Ðuro Ðakovic Grupa d.d's (ZGSE:DDJH) Shareholders Have More To Worry About Than Only Soft Earnings

Ðuro Ðakovic Grupa d.d.'s (ZGSE:DDJH) earnings announcement last week contained some soft numbers, disappointing investors. Our analysis suggests that while the headline numbers were soft, there are some positive factors which shareholders may have missed.

View our latest analysis for Ðuro Ðakovic Grupa d.d

Examining Cashflow Against Ðuro Ðakovic Grupa d.d's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

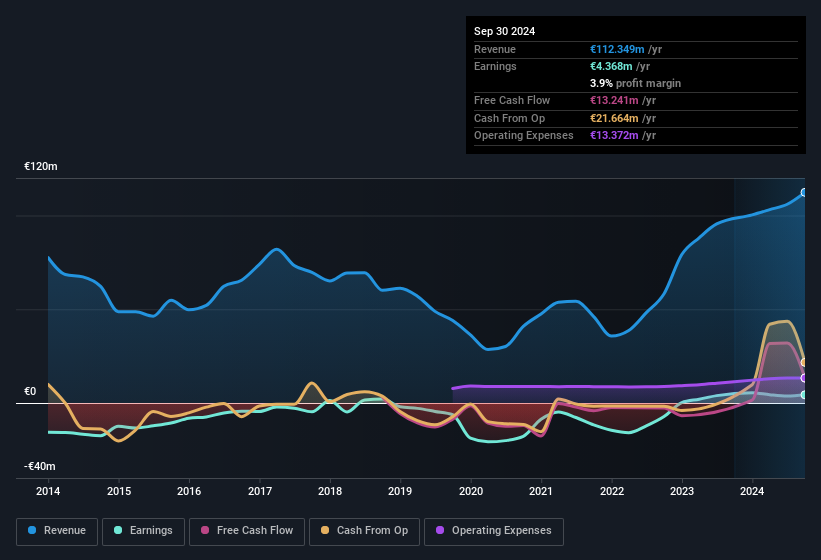

Ðuro Ðakovic Grupa d.d has an accrual ratio of -0.15 for the year to September 2024. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. Indeed, in the last twelve months it reported free cash flow of €13m, well over the €4.37m it reported in profit. Notably, Ðuro Ðakovic Grupa d.d had negative free cash flow last year, so the €13m it produced this year was a welcome improvement. However, that's not the end of the story. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ðuro Ðakovic Grupa d.d.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Ðuro Ðakovic Grupa d.d expanded the number of shares on issue by 9,900% over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Ðuro Ðakovic Grupa d.d's EPS by clicking here.

A Look At The Impact Of Ðuro Ðakovic Grupa d.d's Dilution On Its Earnings Per Share (EPS)

Three years ago, Ðuro Ðakovic Grupa d.d lost money. And even focusing only on the last twelve months, we see profit is down 7.5%. Sadly, earnings per share fell further, down a full 99% in that time. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if Ðuro Ðakovic Grupa d.d's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

As it happens, there are a few different things to consider when we look at Ðuro Ðakovic Grupa d.d's profit and the last one we'll mention is €764k gain booked as unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Ðuro Ðakovic Grupa d.d had a rather significant contribution from unusual items relative to its profit to September 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Ðuro Ðakovic Grupa d.d's Profit Performance

In conclusion, Ðuro Ðakovic Grupa d.d's accrual ratio suggests its earnings are well backed by cash but its boost from unusual items is probably not going to be repeated consistently. Further, the dilution means profits are now split more ways. Considering all this we'd argue Ðuro Ðakovic Grupa d.d's profits probably give an overly generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. While conducting our analysis, we found that Ðuro Ðakovic Grupa d.d has 2 warning signs and it would be unwise to ignore these bad boys.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Ðuro Ðakovic Grupa d.d, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:DDJH

Ðuro Ðakovic Grupa d.d

Operates in defense, transport, and industry and energetics sectors in Croatia and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives