- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1381

Risks To Shareholder Returns Are Elevated At These Prices For Canvest Environmental Protection Group Company Limited (HKG:1381)

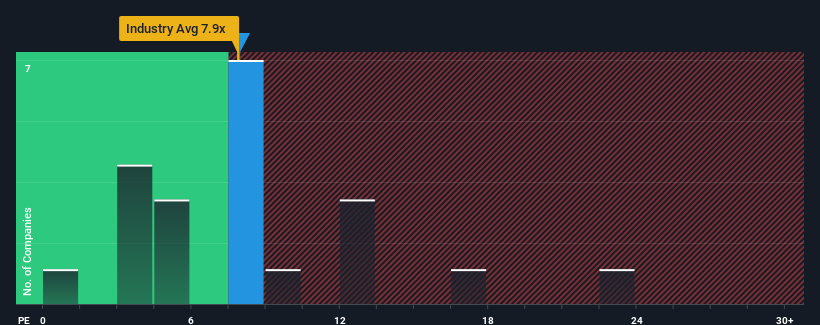

With a median price-to-earnings (or "P/E") ratio of close to 9x in Hong Kong, you could be forgiven for feeling indifferent about Canvest Environmental Protection Group Company Limited's (HKG:1381) P/E ratio of 7.9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Canvest Environmental Protection Group as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Canvest Environmental Protection Group

Is There Some Growth For Canvest Environmental Protection Group?

In order to justify its P/E ratio, Canvest Environmental Protection Group would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 23% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 11% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 15% per annum, which is noticeably more attractive.

With this information, we find it interesting that Canvest Environmental Protection Group is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Canvest Environmental Protection Group currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Canvest Environmental Protection Group you should be aware of.

You might be able to find a better investment than Canvest Environmental Protection Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1381

Canvest Environmental Protection Group

An investment holding company, engages in the operation and management of waste-to-energy (WTE) plants in the People’s Republic of China.

Fair value with acceptable track record.

Market Insights

Community Narratives