- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

Glenveagh Properties And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with fluctuating consumer confidence and shifting economic indicators, investors are seeking opportunities that align with these evolving conditions. Penny stocks, a term that may seem outdated, still hold relevance as they often represent smaller or newer companies with the potential for significant growth. By focusing on those backed by solid financials, investors can uncover hidden value and explore opportunities for outsized returns in this unique investment area.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$42.73B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.14B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,825 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

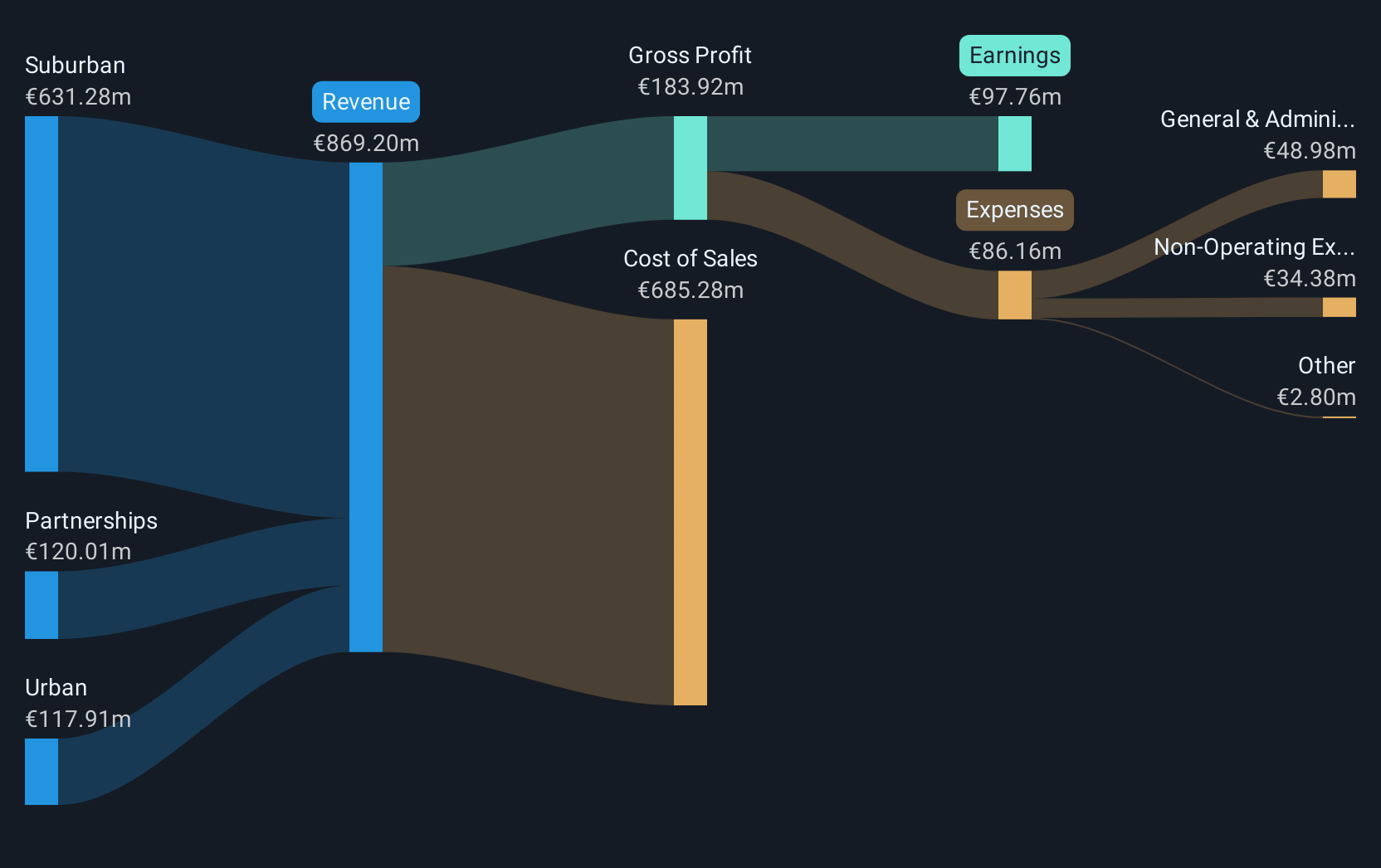

Overview: Glenveagh Properties PLC, along with its subsidiaries, focuses on constructing and selling houses and apartments to private buyers, local authorities, and the private rental sector in Ireland, with a market cap of €902.92 million.

Operations: Glenveagh Properties generates its revenue through two main segments: Urban, contributing €75.88 million, and Suburban, accounting for €463.42 million.

Market Cap: €902.92M

Glenveagh Properties, with a market cap of €902.92 million, presents a mixed picture for investors interested in penny stocks. The company has shown stable financial health, with short-term assets (€1.0 billion) comfortably covering both short and long-term liabilities and interest payments well covered by EBIT (4.3x). Earnings have grown modestly at 5.1% over the past year, below its five-year average but still outpacing the industry decline of -4.7%. Despite high-quality earnings and no significant shareholder dilution recently, concerns include negative operating cash flow and low return on equity (6.8%), alongside increased debt levels over five years.

- Dive into the specifics of Glenveagh Properties here with our thorough balance sheet health report.

- Understand Glenveagh Properties' earnings outlook by examining our growth report.

Roctec Global (SET:ROCTEC)

Simply Wall St Financial Health Rating: ★★★★★★

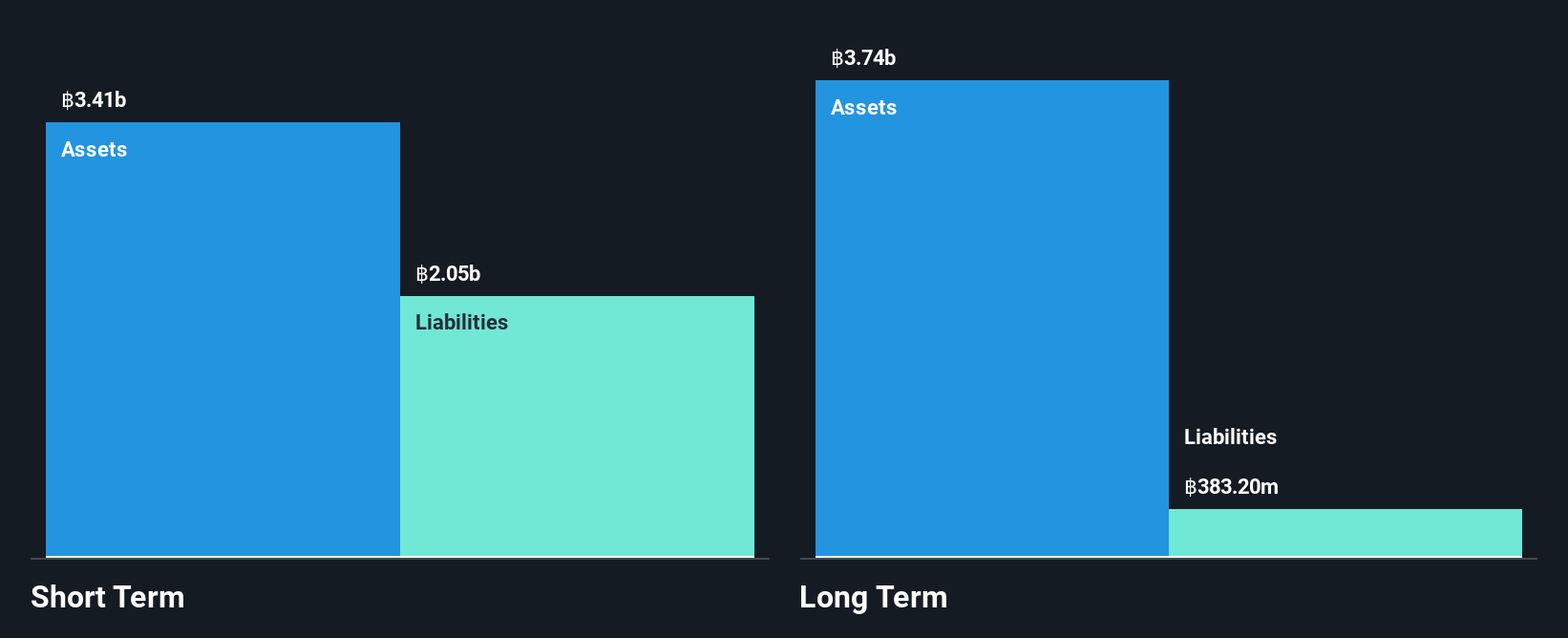

Overview: Roctec Global Public Company Limited, with a market cap of THB8.52 billion, operates in the advertising industry across Thailand, Hong Kong, and Vietnam through its subsidiaries.

Operations: The company's revenue is primarily derived from its system installation service, generating THB2.46 billion, and advertising, contributing THB437 million.

Market Cap: THB8.52B

Roctec Global, with a market cap of THB8.52 billion, offers an intriguing case for those examining penny stocks. The company boasts strong financial health, with short-term assets (THB2.9 billion) exceeding both its short and long-term liabilities. It operates debt-free and has experienced significant earnings growth of 77% over the past year, surpassing industry averages. Despite this growth, its return on equity remains low at 8.2%, and share price volatility persists over recent months. Recent earnings reports show increased revenue (THB1.58 billion) and net income (THB154 million), reflecting improved profit margins from the previous year.

