- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1071

Investor Optimism Abounds Huadian Power International Corporation Limited (HKG:1071) But Growth Is Lacking

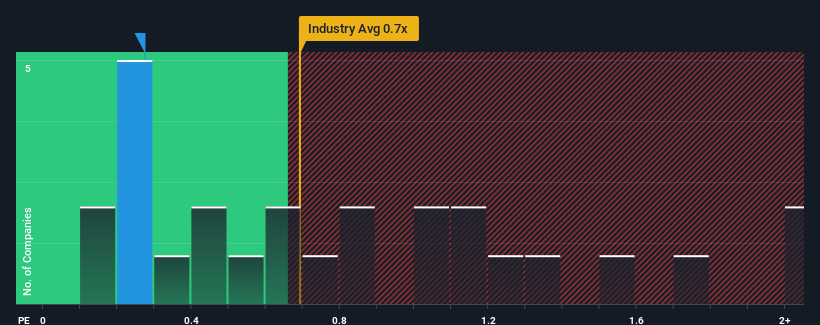

It's not a stretch to say that Huadian Power International Corporation Limited's (HKG:1071) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Renewable Energy industry in Hong Kong, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Huadian Power International

What Does Huadian Power International's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Huadian Power International has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Huadian Power International.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Huadian Power International's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 2.5% during the coming year according to the eight analysts following the company. That's not great when the rest of the industry is expected to grow by 6.1%.

With this information, we find it concerning that Huadian Power International is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Huadian Power International's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Huadian Power International's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You should always think about risks. Case in point, we've spotted 6 warning signs for Huadian Power International you should be aware of, and 4 of them are potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Huadian Power International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1071

Huadian Power International

Engages in the generation and sale of electricity, heat, and coal to power grid companies in the People’s Republic of China.

Undervalued with proven track record.