- Hong Kong

- /

- Gas Utilities

- /

- SEHK:392

Here's Why Beijing Enterprises Holdings (HKG:392) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Beijing Enterprises Holdings (HKG:392). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Beijing Enterprises Holdings

How Fast Is Beijing Enterprises Holdings Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Beijing Enterprises Holdings has grown its trailing twelve month EPS from HK$6.37 to HK$6.85, in the last year. That amounts to a small improvement of 7.6%.

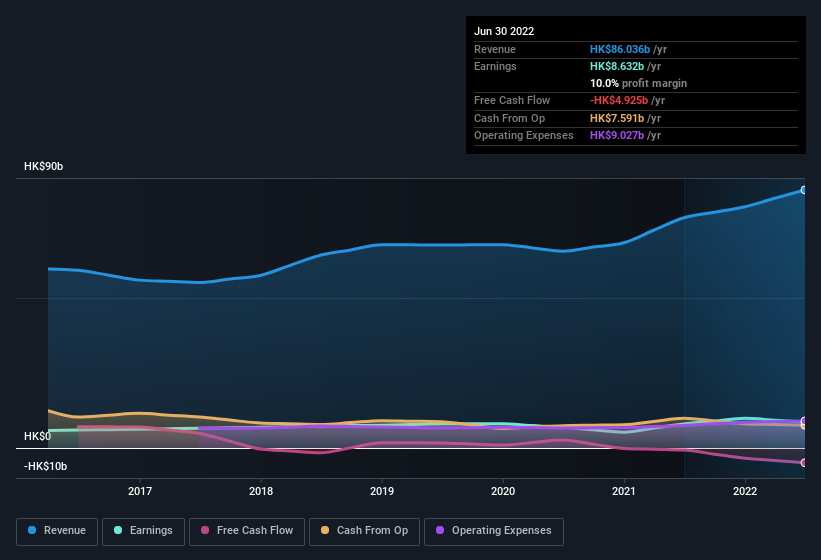

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Beijing Enterprises Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to HK$86b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Beijing Enterprises Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Beijing Enterprises Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

With strong conviction, Beijing Enterprises Holdings insiders have stood united by refusing to sell shares over the last year. But the real excitement comes from the HK$1.0m that CEO & Executive Director Bin Xiong spent buying shares (at an average price of about HK$26.00). Strong buying like that could be a sign of opportunity.

It's reassuring that Beijing Enterprises Holdings insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Beijing Enterprises Holdings with market caps between HK$16b and HK$50b is about HK$5.6m.

Beijing Enterprises Holdings' CEO took home a total compensation package of HK$1.0m in the year prior to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Beijing Enterprises Holdings Worth Keeping An Eye On?

One positive for Beijing Enterprises Holdings is that it is growing EPS. That's nice to see. And there's more to Beijing Enterprises Holdings, with the insider buying and modest CEO pay being a great look for those with an eye on the company. All things considered, Beijing Enterprises Holdings is certainly displaying its merits and is worthy of taking research to the next step. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Beijing Enterprises Holdings , and understanding it should be part of your investment process.

The good news is that Beijing Enterprises Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Enterprises Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:392

Beijing Enterprises Holdings

An investment holding company, engages in the gas, water, environmental, brewery, and other businesses in Mainland China, Germany, and internationally.

Undervalued second-rate dividend payer.

Market Insights

Community Narratives