How Investors May Respond To Ryanair Holdings (ISE:RYA) Appointing Capt. Ray Conway to Oversee Air Safety

Reviewed by Simply Wall St

- On September 10, 2025, the Board of Ryanair Holdings plc announced that Capt. Ray Conway will join as Non-Executive Director with oversight of Air Safety, replacing Mike O'Brien effective October 1, 2025.

- Capt. Conway's extensive tenure at Ryanair and aviation expertise may increase focus on operational leadership in air safety, a critical area for any airline.

- Let's explore how Capt. Conway's appointment with a focus on air safety could influence Ryanair Holdings' investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ryanair Holdings' Investment Narrative?

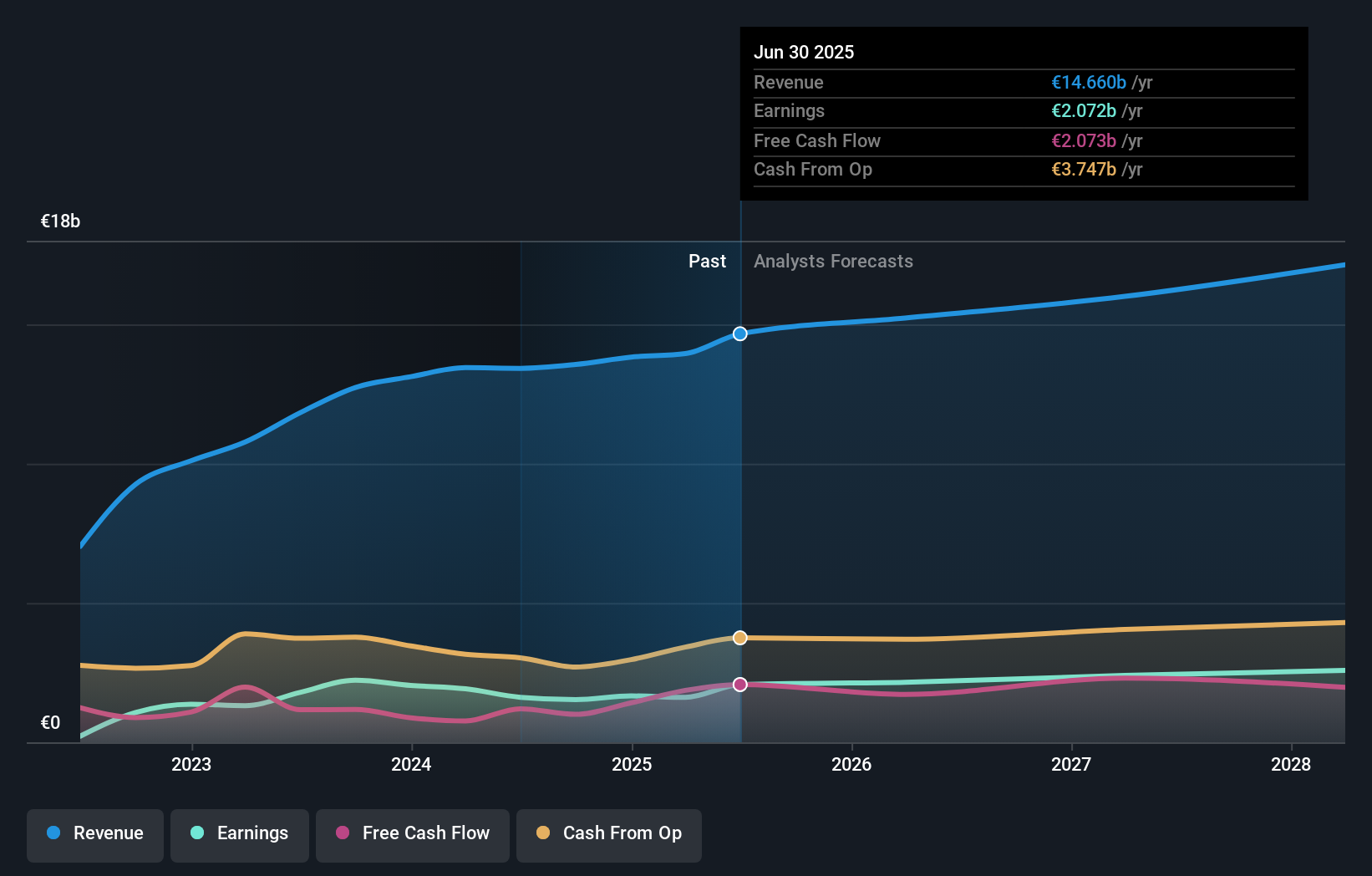

For investors considering Ryanair Holdings, the big picture is all about operational execution amid a mix of solid passenger traffic, disciplined cost controls, and the ability to weather challenges like regulatory hurdles and industry-wide disruptions. The board’s recent move to appoint Capt. Ray Conway as Non-Executive Director for Air Safety signals a sharpened focus on maintaining the company’s safety track record, a core pillar for long-term confidence in any airline stock. While his aviation expertise is unlikely to have an immediate, material impact on short-term earnings or traffic results, it could strengthen Ryanair’s resilience in the face of safety-related regulatory risks, which remain a constant concern for the sector. With earnings targets and growth guidance recently confirmed, short-term catalysts still hinge on passenger numbers, fare trends, and the capacity to minimize external shocks such as air traffic control strikes.

Yet, ongoing operational risks around European flight disruptions could still impact Ryanair in unexpected ways.

Exploring Other Perspectives

Explore 8 other fair value estimates on Ryanair Holdings - why the stock might be worth just €24.33!

Build Your Own Ryanair Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ryanair Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ryanair Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ryanair Holdings' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:RYA

Ryanair Holdings

Provides scheduled-passenger airline services in Ireland, Italy, Spain, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives