- Hong Kong

- /

- Gas Utilities

- /

- SEHK:384

How Investors May Respond To China Gas Holdings (SEHK:384) Strengthening Global LNG Trading and Leadership Team

Reviewed by Sasha Jovanovic

- China Gas Holdings announced the appointment of Ms. Chan Pui Ling as General Counsel and Company Secretary following the resignation of Ms. Chan Wing Ki, and has hired Xiong Xin, a former senior trader at GCL Group, to lead its global LNG and LPG trading business.

- The company has further secured long-term LNG contracts with U.S. exporters, signaling its ambition to increase international gas trading volumes and strengthen its global supply chain.

- We’ll now examine how the addition of trading expertise and new LNG agreements may shape China Gas Holdings’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is China Gas Holdings' Investment Narrative?

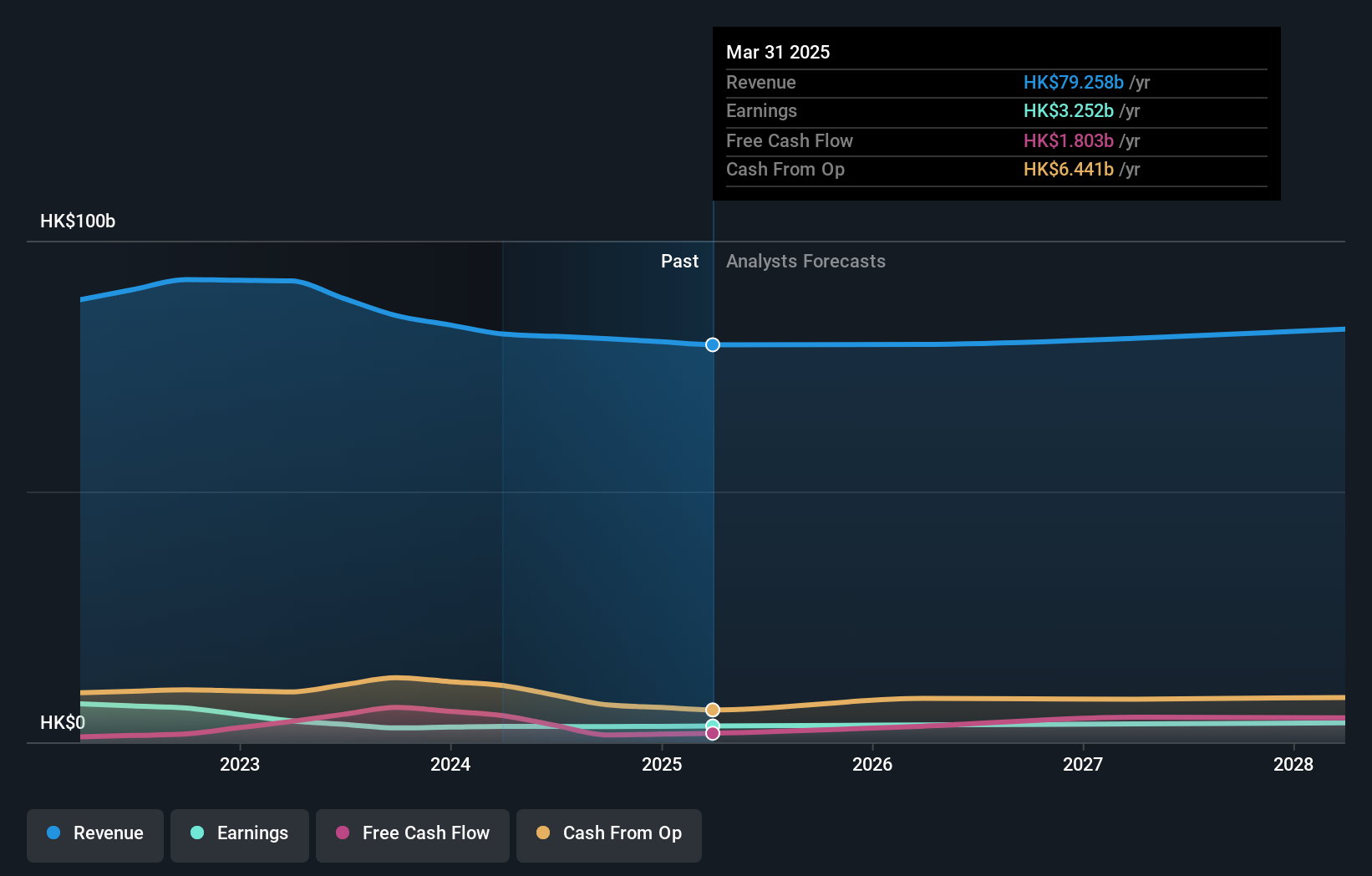

At the core, an investor in China Gas Holdings needs to buy into the company’s vision to transition from a primarily domestic player to a participant in international energy markets, despite modest near-term growth. This latest management shake-up brings experienced legal and trading leadership, injecting fresh momentum behind the company’s international LNG push. The new long-term U.S. LNG contracts could become a genuine short-term catalyst if they accelerate expansion in global trading or help secure gas supply amid a volatile energy market. However, much of the business remains tied to slower-growing domestic revenues and weak cash flow cover for the dividend, so the headline news may not result in material change overnight. It does, however, alter the risk profile: execution on global trading ambitions and integration of new leaders now move front and center, even as board independence and dividend sustainability remain important investor watchpoints. Still, execution risks in global expansion aren’t something to overlook.

Despite retreating, China Gas Holdings' shares might still be trading 46% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on China Gas Holdings - why the stock might be worth 10% less than the current price!

Build Your Own China Gas Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Gas Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Gas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Gas Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:384

China Gas Holdings

An investment holding company, operates as an energy supplier and service provider in the People’s Republic of China.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives