- Croatia

- /

- Industrials

- /

- ZGSE:ADRS

Adris grupa d. d (ZGSE:ADRS) advances 6.0% this week, taking three-year gains to 63%

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. For example, the Adris grupa d. d. (ZGSE:ADRS) share price return of 47% over three years lags the market return in the same period. Zooming in, the stock is up a respectable 8.5% in the last year.

Since the stock has added €79m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Adris grupa d. d

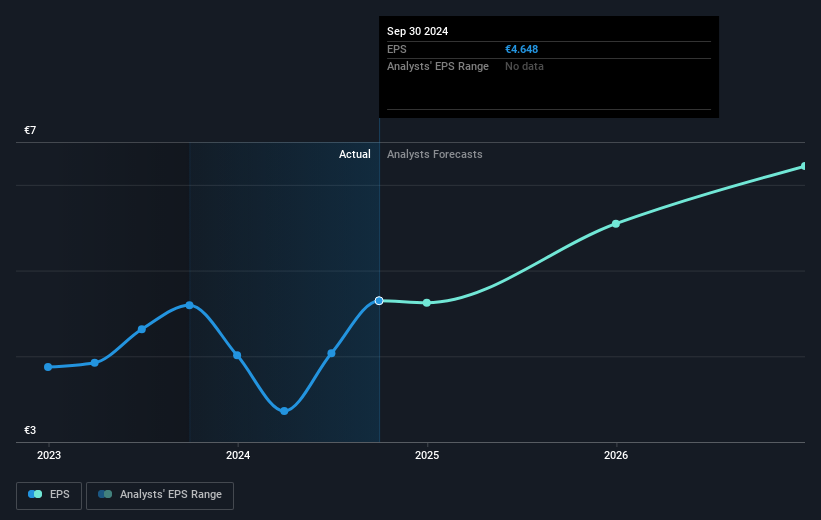

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Adris grupa d. d the TSR over the last 3 years was 63%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Adris grupa d. d shareholders gained a total return of 12% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 8% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Adris grupa d. d is showing 1 warning sign in our investment analysis , you should know about...

But note: Adris grupa d. d may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Croatian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:ADRS

Adris grupa d. d

Engages in the tourism, healthy food, insurance, and real estate businesses in Croatia and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives