- Hong Kong

- /

- Renewable Energy

- /

- SEHK:8326

Here's Why Tonking New Energy Group Holdings (HKG:8326) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Tonking New Energy Group Holdings (HKG:8326). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Tonking New Energy Group Holdings

How Fast Is Tonking New Energy Group Holdings Growing Its Earnings Per Share?

In the last three years Tonking New Energy Group Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Tonking New Energy Group Holdings' EPS grew from HK$0.0075 to HK$0.018, over the previous 12 months. It's not often a company can achieve year-on-year growth of 136%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

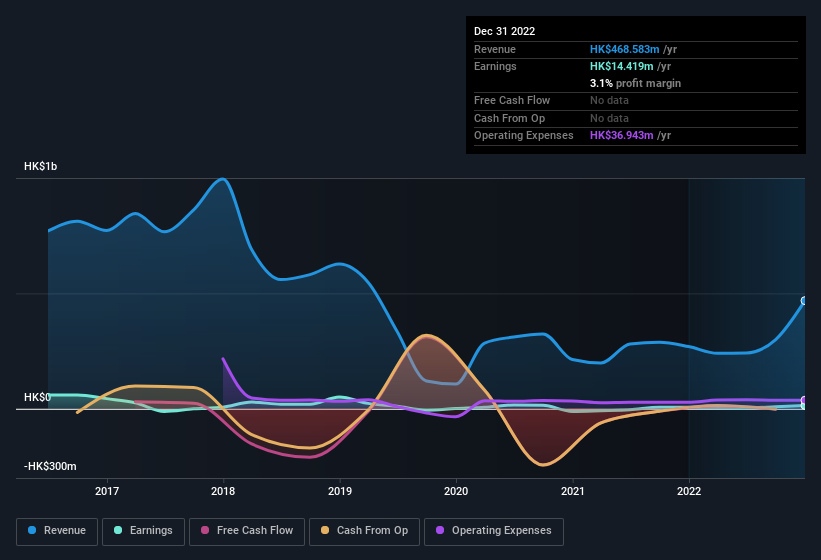

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Tonking New Energy Group Holdings shareholders is that EBIT margins have grown from 1.6% to 4.7% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Tonking New Energy Group Holdings is no giant, with a market capitalisation of HK$129m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Tonking New Energy Group Holdings Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like Tonking New Energy Group Holdings with market caps under HK$1.6b is about HK$1.9m.

Tonking New Energy Group Holdings' CEO took home a total compensation package worth HK$1.1m in the year leading up to March 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Tonking New Energy Group Holdings Worth Keeping An Eye On?

Tonking New Energy Group Holdings' earnings per share have been soaring, with growth rates sky high. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. It will definitely require further research to be sure, but it does seem that Tonking New Energy Group Holdings has the hallmarks of a quality business; and that would make it well worth watching. We should say that we've discovered 3 warning signs for Tonking New Energy Group Holdings (1 is concerning!) that you should be aware of before investing here.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tonking New Energy Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8326

Tonking New Energy Group Holdings

An investment holding company, engages in the renewable energy business in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.