- Hong Kong

- /

- Renewable Energy

- /

- SEHK:2380

What China Power International Development (SEHK:2380)'s Shift in Power Plant Mix and Declining Sales Means For Shareholders

Reviewed by Sasha Jovanovic

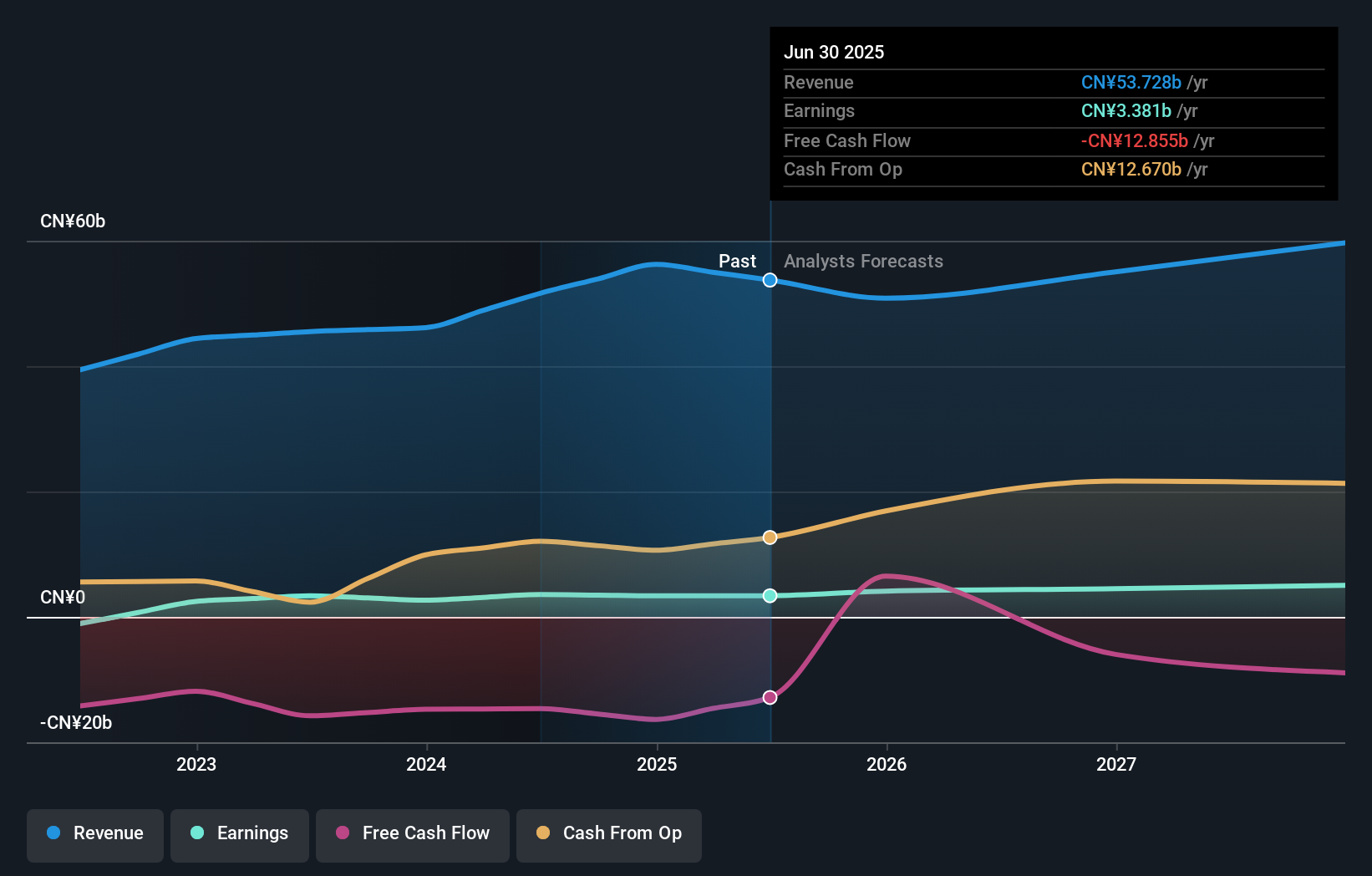

- Earlier this month, China Power International Development Limited reported a 5.29% decrease in electricity sales for October 2025, with overall sales for the first ten months declining by 2.51% year-on-year.

- The company's recent reclassification of wind and coal-fired power projects signals a shift in its business strategy that could influence its future operations.

- We will explore how these operational shifts, especially the evolving power plant mix, shape China Power International Development’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is China Power International Development's Investment Narrative?

To be a shareholder in China Power International Development, you have to believe in the company’s efforts to balance its traditional and renewable energy portfolio, especially as it navigates evolving regulatory, environmental, and market demands in China. The recent drop in electricity sales, alongside a shift in how the company classifies its power generation projects, puts more emphasis on the short-term catalyst of operational execution as the new management team settles in. As board and executive reshuffles continue, leadership stability will likely matter more in the near term, particularly with fresh strategies coming into play. While the headline sales decline is a negative, price moves so far do not suggest a major change in investor sentiment, and current valuation remains just a little below consensus fair value. Still, execution risk appears heightened, and ongoing board turnover and limited management experience are important points for investors to monitor.

On the flip side, substantial board turnover may bring added uncertainty. China Power International Development's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on China Power International Development - why the stock might be worth just HK$3.56!

Build Your Own China Power International Development Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Power International Development research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Power International Development research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Power International Development's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2380

China Power International Development

An investment holding company, develops, constructs, owns, operates, and manages power plants in the People’s Republic of China and internationally.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.