Market Participants Recognise Ðuro Ðakovic Grupa d.d.'s (ZGSE:DDJH) Revenues Pushing Shares 51% Higher

Ðuro Ðakovic Grupa d.d. (ZGSE:DDJH) shares have continued their recent momentum with a 51% gain in the last month alone. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

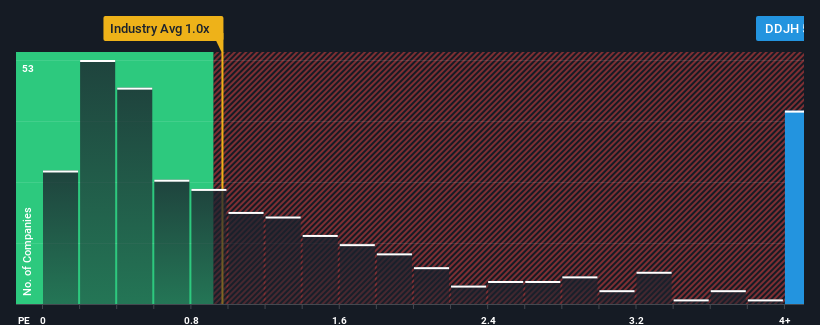

After such a large jump in price, you could be forgiven for thinking Ðuro Ðakovic Grupa d.d is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.8x, considering almost half the companies in Croatia's Machinery industry have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Ðuro Ðakovic Grupa d.d

What Does Ðuro Ðakovic Grupa d.d's P/S Mean For Shareholders?

Recent times have been quite advantageous for Ðuro Ðakovic Grupa d.d as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ðuro Ðakovic Grupa d.d's earnings, revenue and cash flow.How Is Ðuro Ðakovic Grupa d.d's Revenue Growth Trending?

In order to justify its P/S ratio, Ðuro Ðakovic Grupa d.d would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. Pleasingly, revenue has also lifted 274% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 4.6% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Ðuro Ðakovic Grupa d.d's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

The strong share price surge has lead to Ðuro Ðakovic Grupa d.d's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Ðuro Ðakovic Grupa d.d revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Ðuro Ðakovic Grupa d.d that you should be aware of.

If these risks are making you reconsider your opinion on Ðuro Ðakovic Grupa d.d, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:DDJH

Ðuro Ðakovic Grupa d.d

Operates in defense, transport, and industry and energetics sectors in Croatia and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives