- Hong Kong

- /

- Water Utilities

- /

- SEHK:2281

Luzhou Xinglu Water (Group) (HKG:2281) Is Due To Pay A Dividend Of HK$0.073

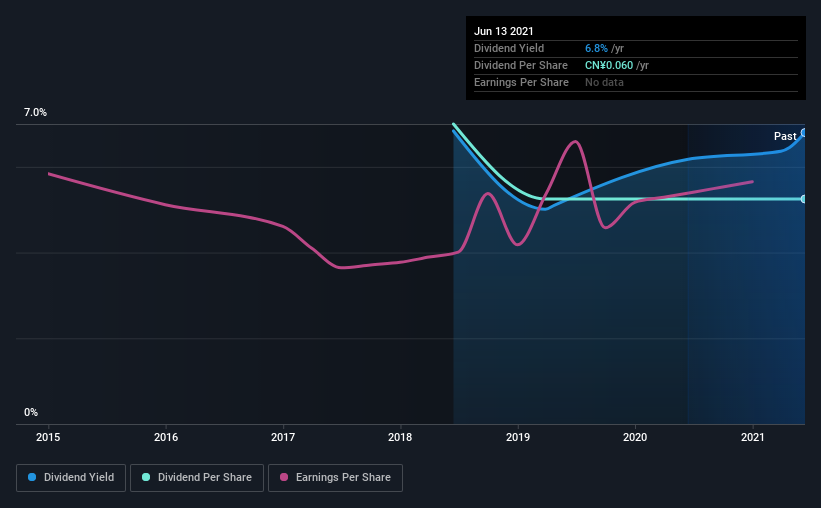

The board of Luzhou Xinglu Water (Group) Co., Ltd. (HKG:2281) has announced that it will pay a dividend on the 30th of July, with investors receiving HK$0.073 per share. This makes the dividend yield 6.8%, which will augment investor returns quite nicely.

Check out our latest analysis for Luzhou Xinglu Water (Group)

Luzhou Xinglu Water (Group)'s Earnings Easily Cover the Distributions

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Luzhou Xinglu Water (Group) is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Over the next year, EPS could expand by 2.0% if recent trends continue. If the dividend continues on this path, the payout ratio could be 30% by next year, which we think can be pretty sustainable going forward.

Luzhou Xinglu Water (Group)'s Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. The dividend has gone from CN¥0.08 in 2018 to the most recent annual payment of CN¥0.06. Doing the maths, this is a decline of about 9.1% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth May Be Hard To Achieve

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Earnings have grown at around 2.0% a year for the past five years, which isn't massive but still better than seeing them shrink. If Luzhou Xinglu Water (Group) is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Luzhou Xinglu Water (Group)'s payments, as there could be some issues with sustaining them into the future. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think Luzhou Xinglu Water (Group) is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 3 warning signs for Luzhou Xinglu Water (Group) (2 don't sit too well with us!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2281

Luzhou Xinglu Water (Group)

Operates as an integrated municipal water service provider in the People’s Republic of China.

Slight risk second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026