Are Ryanair Shares Fairly Priced After Boeing Jet Output News in 2025?

Reviewed by Bailey Pemberton

If you’re sitting on the fence about Ryanair Holdings, you’re not alone. This stock has quietly turned heads, clocking an impressive 27.3% gain year-to-date, 54% over the past year, and more than doubling investors’ money across both the three- and five-year marks. That kind of performance isn’t just a lucky streak. Investors have clearly started to view Ryanair differently, in part due to recent news hinting at growth ahead and decreasing near-term risks. For example, discussions about Boeing increasing 737 jet output could directly support Ryanair’s fleet expansion plans. Meanwhile, positive resolutions in legal disputes and confidence over cost responsibility in tariff talks may have reduced some lingering uncertainties.

But here is where things get interesting if you’re thinking about valuation. Despite the rally, Ryanair’s value score sits at a modest 1 out of 6. That means the company only meets one of the usual benchmarks for being “undervalued.” So while the momentum and news flow look promising, does the math support further upside, or is this a case where all the good news is already priced in?

Next, we’ll break down the typical valuation checks so you can judge for yourself. And don’t worry, there’s an even more practical way to understand Ryanair’s true worth coming up at the end.

Ryanair Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ryanair Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today. This approach helps investors understand what a business is truly worth, beyond market mood swings.

For Ryanair Holdings, the latest reported Free Cash Flow stands at €1.52 billion. Analysts provide detailed projections for the next five years, forecasting growth in annual free cash flow to €1.81 billion by 2030. After five years, further projections are extrapolated based on trends and estimates. All figures are quoted in euros to match Ryanair’s reporting currency.

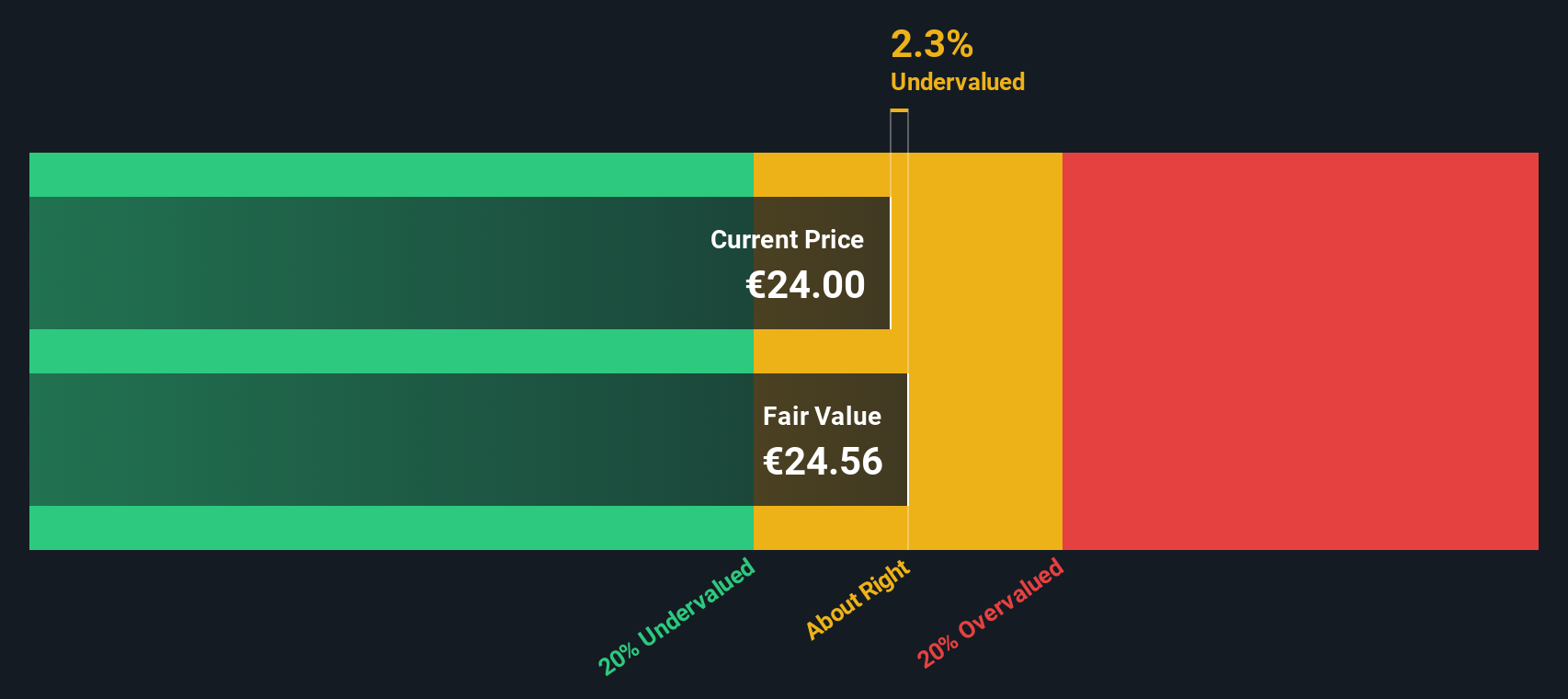

Using the 2 Stage Free Cash Flow to Equity method, the calculated intrinsic value per share comes out to €24.44. This places Ryanair’s stock at about 0.1% above its estimated fair value, meaning the stock currently looks very close to fairly valued based on its cash generation potential.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Ryanair Holdings's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Ryanair Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a commonly used valuation tool for profitable companies such as Ryanair Holdings. It shows investors how much they are paying for each euro of earnings, making it a quick way to judge whether a stock appears expensive or cheap compared to its profits.

A company's "normal" or "fair" PE ratio depends on factors like future growth expectations and financial risk. Companies expected to grow quickly or those with stable earnings can justify a higher PE, while riskier or slow-growing firms typically trade at a lower PE.

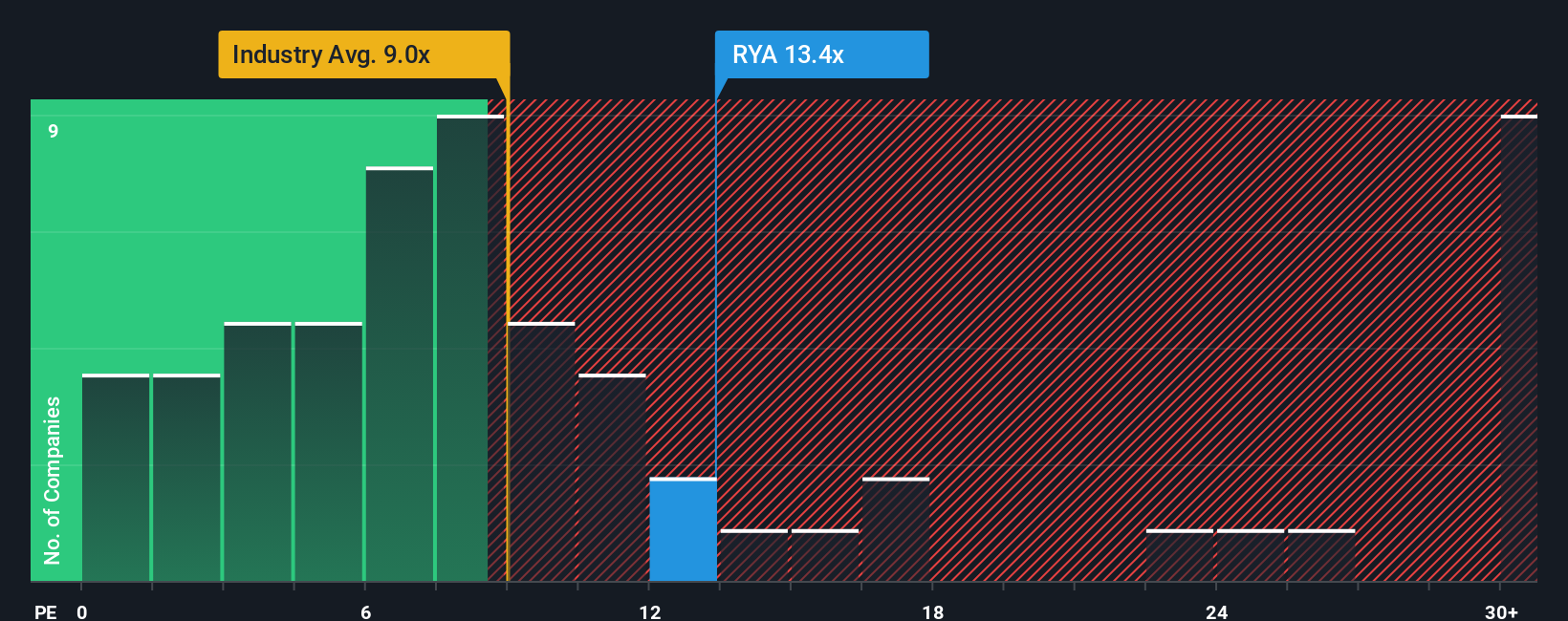

Currently, Ryanair trades at a PE ratio of 12.5x. For comparison, the average among global airline peers is 14.2x, while the broader airline industry sits lower at 9.3x. At first look, Ryanair is just below its peer group average but remains above the wider industry figure.

Simply Wall St’s proprietary “Fair Ratio” takes the comparison further by considering Ryanair’s earnings growth prospects, profit margins, size, and risk profile along with broader industry factors. This approach provides a more tailored view than simply using peer or industry averages.

At present, Ryanair’s actual PE ratio is almost identical to its Fair Ratio, which suggests the market price accurately reflects the company’s fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ryanair Holdings Narrative

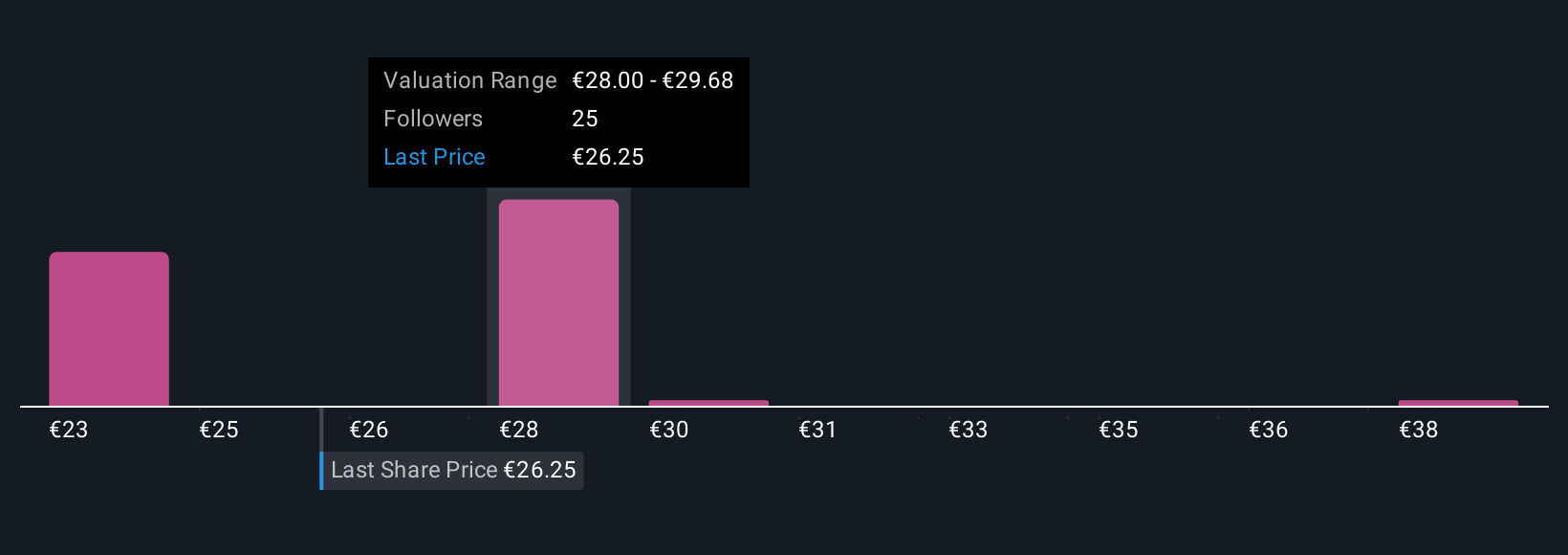

Earlier, we hinted that there’s a smarter way to bridge numbers and real-world reasoning. Now, let’s introduce Narratives. A Narrative is your interpretation of a company’s story, turning your outlook on business trends, financial assumptions, and future potential into a custom fair value. Narratives link Ryanair’s headlines, such as expansion plans or cost changes, to financial projections like future revenue, earnings, and margins. This ultimately generates a fair value you can track against today’s market price.

Accessible right on Simply Wall St’s Community page for millions of investors, Narratives let you compare your view to others, debate ideas, and quickly spot opportunities or risks as new information emerges. These tools are updated live with fresh news or earnings, so your Narrative and your buy or sell decisions stay relevant and informed.

For example, some Narratives see Ryanair as undervalued if its growth story fully plays out, while others think the current price already reflects every positive scenario. By choosing the Narrative that resonates with you, you gain a more dynamic and personalized way to make investment decisions.

Do you think there's more to the story for Ryanair Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:RYA

Ryanair Holdings

Provides scheduled-passenger airline services in Ireland, Italy, Spain, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives