- Hong Kong

- /

- Electric Utilities

- /

- SEHK:2638

Shareholders Of HK Electric Investments and HK Electric Investments (HKG:2638) Must Be Happy With Their 60% Return

If you buy and hold a stock for many years, you'd hope to be making a profit. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the HK Electric Investments and HK Electric Investments Limited (HKG:2638) share price is up 25% in the last five years, that's less than the market return. The last year has been disappointing, with the stock price down 3.3% in that time.

Check out our latest analysis for HK Electric Investments and HK Electric Investments

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, HK Electric Investments and HK Electric Investments actually saw its EPS drop 8.2% per year.

Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. The falling EPS doesn't correlate with the climbing share price, so it's worth taking a look at other metrics.

There's no sign of growing dividends, which might have explained the resilient share price. The revenue decline of 0.8% wouldn't have helped. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

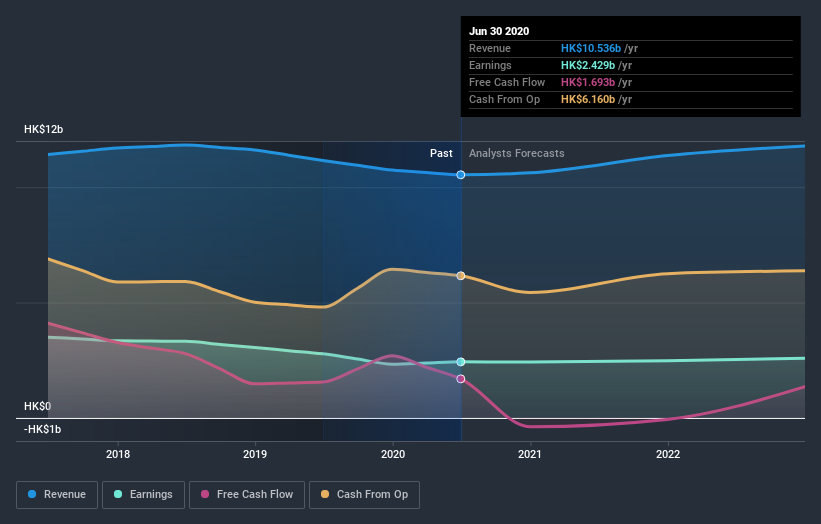

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling HK Electric Investments and HK Electric Investments stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of HK Electric Investments and HK Electric Investments, it has a TSR of 60% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

HK Electric Investments and HK Electric Investments provided a TSR of 0.8% over the last twelve months. But that return falls short of the market. On the bright side, the longer term returns (running at about 10% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for HK Electric Investments and HK Electric Investments that you should be aware of.

Of course HK Electric Investments and HK Electric Investments may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading HK Electric Investments and HK Electric Investments or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade HK Electric Investments and HK Electric Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HK Electric Investments and HK Electric Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2638

HK Electric Investments and HK Electric Investments

An investment holding company, engages in the generation, transmission, distribution, and supply of electricity in Hong Kong Island and Lamma Island.

Fair value with questionable track record.