- Click here to discover the nuances of Roctec Global with our detailed analytical financial health report.

- Evaluate Roctec Global's historical performance by accessing our past performance report.

PropNex (SGX:OYY)

Simply Wall St Financial Health Rating: ★★★★★★

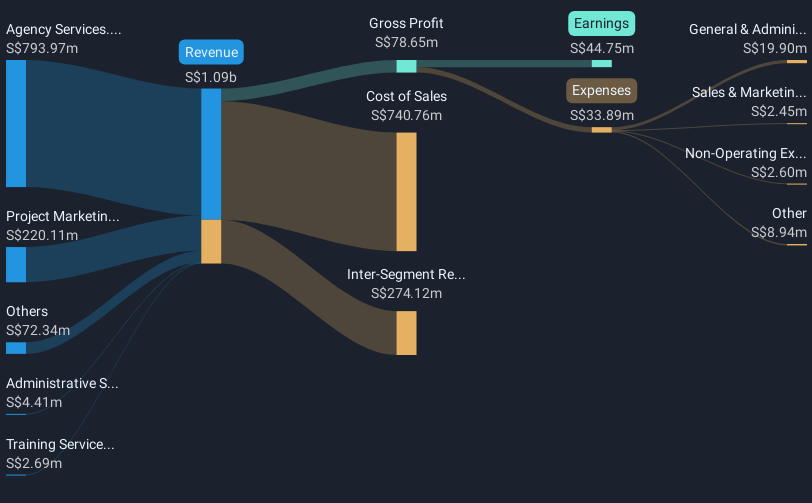

Overview: PropNex Limited offers real estate services both in Singapore and internationally, with a market capitalization of SGD699.30 million.

Operations: The company's revenue is primarily derived from Agency Services at SGD793.97 million and Project Marketing Services at SGD220.11 million, with additional contributions from Training Services at SGD2.69 million and Administrative Support Services at SGD4.41 million.

Market Cap: SGD699.3M

PropNex Limited, with a market capitalization of SGD699.30 million, presents an interesting profile for those considering penny stocks. The company is debt-free, with short-term assets (SGD269.4 million) comfortably covering both short and long-term liabilities. Despite high-quality past earnings and a strong return on equity at 38.7%, recent earnings have declined by 22% compared to last year, underperforming the industry average decline of 1.5%. The dividend yield of 6.05% is not well covered by earnings or free cash flows, indicating potential sustainability issues despite trading significantly below estimated fair value.

- Click to explore a detailed breakdown of our findings in PropNex's financial health report.

- Examine PropNex's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Gain an insight into the universe of 5,825 Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives