- Hong Kong

- /

- Renewable Energy

- /

- SEHK:836

These 4 Measures Indicate That China Resources Power Holdings (HKG:836) Is Using Debt In A Risky Way

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that China Resources Power Holdings Company Limited (HKG:836) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for China Resources Power Holdings

What Is China Resources Power Holdings's Debt?

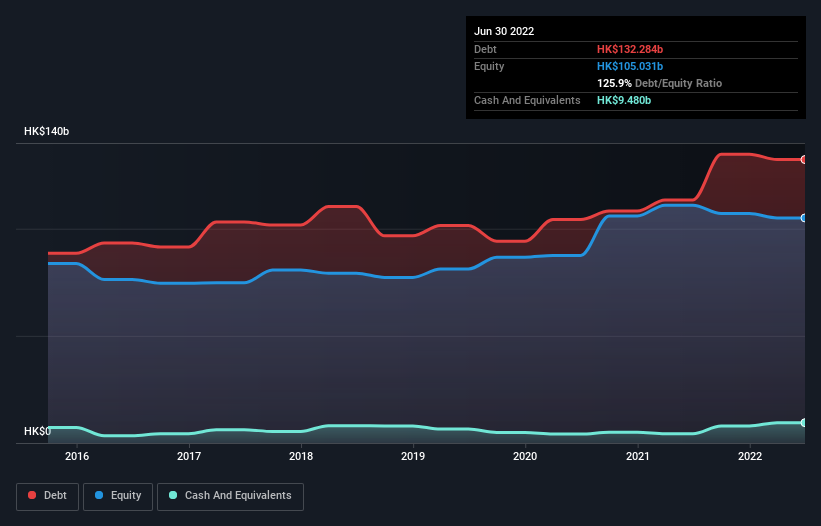

You can click the graphic below for the historical numbers, but it shows that as of June 2022 China Resources Power Holdings had HK$132.3b of debt, an increase on HK$113.4b, over one year. However, it also had HK$9.48b in cash, and so its net debt is HK$122.8b.

A Look At China Resources Power Holdings' Liabilities

The latest balance sheet data shows that China Resources Power Holdings had liabilities of HK$69.8b due within a year, and liabilities of HK$108.1b falling due after that. On the other hand, it had cash of HK$9.48b and HK$40.8b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$127.5b.

This deficit casts a shadow over the HK$80.7b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, China Resources Power Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

China Resources Power Holdings shareholders face the double whammy of a high net debt to EBITDA ratio (6.4), and fairly weak interest coverage, since EBIT is just 1.2 times the interest expense. The debt burden here is substantial. Worse, China Resources Power Holdings's EBIT was down 72% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine China Resources Power Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, China Resources Power Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both China Resources Power Holdings's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. It looks to us like China Resources Power Holdings carries a significant balance sheet burden. If you harvest honey without a bee suit, you risk getting stung, so we'd probably stay away from this particular stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for China Resources Power Holdings (of which 1 is potentially serious!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:836

China Resources Power Holdings

An investment holding company, invests in, develops, operates, and manages power plants and coal mines in the People’s Republic of China.

Good value second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026