- Sweden

- /

- Communications

- /

- OM:NETI B

Discover 3 European Penny Stocks With Market Caps Of €200M

Reviewed by Simply Wall St

The European market has shown mixed results recently, with the pan-European STOXX Europe 600 Index remaining roughly flat and major indexes like France’s CAC 40 and Italy’s FTSE MIB posting modest gains. In such a landscape, investors often look toward smaller or newer companies for potential opportunities. Penny stocks, despite being an older term, still represent a viable investment area by offering growth prospects at lower price points. These stocks can be particularly appealing when they combine strong balance sheets with solid fundamentals, presenting hidden opportunities in the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.44 | €45.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.51 | RON17.25M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.82 | €59.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.62 | €17.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.43 | SEK2.33B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.58 | SEK217.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.16 | €298.22M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €33.05M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 323 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deceuninck NV designs, manufactures, recycles, and distributes multi-material window, door, and building solutions across Europe, North America, Turkey, and internationally with a market cap of €298.22 million.

Operations: The company's revenue is primarily derived from its Window and Door Systems segment, which accounts for €759.81 million, followed by Home Protection at €40.48 million and Outdoor Living at €26.70 million.

Market Cap: €298.22M

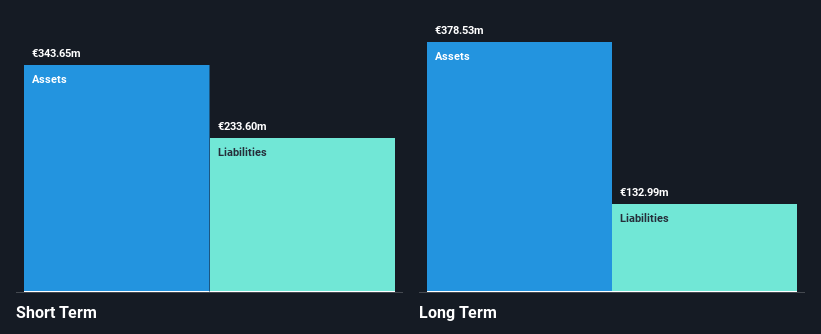

Deceuninck NV, with a market cap of €298.22 million, has shown robust earnings growth of 46.6% over the past year, outpacing the building industry's decline. The company's net debt to equity ratio is satisfactory at 16.7%, and its interest payments are well covered by EBIT (9.8x). While its return on equity is low at 4.5%, Deceuninck's short-term assets exceed both short and long-term liabilities significantly, indicating strong financial health. Despite an unstable dividend track record, recent dividend affirmations suggest potential for income investors who can tolerate volatility in this penny stock space.

- Jump into the full analysis health report here for a deeper understanding of Deceuninck.

- Gain insights into Deceuninck's outlook and expected performance with our report on the company's earnings estimates.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glenveagh Properties PLC, along with its subsidiaries, is engaged in constructing and selling houses and apartments for private buyers, local authorities, and the private rental sector in Ireland, with a market cap of €992.88 million.

Operations: The company's revenue is derived from three segments: Suburban (€631.28 million), Partnerships (€120.01 million), and Urban (€117.91 million).

Market Cap: €992.88M

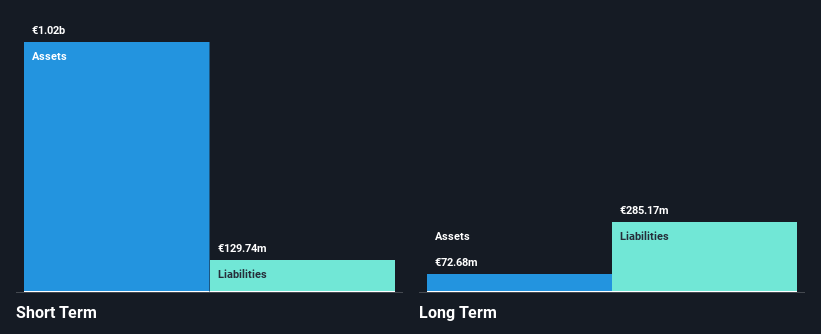

Glenveagh Properties PLC, with a market cap of €992.88 million, has demonstrated substantial earnings growth of 107.5% over the past year, surpassing the Consumer Durables industry average. The company's financial position is solid with short-term assets (€1.1 billion) exceeding both short and long-term liabilities significantly. While its return on equity is relatively low at 13%, Glenveagh's interest payments are well covered by EBIT (6.9x). Recent corporate guidance indicates confidence in delivering 2,600 home units and achieving significant revenue from partnerships and non-core land sales in 2025, highlighting potential for continued growth within this penny stock category.

- Click here and access our complete financial health analysis report to understand the dynamics of Glenveagh Properties.

- Evaluate Glenveagh Properties' prospects by accessing our earnings growth report.

Net Insight (OM:NETI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Net Insight AB (publ) offers media network solutions globally and has a market cap of SEK 1.42 billion.

Operations: The company generates revenue from its Media Networks segment, which amounted to SEK 580.13 million.

Market Cap: SEK1.42B

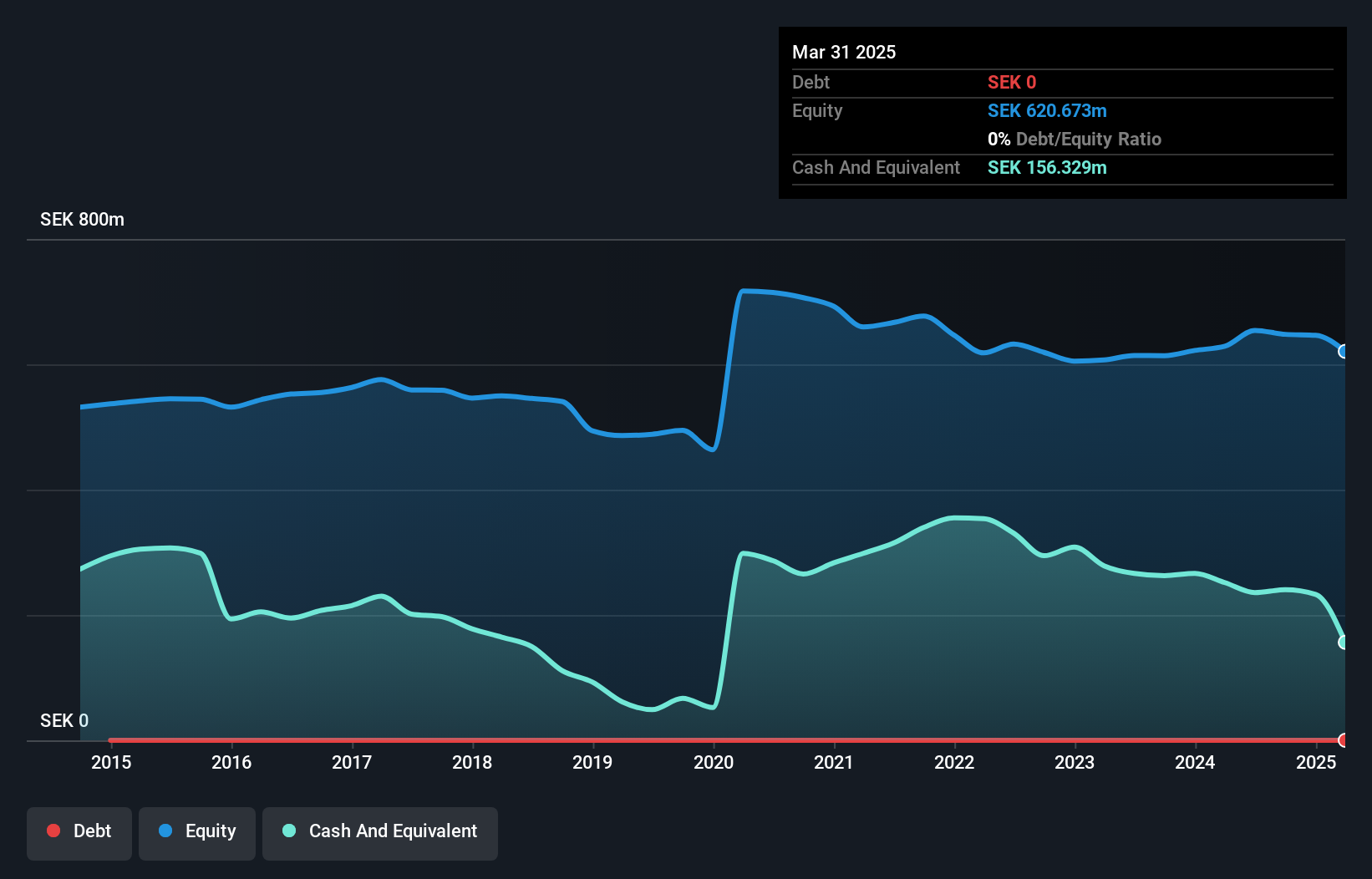

Net Insight, with a market cap of SEK 1.42 billion, presents a mixed picture for investors interested in penny stocks. The company is debt-free and has high-quality earnings, but its recent financial performance shows challenges with declining profit margins from 11.1% to 7.4% and negative earnings growth of -32.8% over the past year. Despite this, Net Insight remains involved in innovative projects like advancing GPS/GNSS-independent synchronization technology for 6G networks in collaboration with Turk Telekom, which could enhance future prospects. Recent share buybacks indicate management's confidence but have not significantly impacted shareholder dilution this year.

- Navigate through the intricacies of Net Insight with our comprehensive balance sheet health report here.

- Learn about Net Insight's future growth trajectory here.

Summing It All Up

- Click through to start exploring the rest of the 320 European Penny Stocks now.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Net Insight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NETI B

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives