- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1250

Investors Who Bought Beijing Enterprises Clean Energy Group (HKG:1250) Shares A Year Ago Are Now Up 133%

It might be of some concern to shareholders to see the Beijing Enterprises Clean Energy Group Limited (HKG:1250) share price down 11% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 133% in that time. So some might not be surprised to see the price retrace some. More important, going forward, is how the business itself is going.

See our latest analysis for Beijing Enterprises Clean Energy Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Beijing Enterprises Clean Energy Group actually saw its earnings per share drop 69%.

Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Unfortunately Beijing Enterprises Clean Energy Group's fell 19% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

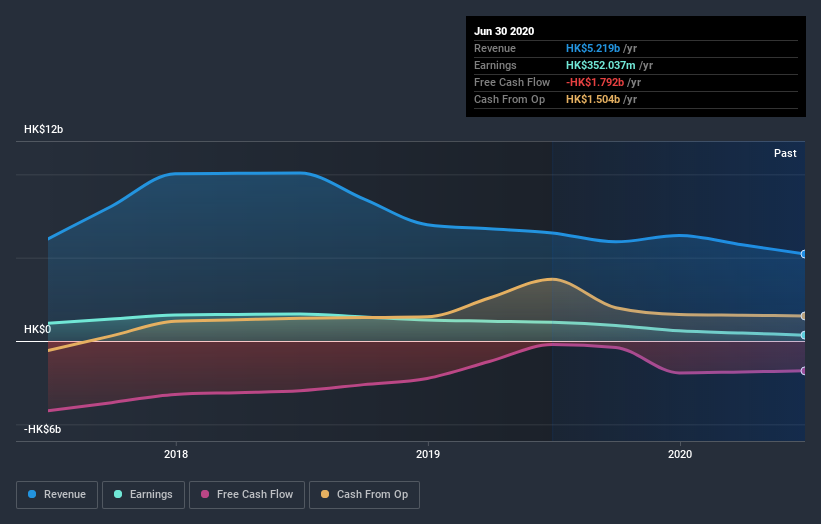

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Beijing Enterprises Clean Energy Group stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that Beijing Enterprises Clean Energy Group shareholders have received a total shareholder return of 133% over one year. That certainly beats the loss of about 12% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Beijing Enterprises Clean Energy Group (1 doesn't sit too well with us) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Beijing Enterprises Clean Energy Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1250

Shandong Hi-Speed New Energy Group

Invests, develops, constructs, operates, and manages photovoltaic power business in Mainland China.

Acceptable track record low.

Market Insights

Community Narratives