- Indonesia

- /

- Healthcare Services

- /

- IDX:PRDA

3 High-Yield Dividend Stocks Offering Up To 8.2%

Reviewed by Simply Wall St

As global markets continue to navigate mixed economic signals and investors seek stability amid fluctuating indices, dividend stocks have garnered significant attention for their potential to provide steady income. In this article, we explore three high-yield dividend stocks offering up to 8.2%, focusing on what makes them appealing in today’s uncertain market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.08% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.27% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.13% | ★★★★★★ |

| Globeride (TSE:7990) | 4.08% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.71% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.83% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.23% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

Click here to see the full list of 2095 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

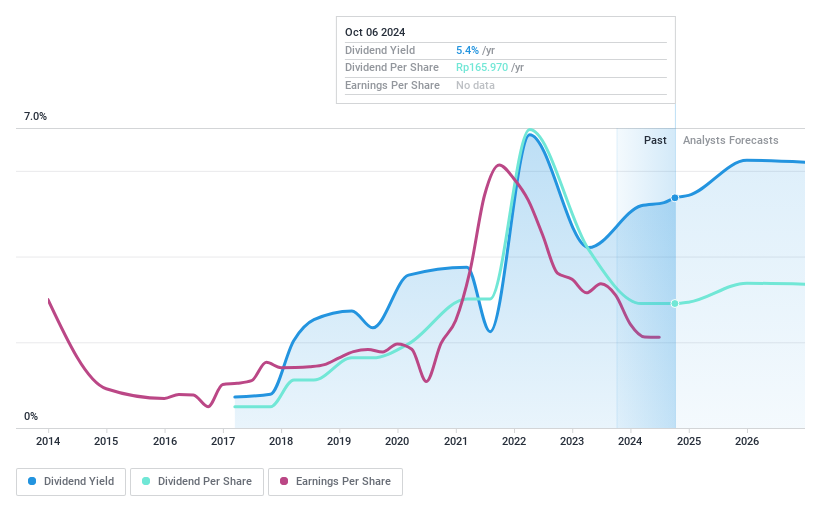

Prodia Widyahusada (IDX:PRDA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Prodia Widyahusada Tbk, with a market cap of IDR33.00 billion, offers clinical laboratory services mainly in Indonesia.

Operations: PT Prodia Widyahusada Tbk generates revenue primarily through its clinical laboratory services in Indonesia.

Dividend Yield: 6.8%

PT Prodia Widyahusada Tbk's dividend, covered by earnings (67.1%) and cash flows (65.9%), offers a yield of 6.76%, placing it in the top 25% of ID market payers. However, its unstable seven-year dividend track record and recent earnings decline—sales at IDR 1.03 billion and net income at IDR 115.67 million for H1 2024—raise concerns about sustainability despite trading below fair value by 36.7%.

- Dive into the specifics of Prodia Widyahusada here with our thorough dividend report.

- Our valuation report unveils the possibility Prodia Widyahusada's shares may be trading at a discount.

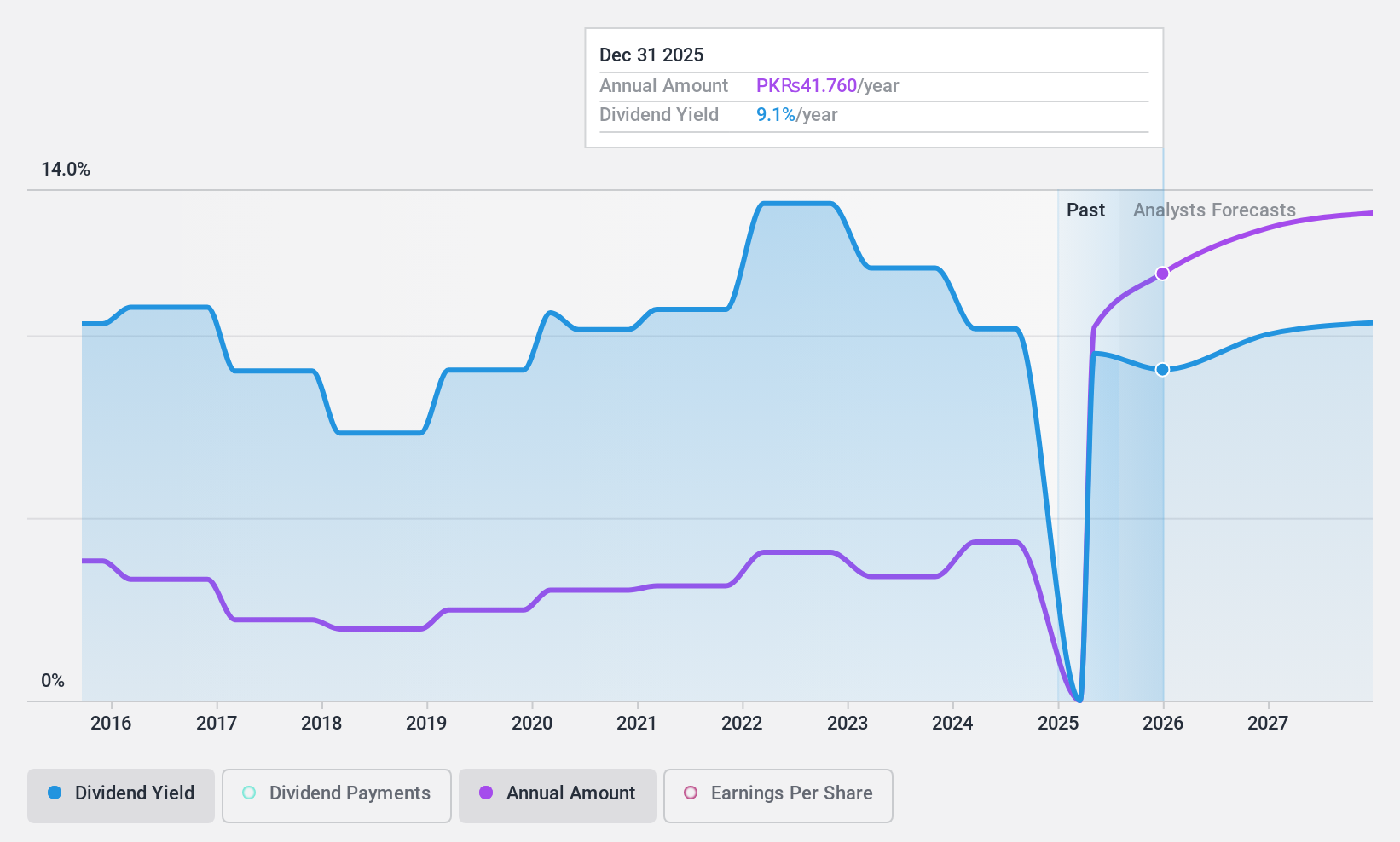

Fauji Fertilizer (KASE:FFC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fauji Fertilizer Company Limited, with a market cap of PKR238.33 billion, manufactures, purchases, and markets fertilizers and chemicals in Pakistan through its subsidiaries.

Operations: Fauji Fertilizer Company Limited generates revenue primarily from the manufacturing, purchasing, and marketing of fertilizers and chemicals in Pakistan.

Dividend Yield: 8.3%

Fauji Fertilizer's dividend payments, covered by earnings (16.2%) and cash flows (31.8%), offer a yield of 8.27%, which is lower than the top 25% of PK market payers. Despite an unstable track record over the past decade, dividends have increased during this period. Recent news includes a board meeting on July 30, 2024, to approve H1 financial results and the resignation of Director Waseem Ajmal Chaudhary in June.

- Get an in-depth perspective on Fauji Fertilizer's performance by reading our dividend report here.

- Our valuation report here indicates Fauji Fertilizer may be undervalued.

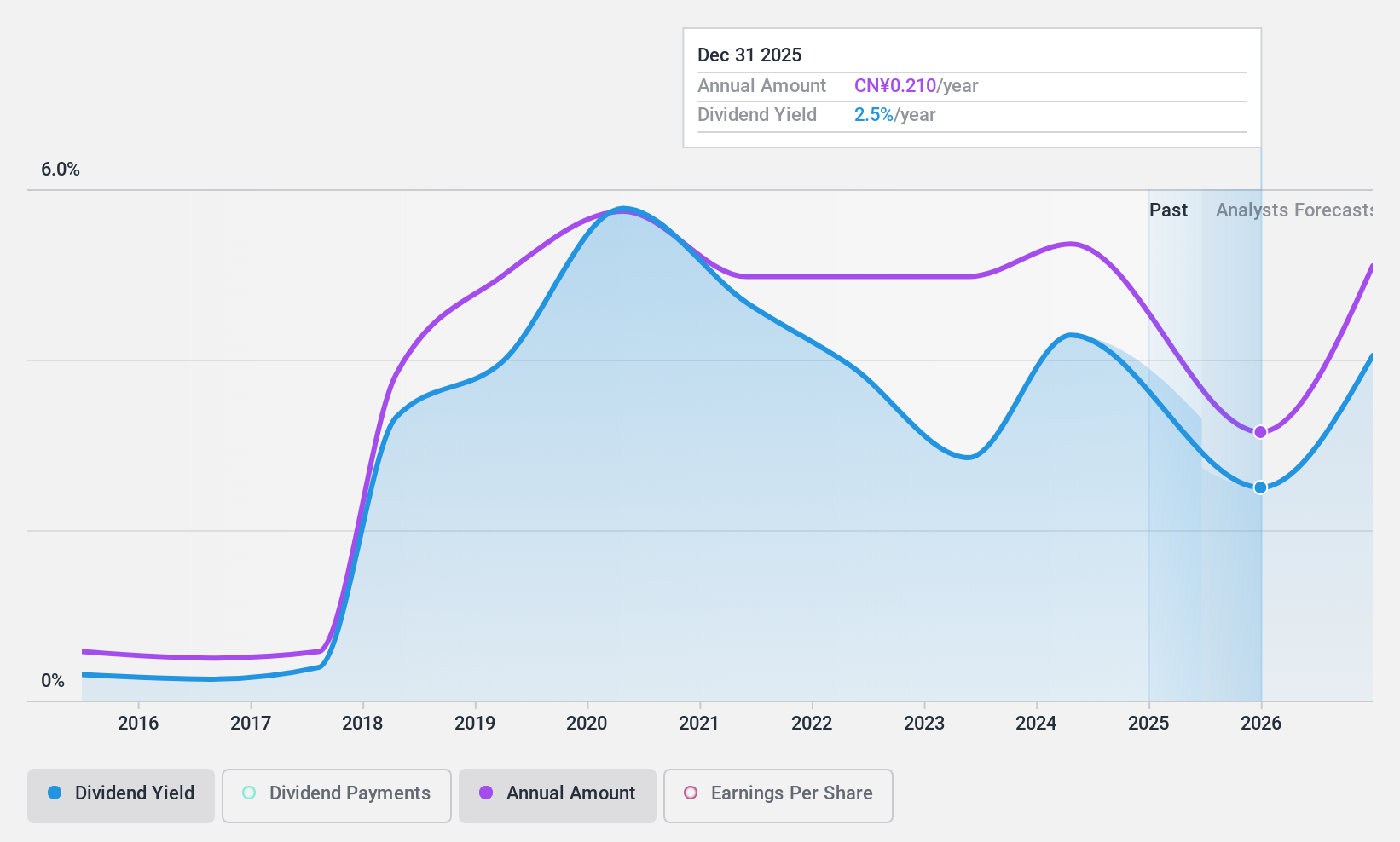

Teyi Pharmaceutical GroupLtd (SZSE:002728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teyi Pharmaceutical Group Co., Ltd. engages in the research, development, production, and sale of Chinese patent medicines, pharmaceutical preparations, raw materials, and products in China with a market cap of CN¥3.97 billion.

Operations: Teyi Pharmaceutical Group Co., Ltd. generates revenue through its Chinese patent medicines, pharmaceutical preparations, and raw materials and products in the People’s Republic of China.

Dividend Yield: 4.5%

Teyi Pharmaceutical Group Ltd's dividend yield of 4.52% ranks in the top 25% of CN market payers, but it is not well covered by earnings or free cash flows, with a high payout ratio of 173.2%. Despite stable and growing dividends over the past decade, recent financial results show a significant decline in net income from CNY 152.13 million to CNY 2.69 million for H1 2024. The company has also engaged in share buybacks totaling CNY 4.15 million recently.

- Delve into the full analysis dividend report here for a deeper understanding of Teyi Pharmaceutical GroupLtd.

- Our expertly prepared valuation report Teyi Pharmaceutical GroupLtd implies its share price may be too high.

Key Takeaways

- Reveal the 2095 hidden gems among our Top Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:PRDA

Prodia Widyahusada

Provides clinical laboratory services primarily in Indonesia.

Flawless balance sheet and undervalued.