As global markets exhibit a notably broad advance with record intraday highs across major indices, investors are keenly observing shifts in economic indicators and their implications for investment strategies. In this context, dividend stocks like Wismilak Inti Makmur continue to attract attention for their potential to offer steady returns amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.73% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.03% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.60% | ★★★★★★ |

| Allianz (XTRA:ALV) | 5.17% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.73% | ★★★★★★ |

| Globeride (TSE:7990) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.54% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.43% | ★★★★★★ |

| Innotech (TSE:9880) | 4.04% | ★★★★★★ |

Click here to see the full list of 1988 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Wismilak Inti Makmur (IDX:WIIM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Wismilak Inti Makmur Tbk is a company based in Indonesia that manufactures and sells cigarettes both domestically and internationally, with a market capitalization of IDR 2.52 billion.

Operations: PT Wismilak Inti Makmur Tbk generates revenue primarily through its cigarette production, totaling IDR 4.64 billion, and its marketing and distribution activities, which contribute IDR 4.30 billion.

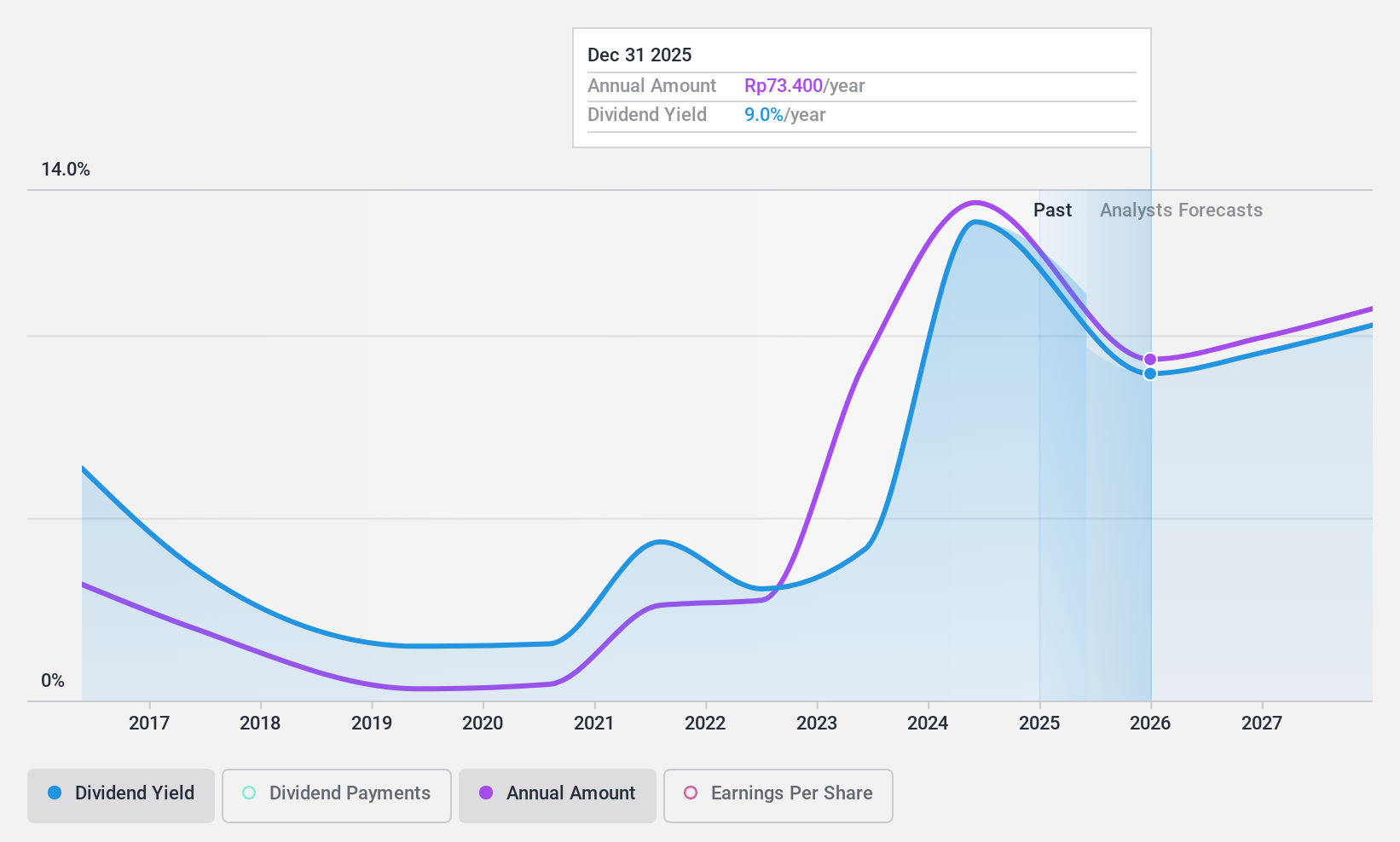

Dividend Yield: 8.8%

PT Wismilak Inti Makmur Tbk has a dividend yield of 8.81%, placing it in the top 25% of dividend payers in the Indonesian market. Despite this, its dividends have shown volatility and lack reliability over the past decade, with significant annual fluctuations exceeding 20%. The company's recent financial performance shows a slight decline in net income and basic earnings per share year-over-year as of Q1 2024. Additionally, while dividends are not well supported by free cash flow or earnings, they benefit from a relatively low payout ratio of 46.8%.

- Click here and access our complete dividend analysis report to understand the dynamics of Wismilak Inti Makmur.

- Insights from our recent valuation report point to the potential undervaluation of Wismilak Inti Makmur shares in the market.

ACNB (NasdaqCM:ACNB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ACNB Corporation, headquartered in the United States, is a financial holding company providing banking, insurance, and financial services to various customer segments with a market capitalization of approximately $318.61 million.

Operations: ACNB Corporation generates revenue through two primary segments: banking, which contributes $95.42 million, and insurance services, accounting for $9.53 million.

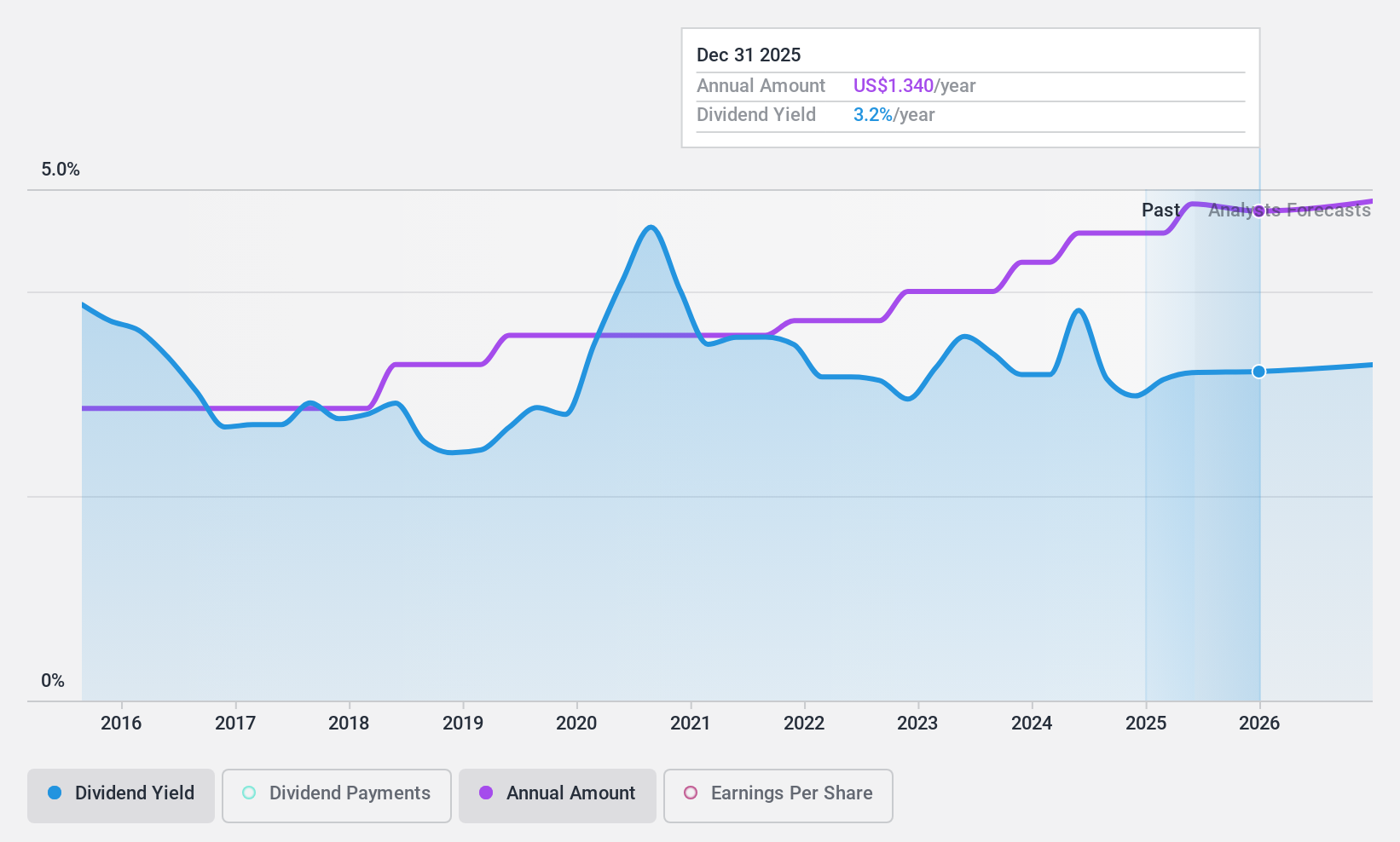

Dividend Yield: 3.4%

ACNB Corporation has demonstrated a consistent ability to pay dividends, with an increase in dividend payments over the past decade. Recently, dividends rose by 14.2% year-over-year as of Q2 2024. Despite a projected average earnings decline of 2.1% annually over the next three years, its current dividend yield stands at 3.43%, which is below the top quartile for U.S. market payers but remains attractive due to its reliability and stability. The company's payout ratio is moderately low at 33.5%, suggesting that dividends are well covered by earnings, though future coverage data lacks clarity.

- Get an in-depth perspective on ACNB's performance by reading our dividend report here.

- According our valuation report, there's an indication that ACNB's share price might be on the cheaper side.

Horizon Bancorp (NasdaqGS:HBNC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Horizon Bancorp, Inc., with a market cap of approximately $598.87 million, serves as the bank holding company for Horizon Bank, which offers a range of commercial and retail banking services.

Operations: Horizon Bancorp, Inc. generates its revenue primarily through commercial banking, with a segment income of $183.08 million.

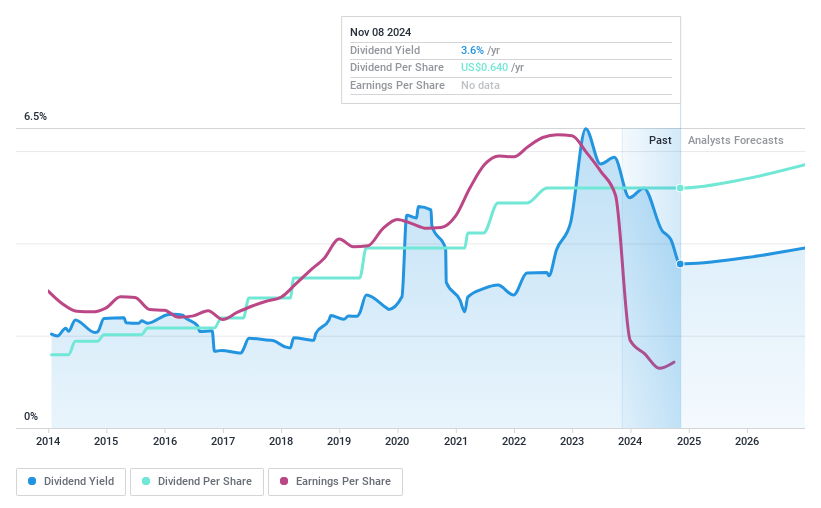

Dividend Yield: 4.7%

Horizon Bancorp's dividend yield of 4.71% ranks in the top 25% of US market payers, reflecting a strong historical commitment to shareholder returns. However, its payout ratio at 117.7% raises concerns about sustainability as it indicates dividends are not well covered by earnings. Recent financial performance shows a decline with profit margins dropping from last year’s 36.6% to 13%. Additionally, Horizon was recently added to the Russell 2000 Dynamic Index and has seen significant executive changes which could impact future operations and financial strategies.

- Take a closer look at Horizon Bancorp's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Horizon Bancorp is trading beyond its estimated value.

Summing It All Up

- Discover the full array of 1988 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wismilak Inti Makmur might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:WIIM

Wismilak Inti Makmur

Manufactures and sells cigarettes in Indonesia and internationally.

Undervalued with excellent balance sheet and pays a dividend.