China Ocean Group Development Limited's (HKG:8047) 28% Share Price Plunge Could Signal Some Risk

China Ocean Group Development Limited (HKG:8047) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

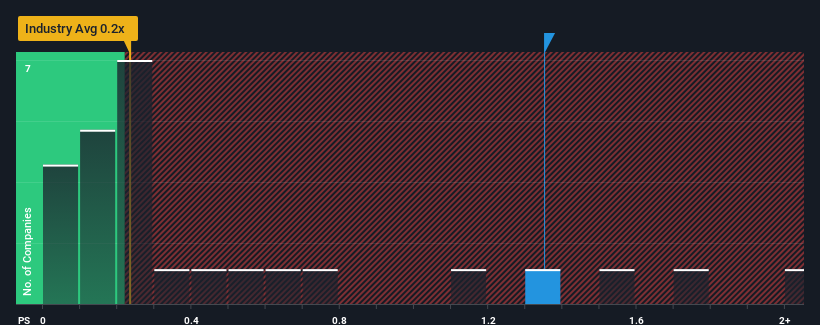

In spite of the heavy fall in price, given close to half the companies operating in Hong Kong's Logistics industry have price-to-sales ratios (or "P/S") below 0.2x, you may still consider China Ocean Group Development as a stock to potentially avoid with its 1.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for China Ocean Group Development

What Does China Ocean Group Development's P/S Mean For Shareholders?

The revenue growth achieved at China Ocean Group Development over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Ocean Group Development's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For China Ocean Group Development?

In order to justify its P/S ratio, China Ocean Group Development would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 65% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 4.9% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that China Ocean Group Development's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From China Ocean Group Development's P/S?

China Ocean Group Development's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of China Ocean Group Development revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 4 warning signs for China Ocean Group Development (2 shouldn't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8047

China Ocean Group Development

An investment holding company, engages in the supply chain management and ocean fishing businesses in the People’s Republic of China, Hong Kong, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives