Electrolux Professional And Two More Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by cautious commentary from the Federal Reserve and political uncertainty, global markets experienced notable declines, with U.S. indices such as the S&P 500 and Dow Jones Industrial Average posting losses. Despite these challenges, economic indicators like robust GDP growth and retail sales in the U.S. suggest underlying economic strength that could present opportunities for discerning investors seeking undervalued stocks. In such volatile conditions, identifying stocks trading below their intrinsic value can offer potential long-term benefits by capitalizing on market inefficiencies or temporary mispricings. This article explores Electrolux Professional and two other companies that are currently estimated to be undervalued in light of these market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hainan Jinpan Smart Technology (SHSE:688676) | CN¥43.43 | CN¥86.61 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.95 | ₹2250.68 | 49.8% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | US$34.58 | US$68.97 | 49.9% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.04 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.82 | 50% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.00 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.45 | 49.7% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2400.00 | CLP4798.13 | 50% |

| Paycor HCM (NasdaqGS:PYCR) | US$19.33 | US$38.52 | 49.8% |

Here's a peek at a few of the choices from the screener.

Electrolux Professional (OM:EPRO B)

Overview: Electrolux Professional AB (publ) offers food service, beverage, and laundry products and solutions to various sectors such as restaurants, hotels, healthcare, and educational facilities with a market cap of SEK19.86 billion.

Operations: The company's revenue is comprised of SEK4.70 billion from laundry products and SEK7.53 billion from food and beverage solutions.

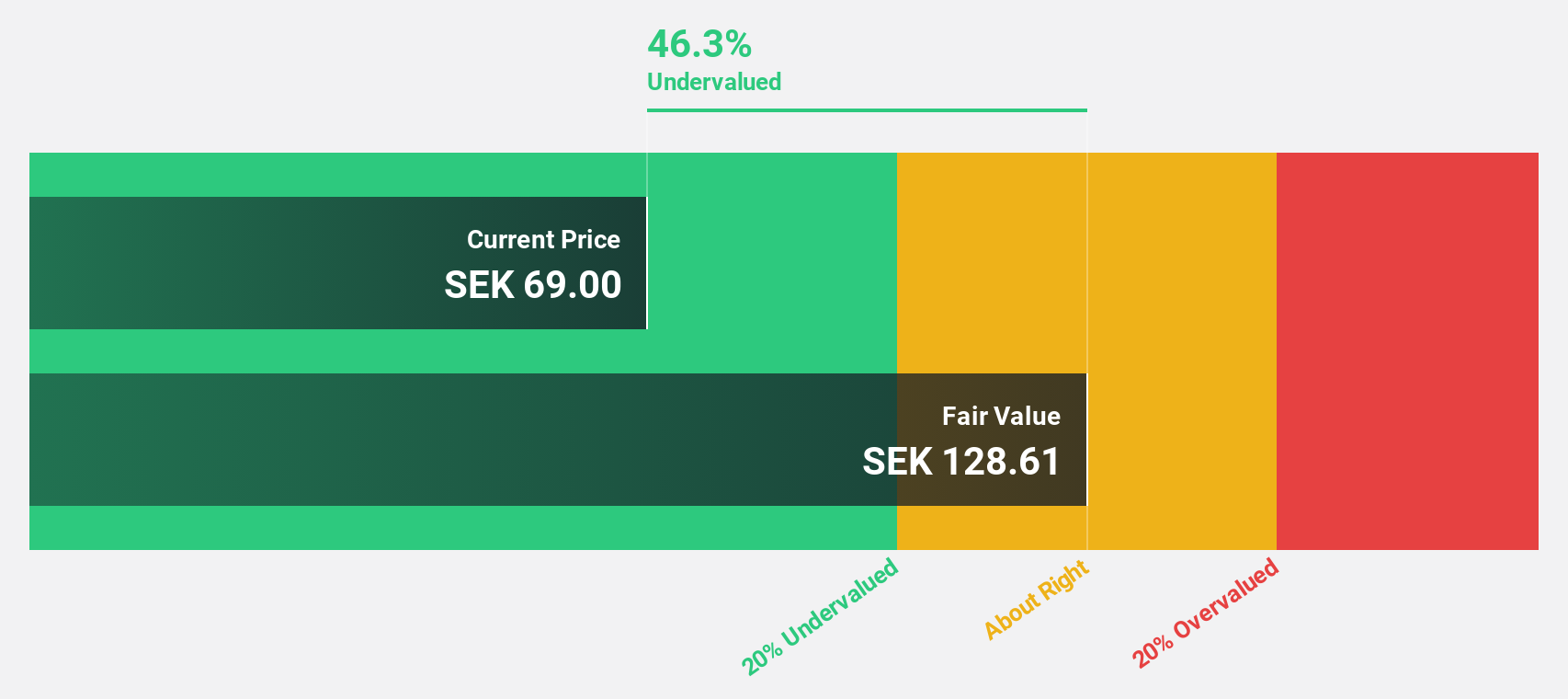

Estimated Discount To Fair Value: 44.2%

Electrolux Professional appears undervalued, trading 44.2% below its estimated fair value of SEK 123.75 with a current price around SEK 69.1. Recent earnings show consistent growth, with Q3 sales rising to SEK 2.93 billion from SEK 2.75 billion year-on-year and net income increasing to SEK 187 million from SEK 159 million. Despite high debt levels, projected annual earnings growth of over 20% outpaces the Swedish market's average, suggesting potential for future cash flow appreciation.

- Our comprehensive growth report raises the possibility that Electrolux Professional is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Electrolux Professional stock in this financial health report.

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company that offers intra-city on-demand delivery services in the People’s Republic of China, with a market cap of HK$8.46 billion.

Operations: The company generates CN¥13.52 billion from its intra-city on-demand delivery service business in the People’s Republic of China.

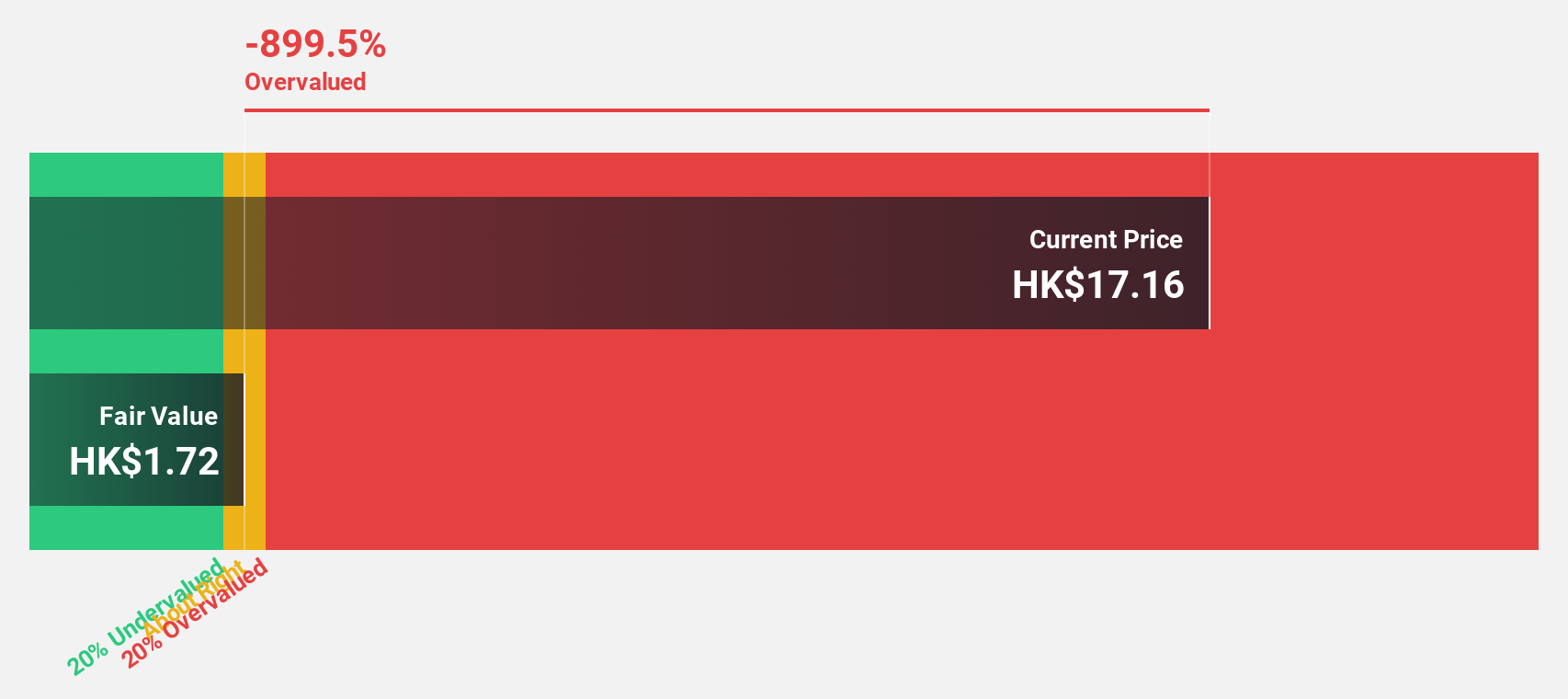

Estimated Discount To Fair Value: 40.3%

Hangzhou SF Intra-city Industrial is trading at HK$9.25, significantly below its estimated fair value of HK$15.49, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow 55.73% annually, outpacing the Hong Kong market's average growth rate of 11.5%. Despite recent insider selling and low projected return on equity, the completion of a follow-on equity offering suggests strategic positioning for future growth opportunities.

- Insights from our recent growth report point to a promising forecast for Hangzhou SF Intra-city Industrial's business outlook.

- Click to explore a detailed breakdown of our findings in Hangzhou SF Intra-city Industrial's balance sheet health report.

Stratec (XTRA:SBS)

Overview: Stratec SE, along with its subsidiaries, designs and manufactures automation and instrumentation solutions for in-vitro diagnostics and life sciences globally, with a market cap of €361.64 million.

Operations: The company generates revenue from its Automation Solutions for Highly Regulated Laboratory segment, amounting to €250.54 million.

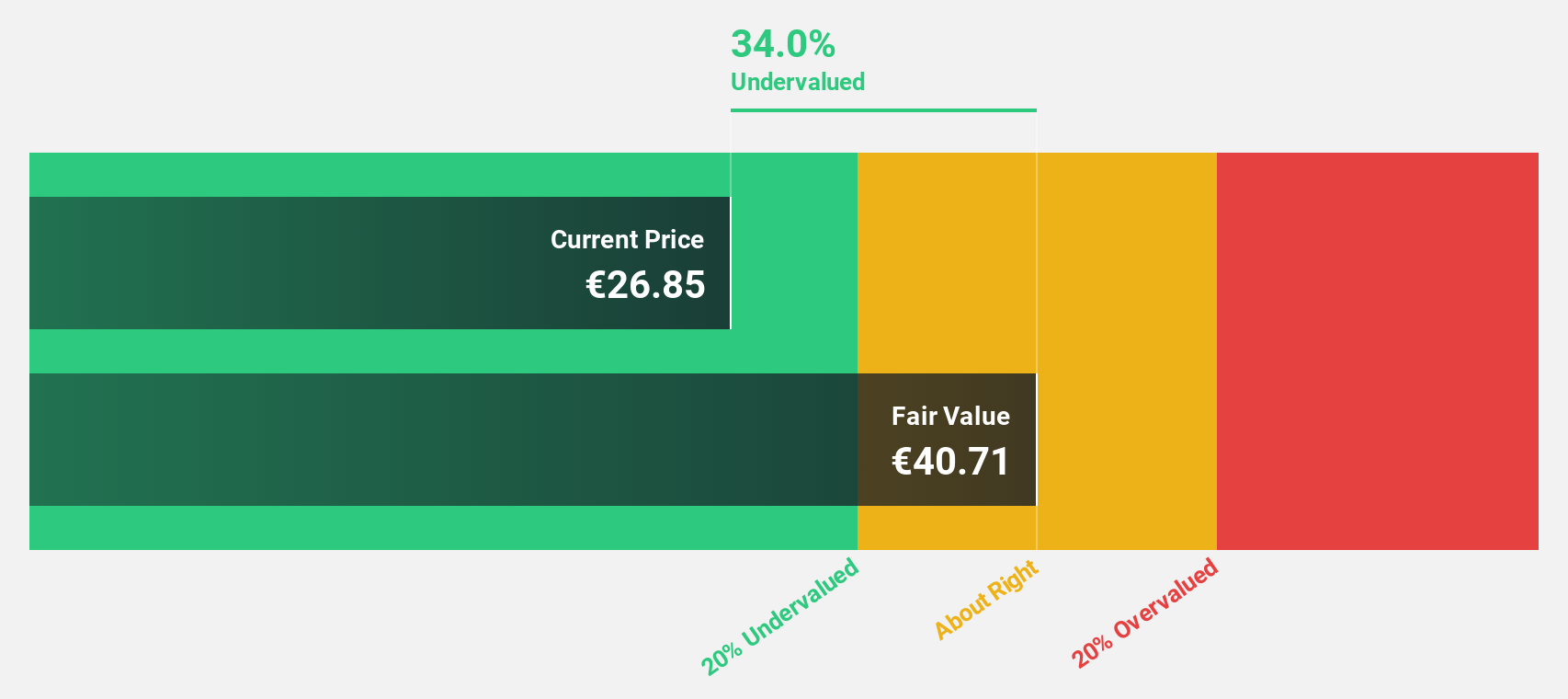

Estimated Discount To Fair Value: 45.8%

Stratec SE, trading at €29.75, is significantly below its estimated fair value of €54.86, highlighting potential undervaluation based on cash flows. Despite a high debt level and volatile share price, earnings are projected to grow 25.4% annually over the next three years—outpacing the German market's average growth rate of 20.6%. Recent earnings showed decreased sales (€57.23 million) and net income (€0.549 million), reflecting current financial challenges amidst growth forecasts.

- The growth report we've compiled suggests that Stratec's future prospects could be on the up.

- Click here to discover the nuances of Stratec with our detailed financial health report.

Where To Now?

- Navigate through the entire inventory of 871 Undervalued Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou SF Intra-city Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9699

Hangzhou SF Intra-city Industrial

An investment holding company, provides intra-city on-demand delivery services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives