- South Korea

- /

- Machinery

- /

- KOSE:A010140

Vestas Wind Systems Leads 3 Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

Global markets have shown mixed performance recently, with small-cap and value shares outpacing large-cap growth stocks. Despite some significant midweek sell-offs, overall earnings for the S&P 500 are predicted to have risen compared to the same quarter last year. In this context, identifying undervalued stocks can be particularly rewarding. These stocks are trading below their intrinsic value and offer potential for growth as market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥161.50 | CN¥322.64 | 49.9% |

| Gränges (OM:GRNG) | SEK130.60 | SEK259.41 | 49.7% |

| Marriott Vacations Worldwide (NYSE:VAC) | US$85.45 | US$169.56 | 49.6% |

| LITALICO (TSE:7366) | ¥1331.00 | ¥2639.15 | 49.6% |

| Cyber Security Cloud (TSE:4493) | ¥2176.00 | ¥4314.63 | 49.6% |

| Duckhorn Portfolio (NYSE:NAPA) | US$7.21 | US$14.41 | 50% |

| RaySearch Laboratories (OM:RAY B) | SEK139.40 | SEK277.70 | 49.8% |

| Smartsheet (NYSE:SMAR) | US$48.23 | US$95.76 | 49.6% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €8.376 | €16.72 | 49.9% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.47 | CN¥18.84 | 49.7% |

Let's dive into some prime choices out of the screener.

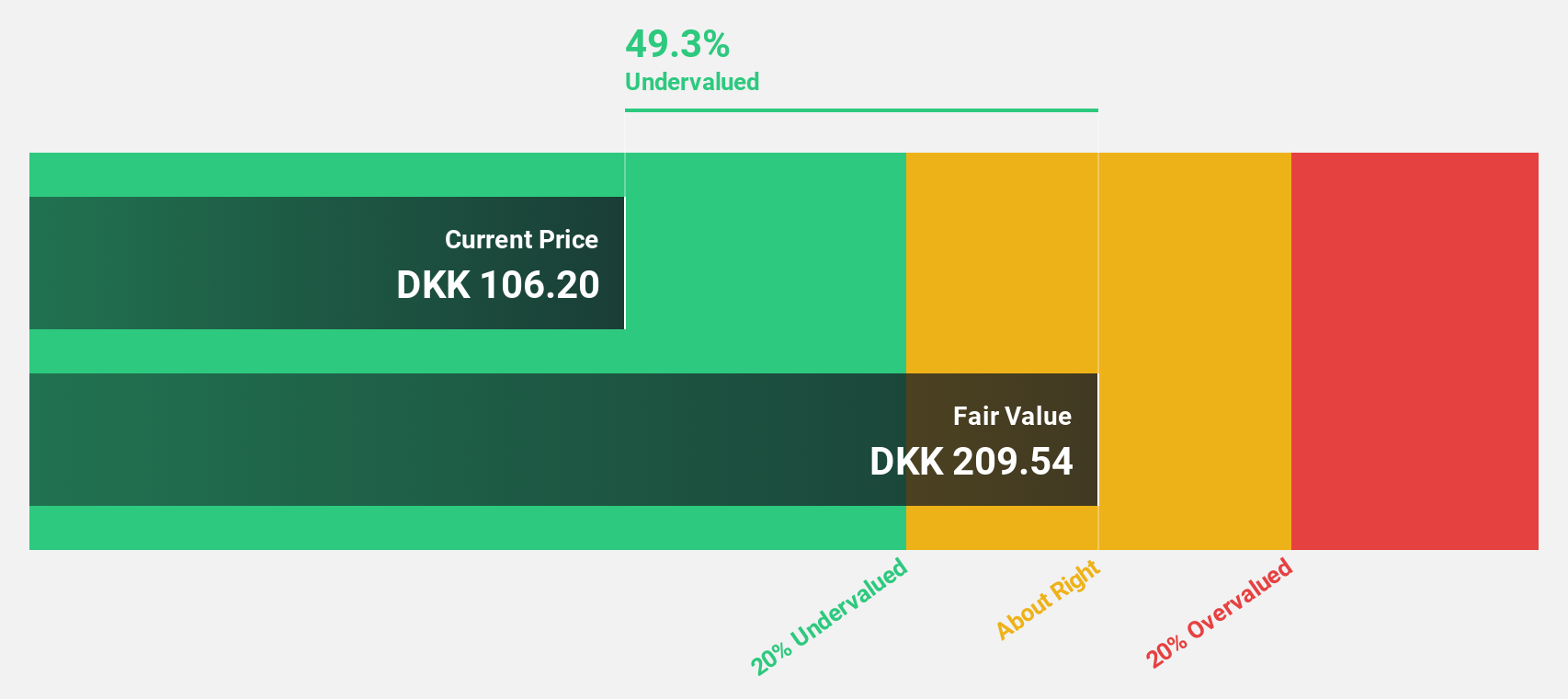

Vestas Wind Systems (CPSE:VWS)

Overview: Vestas Wind Systems A/S designs, manufactures, installs, and services wind turbines globally with a market cap of DKK167.58 billion.

Operations: Revenue segments (in millions of €): Service: 3664, Power Solutions: 11570 Vestas generates revenue primarily from its Power Solutions segment (€11.57 billion) and its Service segment (€3.66 billion).

Estimated Discount To Fair Value: 35.2%

Vestas Wind Systems is trading at DKK166.05, significantly below its estimated fair value of DKK256.24, making it highly undervalued based on discounted cash flow analysis. Despite forecasted revenue growth of 11.4% per year being slower than 20%, Vestas is expected to become profitable within three years and achieve a high return on equity (27.3%). Recent orders for large wind projects in the USA and Canada further support its strong cash flow potential and operational expansion.

- Upon reviewing our latest growth report, Vestas Wind Systems' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Vestas Wind Systems' balance sheet health report.

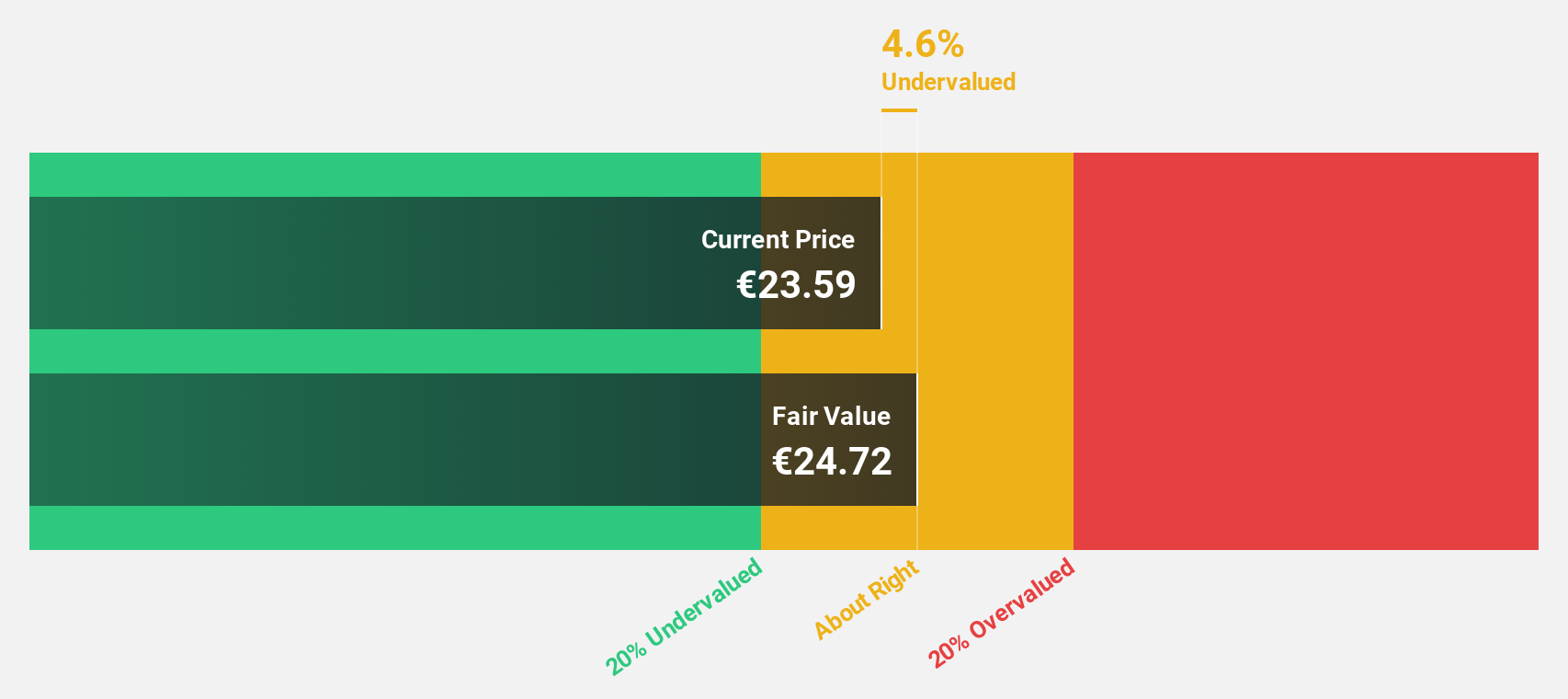

Ryanair Holdings (ISE:RYA)

Overview: Ryanair Holdings plc, with a market cap of €16.79 billion, operates scheduled-passenger airline services in Ireland, the United Kingdom, Spain, Italy, and internationally through its subsidiaries.

Operations: Ryanair Holdings generates revenue primarily through Ryanair DAC (€14.06 billion) and Other Airlines (€1.51 billion).

Estimated Discount To Fair Value: 24.3%

Ryanair Holdings is trading at €15, significantly below its estimated fair value of €19.81, indicating it may be undervalued based on discounted cash flow analysis. Despite recent earnings showing a decline in net income to €360 million from €662.9 million a year ago, the company has demonstrated strong passenger growth and maintained high load factors. Additionally, Ryanair's ongoing share buyback program and favorable legal rulings enhance its financial stability and future cash flows.

- In light of our recent growth report, it seems possible that Ryanair Holdings' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Ryanair Holdings.

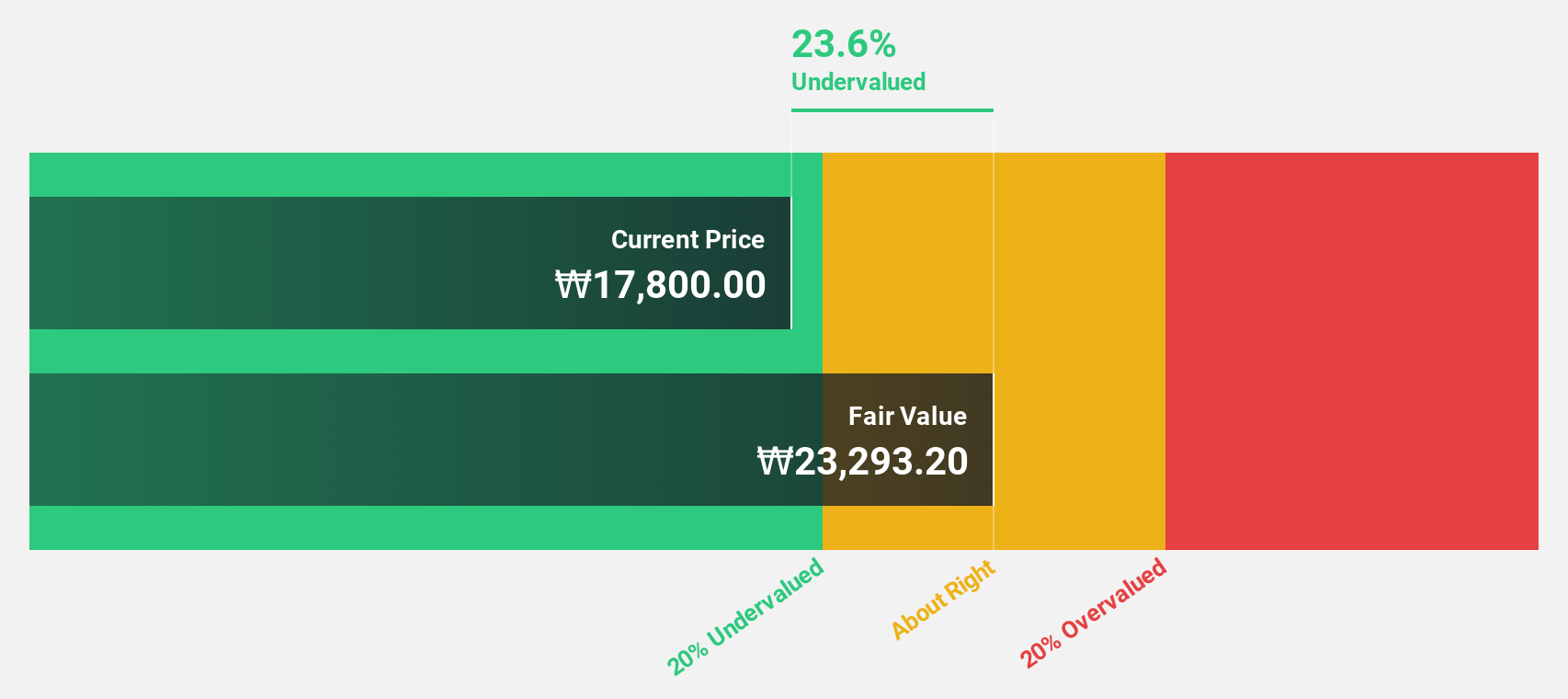

Samsung Heavy Industries (KOSE:A010140)

Overview: Samsung Heavy Industries Co., Ltd. operates in the shipbuilding, offshore, and machinery and electric systems sectors globally, with a market cap of ₩10.10 trillion.

Operations: Samsung Heavy Industries' revenue segments include Engineering (₩758.93 million) and Shipbuilding & Marine Engineering (₩8.19 billion).

Estimated Discount To Fair Value: 41.5%

Samsung Heavy Industries is trading at ₩11,640, significantly below its estimated fair value of ₩19,889.08. The company has shown earnings growth of 20.6% annually over the past five years and is expected to become profitable within three years with a projected profit growth above market average. Recent agreements with ADNOC for constructing LNG carriers further bolster its future cash flow potential despite slower revenue growth compared to industry benchmarks.

- Our earnings growth report unveils the potential for significant increases in Samsung Heavy Industries' future results.

- Dive into the specifics of Samsung Heavy Industries here with our thorough financial health report.

Taking Advantage

- Click through to start exploring the rest of the 994 Undervalued Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A010140

Samsung Heavy Industries

Engages in the shipbuilding, offshore, and energy and infra businesses worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives