- Hong Kong

- /

- Water Utilities

- /

- SEHK:1129

A Look At China Water Industry Group's (HKG:1129) Share Price Returns

China Water Industry Group Limited (HKG:1129) shareholders should be happy to see the share price up 18% in the last week. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 84% in that time. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for China Water Industry Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

China Water Industry Group became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

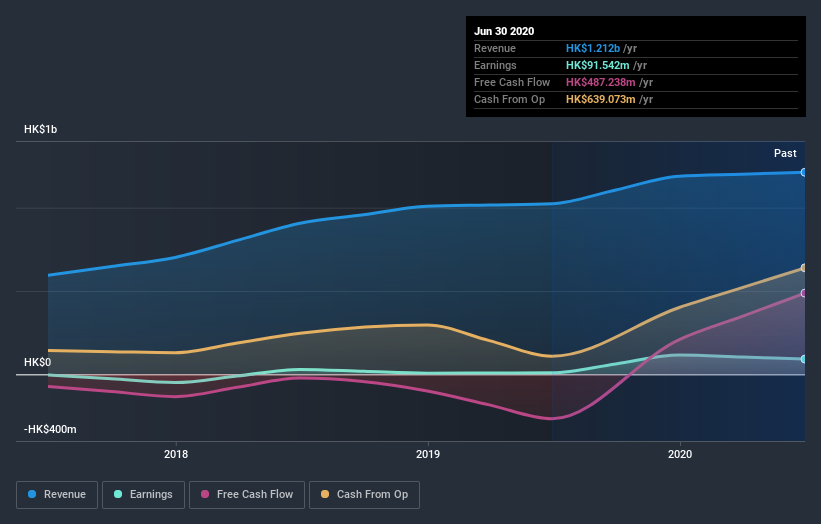

Revenue is actually up 22% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating China Water Industry Group further; while we may be missing something on this analysis, there might also be an opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on China Water Industry Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

China Water Industry Group shareholders are down 39% for the year, but the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand China Water Industry Group better, we need to consider many other factors. Take risks, for example - China Water Industry Group has 2 warning signs we think you should be aware of.

Of course China Water Industry Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Water Industry Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1129

China Water Industry Group

An investment holding company, provides water supply and sewage treatment services in the People’s Republic of China.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives