- Hungary

- /

- Telecom Services and Carriers

- /

- BUSE:MTELEKOM

Here's Why Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság (BUSE:MTELEKOM) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság (BUSE:MTELEKOM), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság with the means to add long-term value to shareholders.

View our latest analysis for Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság

How Fast Is Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság has grown EPS by 27% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

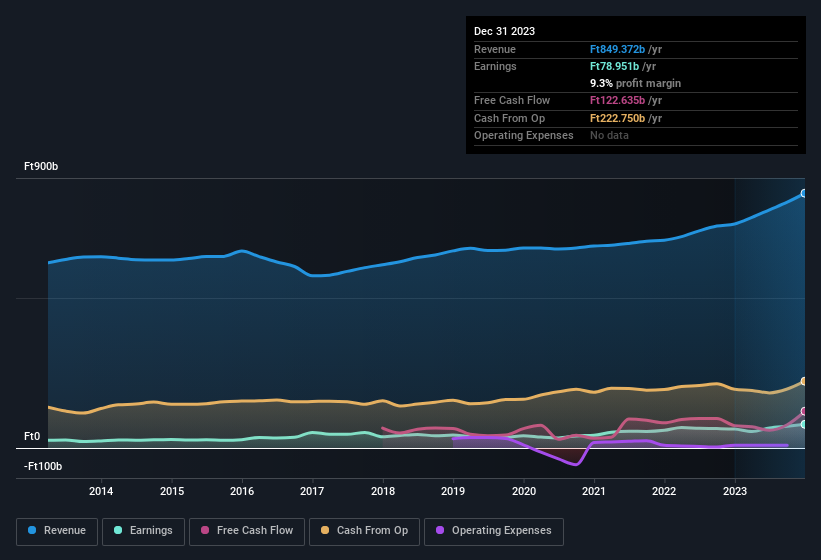

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság is growing revenues, and EBIT margins improved by 3.3 percentage points to 17%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság's future EPS 100% free.

Are Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság with market caps between Ft362b and Ft1.2t is about Ft496m.

Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság offered total compensation worth Ft434m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság's strong EPS growth. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság , and understanding this should be part of your investment process.

Although Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Hungarian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:MTELEKOM

Magyar Telekom Távközlési Nyilvánosan Müködö Részvénytársaság

Provides fixed-line and mobile telecommunication services for residential and business customers in Hungary, Bulgaria, Romania, and the Republic of North Macedonia.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives