- Ireland

- /

- Healthcare Services

- /

- ISE:UPR

Uniphar plc's (ISE:UPR) Business Is Trailing The Market But Its Shares Aren't

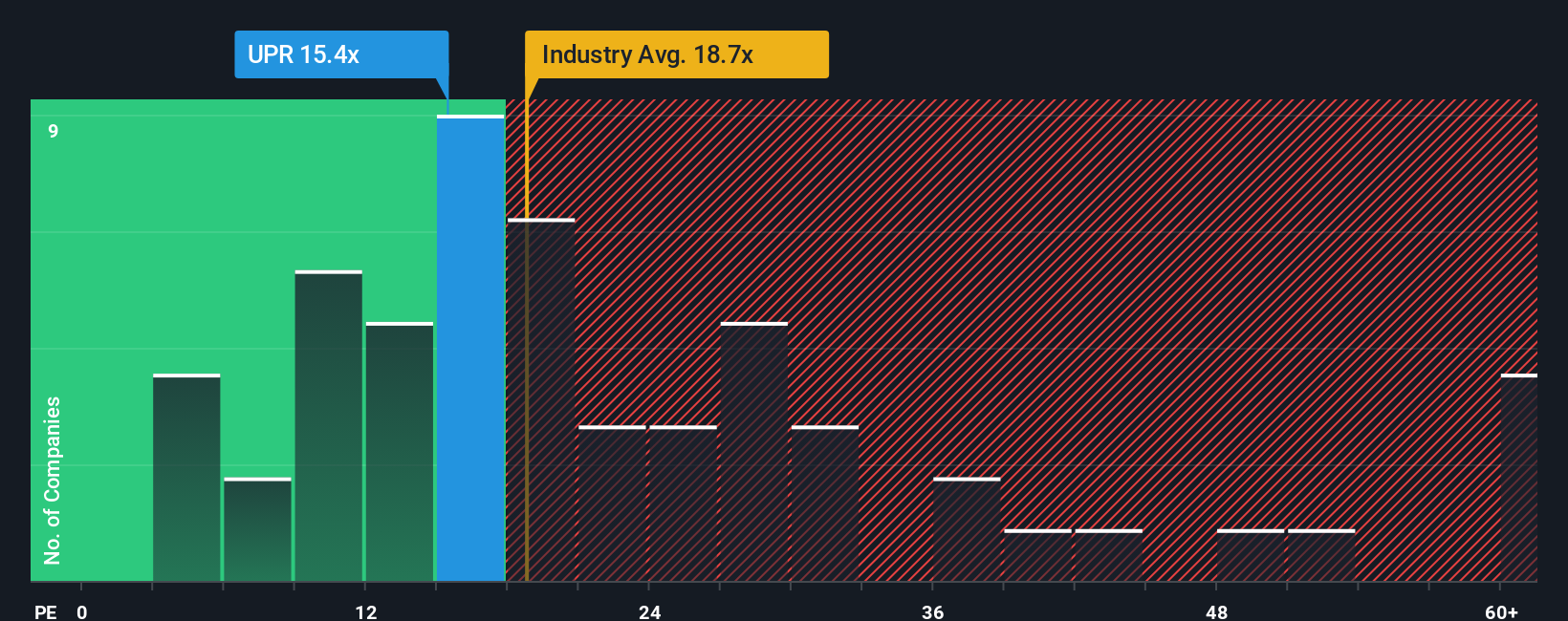

There wouldn't be many who think Uniphar plc's (ISE:UPR) price-to-earnings (or "P/E") ratio of 15.4x is worth a mention when the median P/E in Ireland is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Uniphar as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Uniphar

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Uniphar's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 49% gain to the company's bottom line. Pleasingly, EPS has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 3.9% per annum during the coming three years according to the nine analysts following the company. That's shaping up to be materially lower than the 7.5% per year growth forecast for the broader market.

In light of this, it's curious that Uniphar's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Uniphar's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Uniphar is showing 1 warning sign in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ISE:UPR

Uniphar

Operates as a diversified healthcare services company in the Republic of Ireland, the United Kingdom, the Netherlands, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives