- Hungary

- /

- Oil and Gas

- /

- BUSE:MOL

If EPS Growth Is Important To You, MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság (BUSE:MOL) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság (BUSE:MOL), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság with the means to add long-term value to shareholders.

See our latest analysis for MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság

MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 46%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

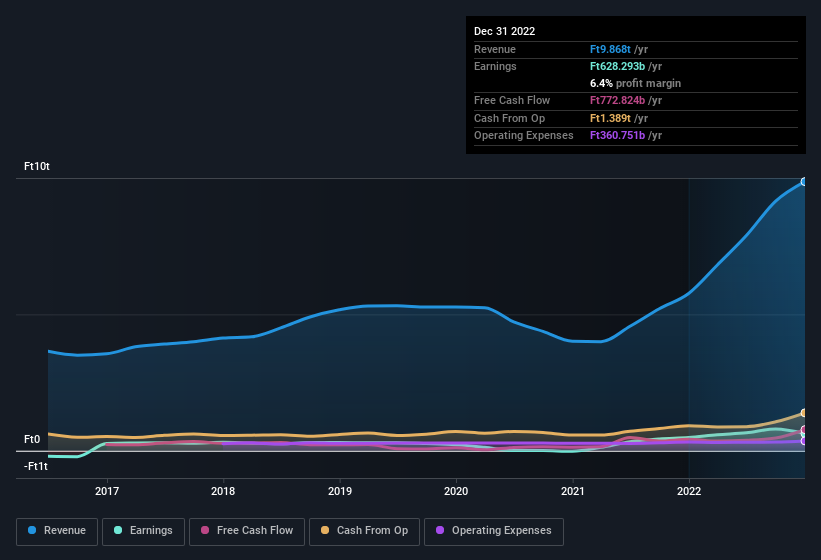

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság is growing revenues, and EBIT margins improved by 2.3 percentage points to 12%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság's forecast profits?

Are MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a Ft1.8t company like MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság. But we do take comfort from the fact that they are investors in the company. As a matter of fact, their holding is valued at Ft9.2b. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between Ft1.4t and Ft4.2t, like MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság, the median CEO pay is around Ft858m.

The MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság CEO received total compensation of just Ft381m in the year to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság Deserve A Spot On Your Watchlist?

MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság's earnings per share have been soaring, with growth rates sky high. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság is certainly doing some things right and is well worth investigating. We don't want to rain on the parade too much, but we did also find 1 warning sign for MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:MOL

MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság

Operates as an integrated oil and gas company in Hungary and internationally.

Flawless balance sheet established dividend payer.