- Hong Kong

- /

- Gas Utilities

- /

- SEHK:384

Assessing China Gas Holdings After 20% Rally and Recent Earnings Rebound in 2025

Reviewed by Simply Wall St

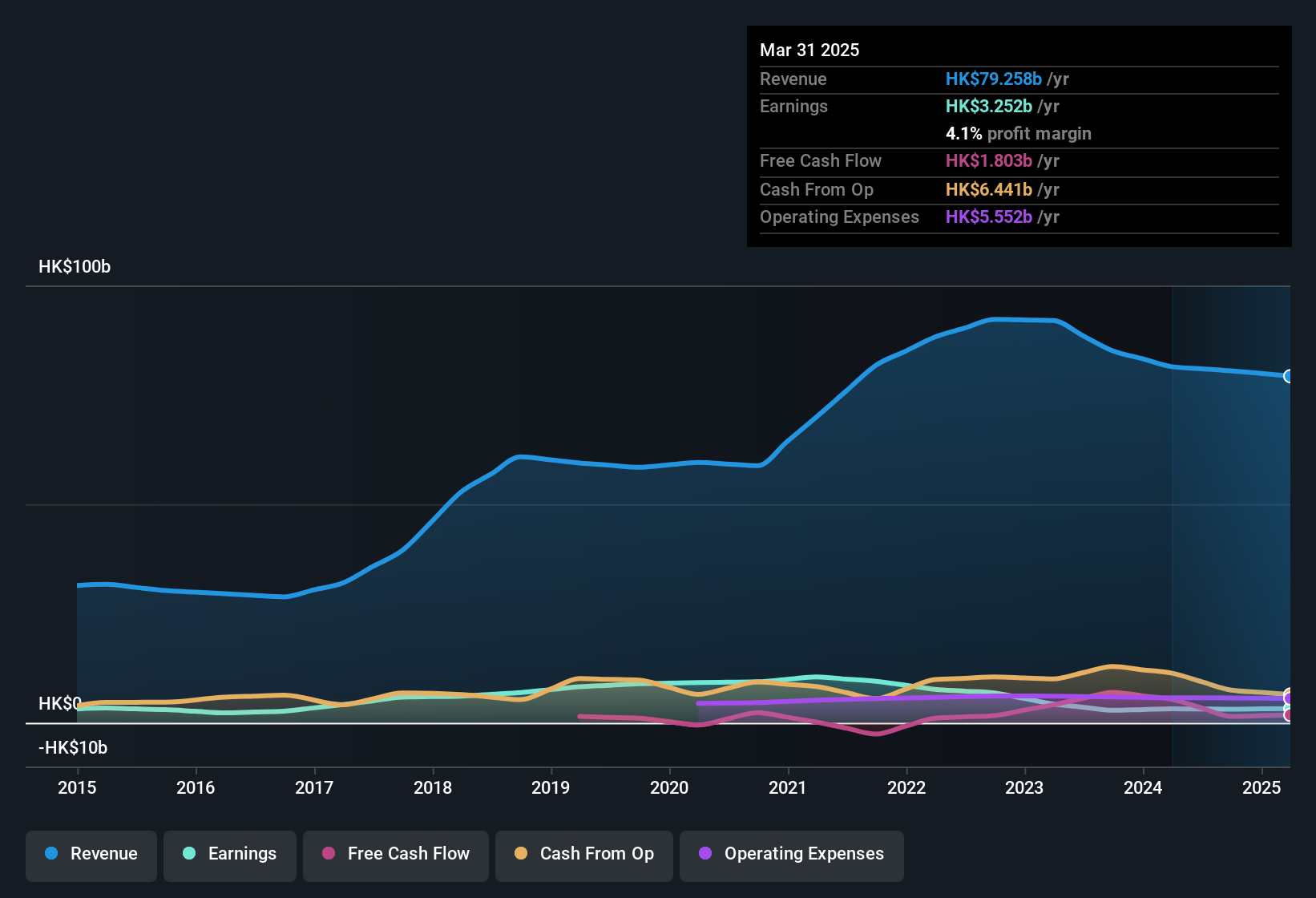

Trying to figure out what to do with China Gas Holdings stock? You are not alone. After a solid year-to-date rally of 20.0%, it is no wonder investors are sizing up their next move. Over the past week, shares edged up by 2.1%. However, zoom out a little further and you will spot recent volatility. A 5.7% loss over the last month might make you hesitate, even though the stock is still up 40.1% over the past year. Taking an even wider view reveals a more sobering story, with the five-year return at -52.1% and three-year performance at -15.6%.

Why the sudden change in mood for China Gas Holdings? Broader trends in regional energy demand and evolving market conditions have clearly played a role in driving share prices higher this year. Improved investor sentiment is giving the stock some fresh momentum. At the same time, those longer-term losses point to risks that have not fully disappeared, which matters if you are thinking about holding for the long term.

So, is the stock undervalued or are the risks too great? To answer this, it makes sense to break down how China Gas Holdings stacks up across different valuation methods. We looked at six key checks, and the company is considered undervalued in three of them, giving it a value score of 3. Each method has its quirks, and by the end of this article, we will also consider a smarter way to make sense of what all those numbers really mean for your investment decisions.

China Gas Holdings delivered 40.1% returns over the last year. See how this stacks up to the rest of the Gas Utilities industry.Approach 1: China Gas Holdings Discounted Cash Flow (DCF) Analysis

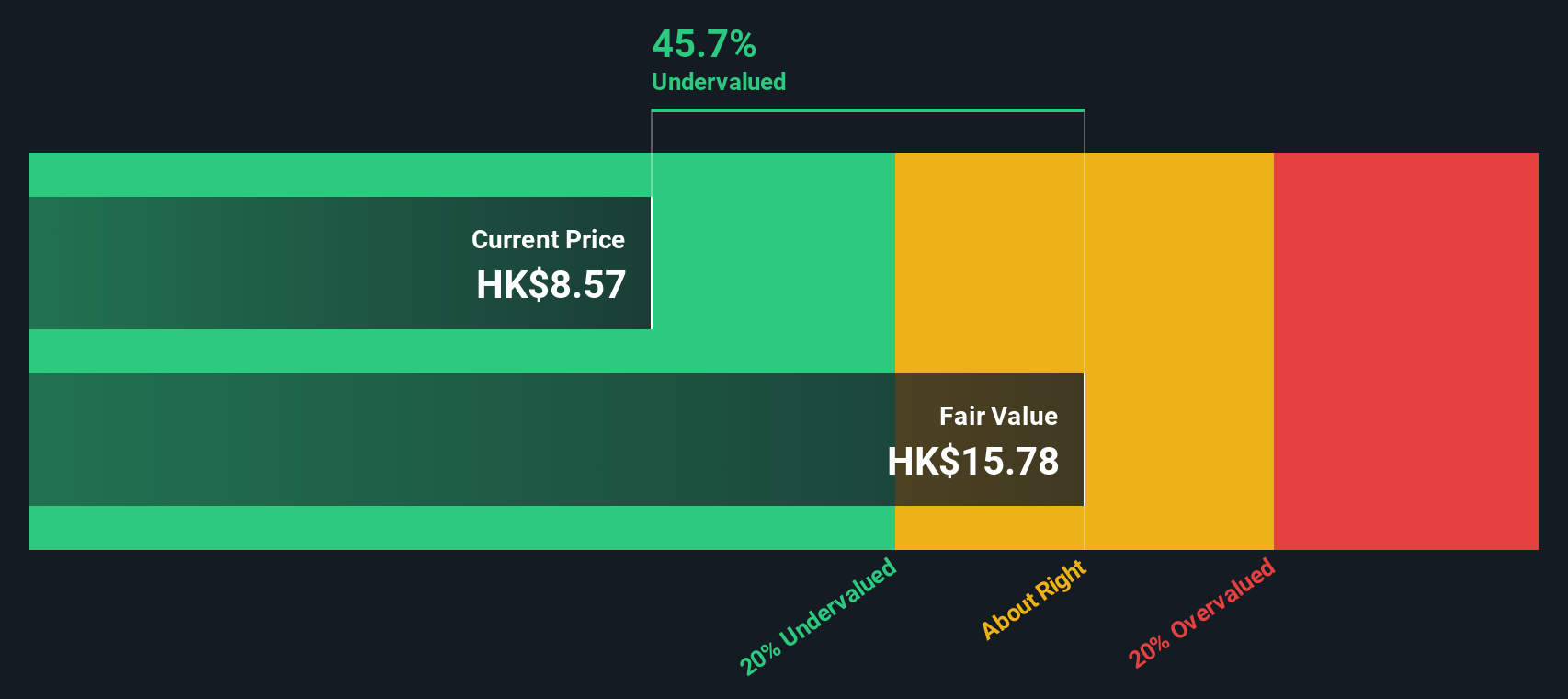

The Discounted Cash Flow (DCF) model estimates the value of a company based on projections of its future cash flows, which are discounted back to their present value to reflect today's worth. For China Gas Holdings, this approach starts with the company’s current Free Cash Flow of HK$1.26 billion. Looking ahead, analyst forecasts and further extrapolations suggest Free Cash Flow could reach HK$5.35 billion in ten years. This reflects expectations of steady growth in the business’s underlying cash generation.

All projections in this analysis are denominated in Hong Kong Dollars. Analyst estimates provide guidance for the next five years, and Simply Wall St's model extends forecasts beyond that point using incremental growth assumptions. The result of the DCF model puts China Gas Holdings’ estimated intrinsic value at HK$15.59 per share.

Compared with the company’s recent share price, this implies the stock is trading at a 49.2% discount to its estimated fair value. In practical terms, the current price appears significantly undervalued relative to what the business could be worth based on its future cash flows.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for China Gas Holdings.

Approach 2: China Gas Holdings Price vs Earnings (PE Ratio)

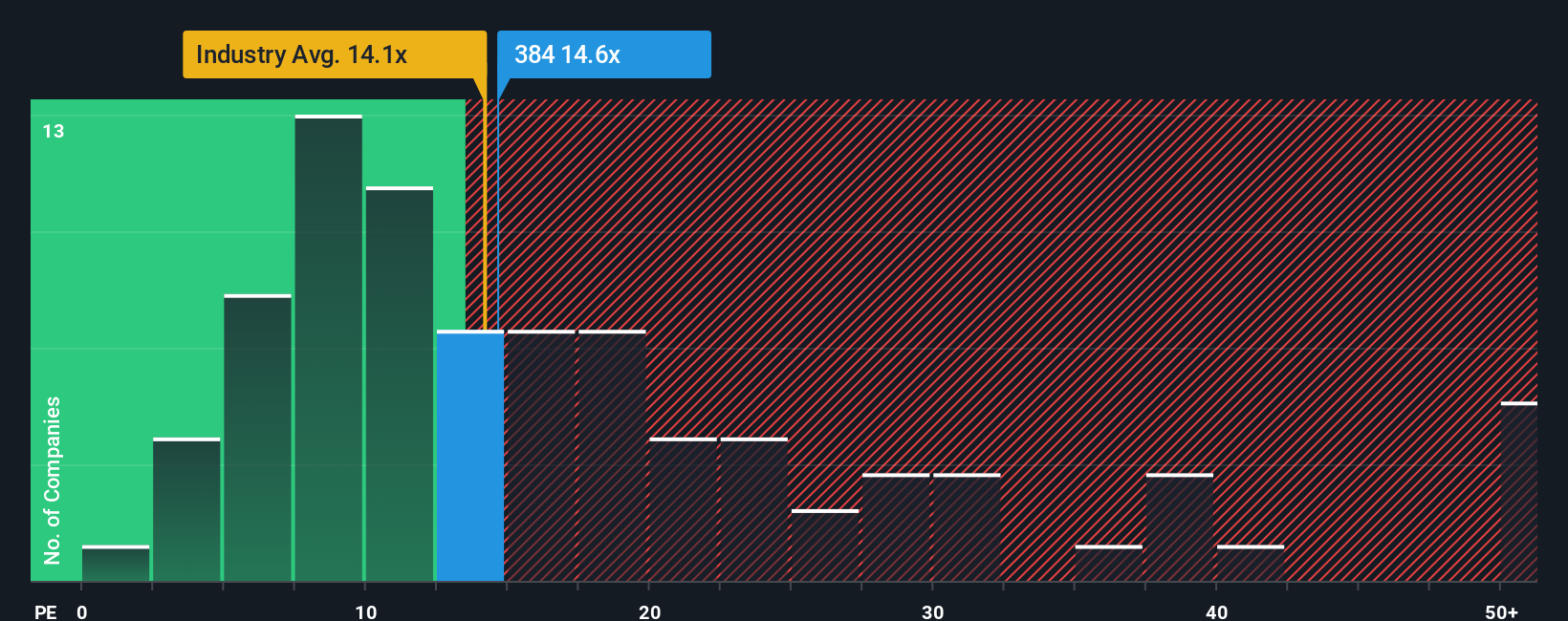

The Price-to-Earnings (PE) ratio is a popular yardstick for valuing profitable companies like China Gas Holdings. It offers a way to compare how much investors are willing to pay for each dollar of earnings, making it especially relevant when a company has steady profitability. A "normal" or fair PE ratio can vary depending on growth prospects. Companies expected to grow faster typically deserve a higher PE, while higher risks or slower growth justify a lower one.

Currently, China Gas Holdings trades at a PE ratio of 13.3x. This lines up closely with the Gas Utilities industry average of 13.3x and stands just above the average PE of its peers at 11.2x. At first glance, this suggests the stock is priced similarly to the market’s expectations for comparable companies in the sector.

However, Simply Wall St’s proprietary "Fair Ratio" for China Gas Holdings is 10.3x. The Fair Ratio is a more comprehensive benchmark than simply referencing peer groups or industry averages, as it blends in critical factors like the company’s own growth outlook, profits, market cap, risk profile, and how it compares to the broader industry. This holistic approach helps adjust for subtle but important business realities that raw averages may miss.

With China Gas Holdings’ actual PE ratio of 13.3x sitting notably above the Fair Ratio of 10.3x, the stock appears somewhat expensive on earnings alone, despite being in line with industry norms.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your China Gas Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, flexible way to tell your story about a company by connecting your own assumptions and forecasts (like future revenue, earnings and margins) to a fair value, and then seeing how that story stacks up against the current market price. Narratives turn numbers into meaningful investment decisions by tying your investment thesis directly to financial forecasts and valuation, so you are not just following formulas but actually shaping your outlook based on what you believe will happen next.

Narratives make investing approachable and dynamic, offering an easy-to-use tool within Simply Wall St’s Community page, trusted by millions of investors. They help you decide when to buy or sell by automatically comparing your Narrative’s fair value to the stock’s current price, and are kept up-to-date as new information like earnings or news arrives. For example, you might believe China Gas Holdings is worth HK$19 per share based on a bullish outlook, while another investor with a more cautious view might set their fair value as low as HK$10, and each Narrative is continuously updated as new data comes in.

Do you think there's more to the story for China Gas Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:384

China Gas Holdings

An investment holding company, operates as an energy supplier and service provider in the People’s Republic of China.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives