Ryanair (ISE:RYA): Assessing Whether Shares Remain Undervalued After Recent Dip

Reviewed by Kshitija Bhandaru

Ryanair Holdings (ISE:RYA) has seen its stock shift slightly in recent sessions, prompting investors to take a closer look at what might be moving shares. Over the past month, the stock dipped 1%.

See our latest analysis for Ryanair Holdings.

While Ryanair’s shares have dipped slightly this month, their recent slide comes after generally steady gains, with a 1-year total shareholder return of 52%. Momentum has cooled compared to last year, but long-term investors have still seen solid rewards.

If you’re keen to look beyond airlines, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

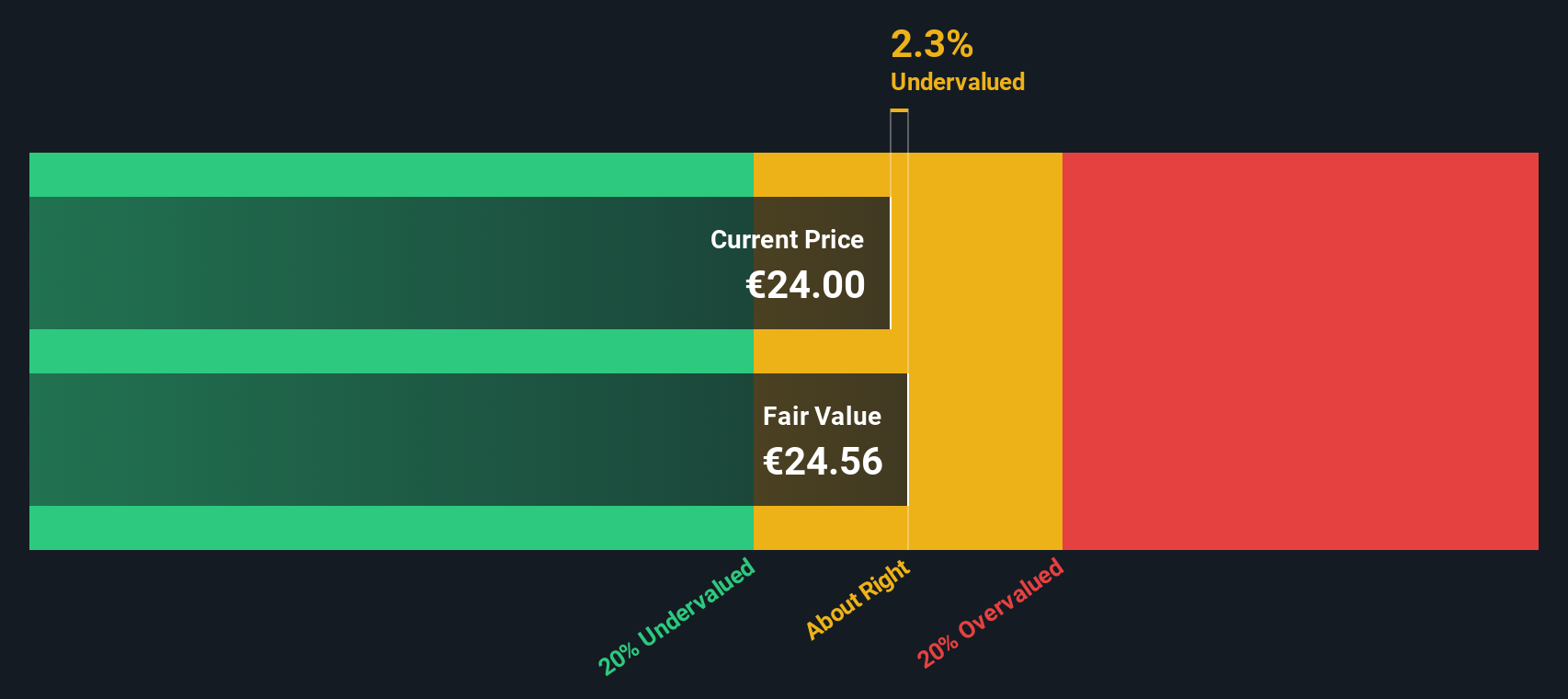

With shares pulling back after a strong run and modest growth expectations ahead, the key question is whether Ryanair is undervalued at these levels or if the market has already accounted for the company’s future prospects.

Price-to-Earnings of 12.5x: Is it justified?

Ryanair is trading at a price-to-earnings (P/E) ratio of 12.5 times, slightly lower than the peer average of 14.2x even as its share price sits at €24.47. This suggests the stock is valued a bit more conservatively compared to industry peers, potentially leaving room for upside if growth continues.

The P/E ratio measures how much investors are willing to pay for each euro of current earnings. In the airline sector, this figure can reveal market expectations for future profitability and the company’s earnings quality, which is critical in a cyclical and competitive industry like airlines.

Ryanair’s P/E multiple is below that of its direct peers, indicating its earnings are being priced less aggressively. However, relative to the global airlines industry average of 9.2x, Ryanair is valued at a premium. This reflects investor confidence in its strong growth record, high return on equity, and resilient business model. If the market were to converge towards the sector’s fair ratio level, the stock might experience some re-rating pressure if it does not maintain or accelerate its performance trajectory.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.5x (UNDERVALUED)

However, Ryanair faces headwinds from fluctuating demand and potential cost increases, which could weigh on earnings if industry conditions unexpectedly worsen.

Find out about the key risks to this Ryanair Holdings narrative.

Another View: Discounted Cash Flow Model

Taking a different approach, the SWS DCF model suggests that Ryanair’s stock is trading slightly below our estimate of its fair value (by just 0.1%). This points to a largely balanced valuation, where neither a big discount nor a premium is present. With both methods showing similar results, should investors expect major surprises from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ryanair Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ryanair Holdings Narrative

If you have your own perspective or want to look deeper into the numbers, you can easily craft your own analysis in just a few minutes. Do it your way

A great starting point for your Ryanair Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Challenge yourself to spot tomorrow’s winners by using the Simply Wall Street Screener. Don’t wait; savvy investors are already researching unique opportunities others overlook.

- Uncover new gains by tracking income from these 19 dividend stocks with yields > 3% with attractive yields and stable cash flows.

- Seize the potential in next-generation technology trends through these 24 AI penny stocks making waves in artificial intelligence innovation.

- Capture bargains before the crowd spots them and browse these 901 undervalued stocks based on cash flows for undervalued stocks based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:RYA

Ryanair Holdings

Provides scheduled-passenger airline services in Ireland, Italy, Spain, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives