- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1600

More money in the bank for insiders who divested CN¥922m worth of Tian Lun Gas Holdings Limited (HKG:1600) shares last year

Last week, Tian Lun Gas Holdings Limited's (HKG:1600) stock jumped 13%, but insiders who sold CN¥922m worth of stock in over the past year are likely to be in a better position. Selling at an average price of CN¥7.68, which is higher than the current price might have been the right call as holding on to stock would have meant their investment would be worth less now than it was at the time of sale.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Tian Lun Gas Holdings

Tian Lun Gas Holdings Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Founder & Chairman of the Board, Yingcen Zhang, sold HK$922m worth of shares at a price of HK$7.68 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is HK$5.57. So it may not tell us anything about how insiders feel about the current share price. The only individual insider seller over the last year was Yingcen Zhang.

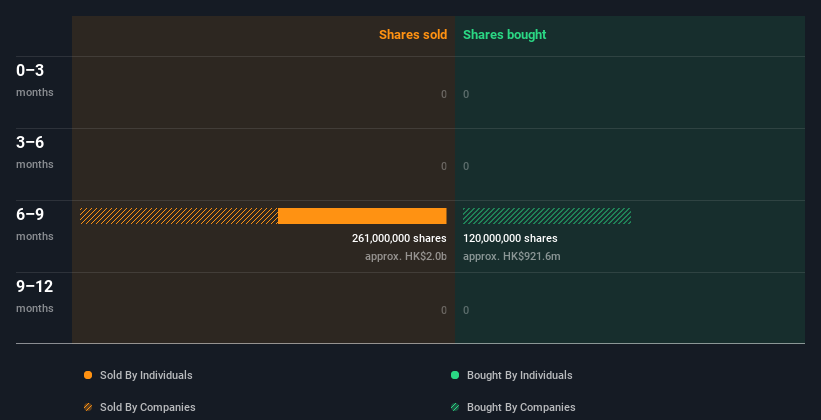

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership of Tian Lun Gas Holdings

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Tian Lun Gas Holdings insiders own about HK$2.0b worth of shares (which is 35% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Tian Lun Gas Holdings Tell Us?

It doesn't really mean much that no insider has traded Tian Lun Gas Holdings shares in the last quarter. While we feel good about high insider ownership of Tian Lun Gas Holdings, we can't say the same about the selling of shares. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Tian Lun Gas Holdings. Case in point: We've spotted 3 warning signs for Tian Lun Gas Holdings you should be aware of.

But note: Tian Lun Gas Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tian Lun Gas Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1600

Tian Lun Gas Holdings

Engages in the transportation, distribution, and sale of natural gas and compressed natural gas through its gas pipeline connections in the People’ Republic of China.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion