- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1265

Tianjin Jinran Public Utilities (HKG:1265) stock falls 11% in past week as five-year earnings and shareholder returns continue downward trend

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. So we wouldn't blame long term Tianjin Jinran Public Utilities Company Limited (HKG:1265) shareholders for doubting their decision to hold, with the stock down 54% over a half decade. And it's not just long term holders hurting, because the stock is down 24% in the last year. The falls have accelerated recently, with the share price down 14% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 19% in the same timeframe.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Before we look at the performance, you might like to know that our analysis indicates that 1265 is potentially overvalued!

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Tianjin Jinran Public Utilities moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 1.7% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

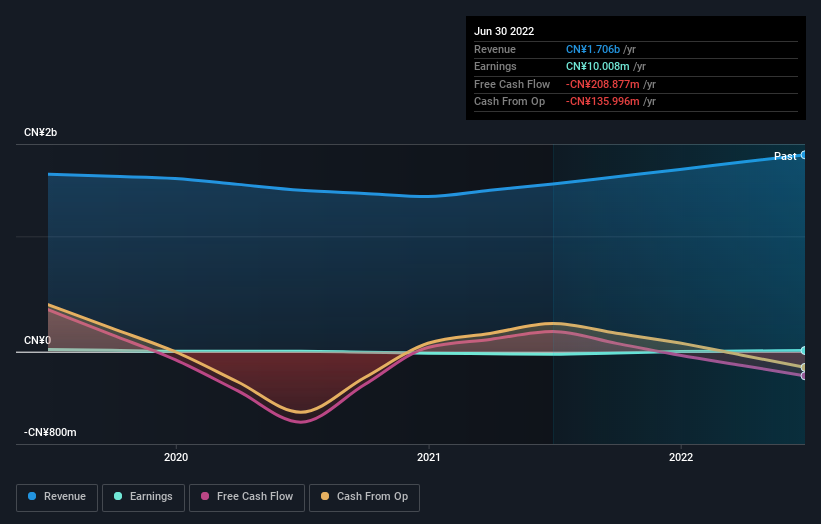

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Tianjin Jinran Public Utilities' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Tianjin Jinran Public Utilities shareholders, and that cash payout explains why its total shareholder loss of 47%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

The total return of 24% received by Tianjin Jinran Public Utilities shareholders over the last year isn't far from the market return of -25%. So last year was actually even worse than the last five years, which cost shareholders 8% per year. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. It's always interesting to track share price performance over the longer term. But to understand Tianjin Jinran Public Utilities better, we need to consider many other factors. Even so, be aware that Tianjin Jinran Public Utilities is showing 3 warning signs in our investment analysis , and 2 of those are concerning...

We will like Tianjin Jinran Public Utilities better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Jinran Public Utilities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1265

Tianjin Jinran Public Utilities

Engages in the sale of piped natural gas in Mainland China.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026