- Hong Kong

- /

- Gas Utilities

- /

- SEHK:3633

Does Zhongyu Energy Holdings (HKG:3633) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Zhongyu Energy Holdings Limited (HKG:3633) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Zhongyu Energy Holdings

What Is Zhongyu Energy Holdings's Debt?

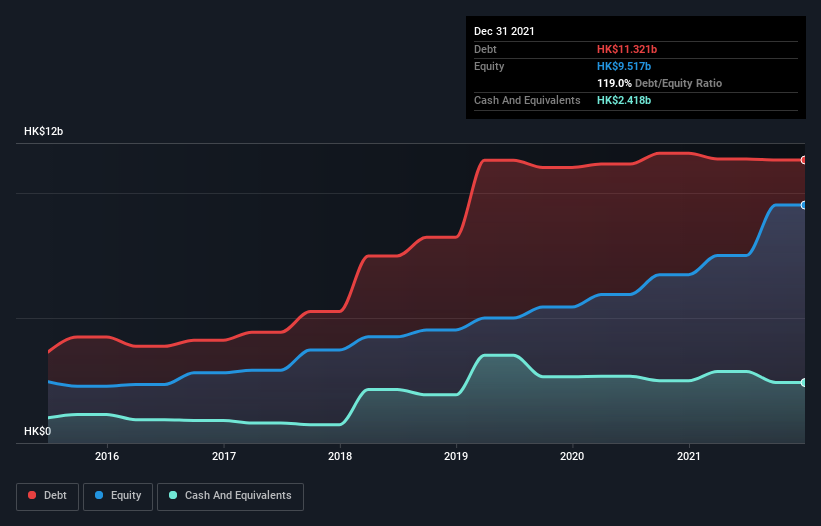

As you can see below, Zhongyu Energy Holdings had HK$11.3b of debt, at December 2021, which is about the same as the year before. You can click the chart for greater detail. However, it also had HK$2.42b in cash, and so its net debt is HK$8.90b.

A Look At Zhongyu Energy Holdings' Liabilities

We can see from the most recent balance sheet that Zhongyu Energy Holdings had liabilities of HK$8.43b falling due within a year, and liabilities of HK$8.73b due beyond that. Offsetting this, it had HK$2.42b in cash and HK$2.58b in receivables that were due within 12 months. So it has liabilities totalling HK$12.2b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of HK$19.6b, so it does suggest shareholders should keep an eye on Zhongyu Energy Holdings' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With net debt to EBITDA of 4.8 Zhongyu Energy Holdings has a fairly noticeable amount of debt. On the plus side, its EBIT was 9.0 times its interest expense, and its net debt to EBITDA, was quite high, at 4.8. We saw Zhongyu Energy Holdings grow its EBIT by 8.8% in the last twelve months. Whilst that hardly knocks our socks off it is a positive when it comes to debt. There's no doubt that we learn most about debt from the balance sheet. But it is Zhongyu Energy Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Considering the last three years, Zhongyu Energy Holdings actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

While Zhongyu Energy Holdings's net debt to EBITDA makes us cautious about it, its track record of converting EBIT to free cash flow is no better. But its not so bad at covering its interest expense with its EBIT. We should also note that Gas Utilities industry companies like Zhongyu Energy Holdings commonly do use debt without problems. Taking the abovementioned factors together we do think Zhongyu Energy Holdings's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Zhongyu Energy Holdings you should be aware of, and 1 of them doesn't sit too well with us.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Zhongyu Energy Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3633

Zhongyu Energy Holdings

An investment holding company, engages in the development, construction, and operation of natural gas projects in the People’s Republic of China.

Slight risk with poor track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026