- Hong Kong

- /

- Renewable Energy

- /

- SEHK:836

Here's Why We Think China Resources Power Holdings (HKG:836) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like China Resources Power Holdings (HKG:836), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for China Resources Power Holdings

China Resources Power Holdings's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years China Resources Power Holdings grew its EPS by 12% per year. That's a good rate of growth, if it can be sustained.

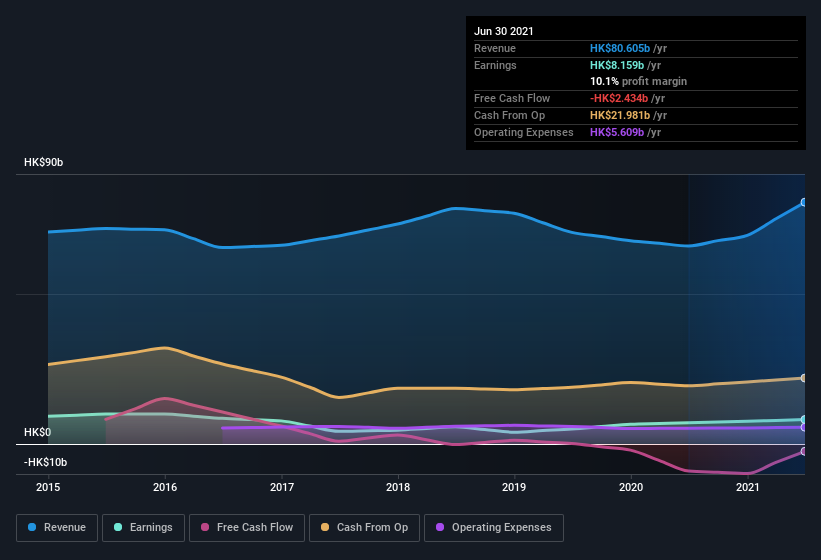

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, China Resources Power Holdings's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for China Resources Power Holdings.

Are China Resources Power Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell China Resources Power Holdings shares in the last year. But the really good news is that Independent Non-Executive Director Chak-Kwong So spent HK$4.3m buying stock stock, at an average price of around HK$10.64. Big buys like that give me a sense of opportunity; actions speak louder than words.

The good news, alongside the insider buying, for China Resources Power Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold HK$102m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add China Resources Power Holdings To Your Watchlist?

One positive for China Resources Power Holdings is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with China Resources Power Holdings (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

As a growth investor I do like to see insider buying. But China Resources Power Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:836

China Resources Power Holdings

An investment holding company, invests in, develops, operates, and manages power plants and coal mines in the People’s Republic of China.

Good value second-rate dividend payer.

Market Insights

Community Narratives