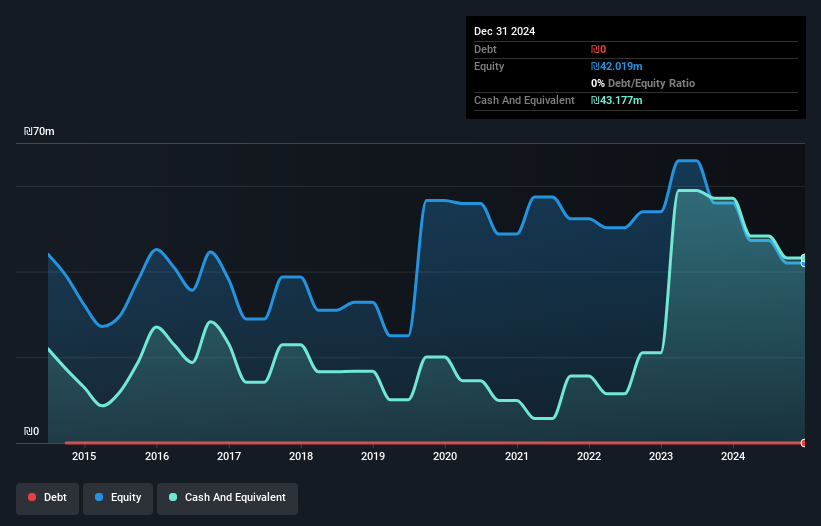

Allmed Solutions Ltd, with a market cap of ₪32.77 million, operates in the medical equipment sector but remains pre-revenue, generating less than US$1 million. Despite being unprofitable and experiencing increased losses at a rate of 49.9% annually over the past five years, it benefits from a strong cash position with sufficient runway for over three years without debt concerns. The management team and board are experienced with average tenures of 3.8 and 6.2 years respectively, while shareholder dilution has not been significant recently. Short-term assets comfortably cover both short- and long-term liabilities, indicating sound liquidity management.

- Navigate through the intricacies of Allmed Solutions with our comprehensive balance sheet health report here.

- Gain insights into Allmed Solutions' historical outcomes by reviewing our past performance report.

Tgi Infrastructures (TASE:TGI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tgi Infrastructures Ltd, along with its subsidiary, specializes in producing, processing, assembling, and marketing magnesium-based mechanical assemblies for the automotive industry in Israel; it has a market cap of ₪205.04 million.

Operations: Tgi Infrastructures generates revenue primarily from two segments: Infrastructure and Energy, contributing ₪79.25 million, and The Metal and Electrical Industries, contributing ₪86.25 million.

Market Cap: ₪205.04M

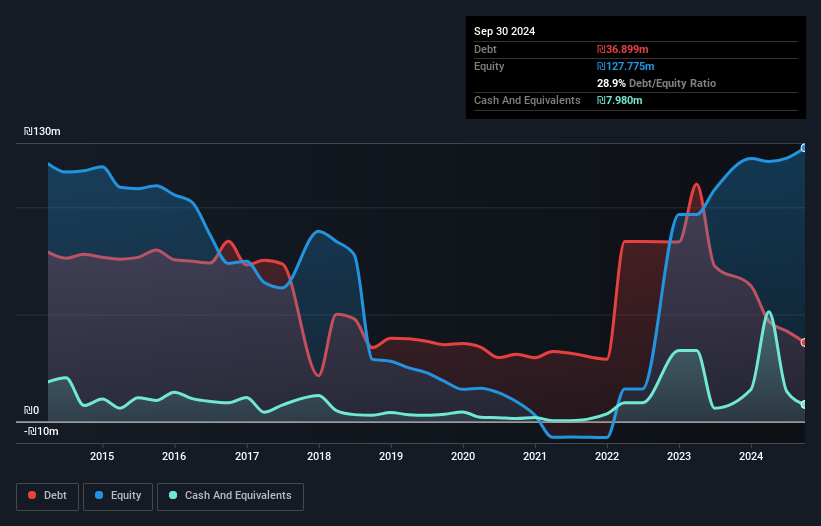

Tgi Infrastructures, with a market cap of ₪205.04 million, operates in the automotive sector and has demonstrated robust financial stability. Its recent earnings report shows sales of ₪125.07 million for the first nine months of 2025, with net income rising to ₪12.11 million from a year ago. The company maintains strong liquidity, as short-term assets significantly exceed liabilities, and it has effectively reduced its debt-to-equity ratio over five years to 32.5%. Despite an unstable dividend history, Tgi's earnings growth outpaces the industry average and is supported by high-quality earnings and satisfactory interest coverage on debt obligations.

- Unlock comprehensive insights into our analysis of Tgi Infrastructures stock in this financial health report.

- Evaluate Tgi Infrastructures' historical performance by accessing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 81 Middle Eastern Penny Stocks right here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHGZT

Ihlas Gazetecilik

Ihlas Gazetecilik A.S. publishes, sells, distributes, and markets newspapers, books, encyclopedias, brochures, and magazines in Turkey and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)