- Hong Kong

- /

- Electric Utilities

- /

- SEHK:2

CLP Holdings (HKG:2) investors are sitting on a loss of 20% if they invested five years ago

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in CLP Holdings Limited (HKG:2), since the last five years saw the share price fall 35%. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 11% in the same timeframe.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for CLP Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

CLP Holdings became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

The steady dividend doesn't really explain why the share price is down. While it's not completely obvious why the share price is down, a closer look at the company's history might help explain it.

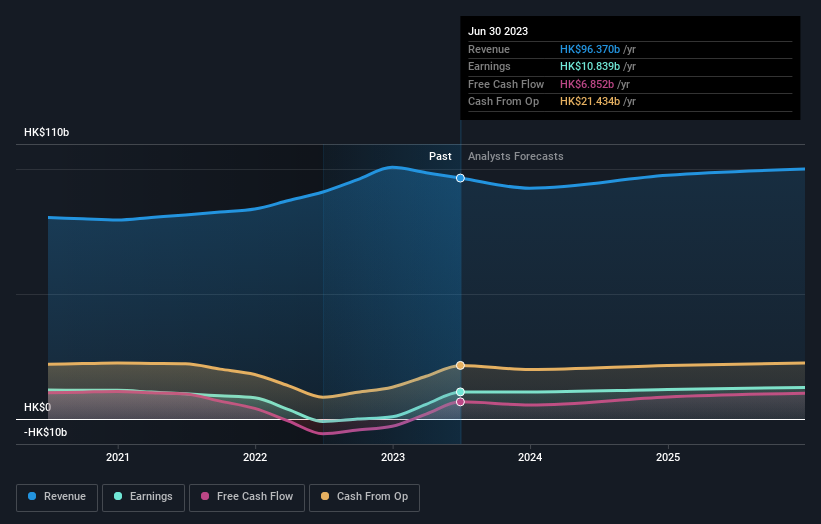

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that CLP Holdings has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling CLP Holdings stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, CLP Holdings' TSR for the last 5 years was -20%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that CLP Holdings has rewarded shareholders with a total shareholder return of 13% in the last twelve months. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand CLP Holdings better, we need to consider many other factors. For instance, we've identified 2 warning signs for CLP Holdings that you should be aware of.

But note: CLP Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2

CLP Holdings

An investment holding company, engages in the generation, retail, transmission, and distribution of electricity in Hong Kong, Mainland China, India, Thailand, Taiwan, and Australia.

Proven track record average dividend payer.

Market Insights

Community Narratives