- Hungary

- /

- Telecom Services and Carriers

- /

- BUSE:MTELEKOM

Reflecting on Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság's (BUSE:MTELEKOM) Share Price Returns Over The Last Three Years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság (BUSE:MTELEKOM) shareholders have had that experience, with the share price dropping 19% in three years, versus a market return of about 6.4%. There was little comfort for shareholders in the last week as the price declined a further 1.3%.

View our latest analysis for Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság

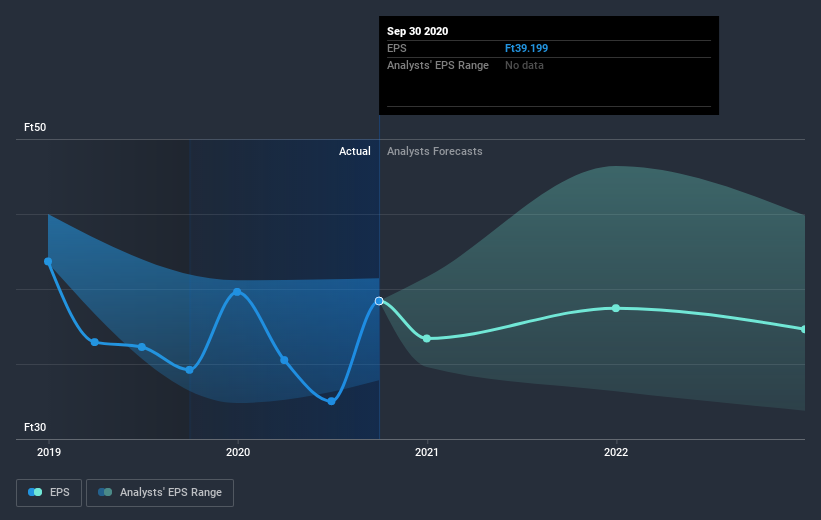

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság's earnings per share (EPS) dropped by 7.8% each year. This change in EPS is reasonably close to the 7% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság, it has a TSR of -3.9% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság shares lost 9.2% throughout the year, that wasn't as bad as the market loss of 13%. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HU exchanges.

If you’re looking to trade Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BUSE:MTELEKOM

Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság

Provides fixed-line and mobile telecommunication services for residential and business customers in Hungary, Bulgaria, Romania, and the Republic of North Macedonia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives