- Hong Kong

- /

- Renewable Energy

- /

- SEHK:916

China Longyuan Power Group Corporation Limited (HKG:916) Soars 29% But It's A Story Of Risk Vs Reward

China Longyuan Power Group Corporation Limited (HKG:916) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

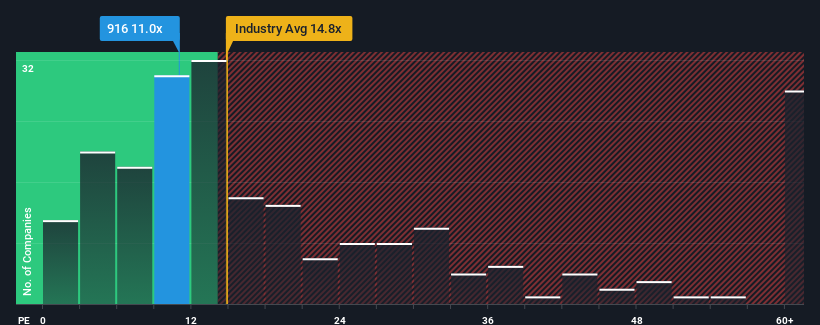

Although its price has surged higher, you could still be forgiven for feeling indifferent about China Longyuan Power Group's P/E ratio of 11x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

China Longyuan Power Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for China Longyuan Power Group

How Is China Longyuan Power Group's Growth Trending?

In order to justify its P/E ratio, China Longyuan Power Group would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.7%. The last three years don't look nice either as the company has shrunk EPS by 25% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 26% per annum over the next three years. With the market only predicted to deliver 12% per year, the company is positioned for a stronger earnings result.

In light of this, it's curious that China Longyuan Power Group's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On China Longyuan Power Group's P/E

China Longyuan Power Group's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that China Longyuan Power Group currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for China Longyuan Power Group you should be aware of, and 1 of them doesn't sit too well with us.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:916

China Longyuan Power Group

Generates and sells wind, coal, and photovoltaic (PV) power in the Chinese Mainland, Canada, South Africa, and Ukraine.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives