- Hong Kong

- /

- Infrastructure

- /

- SEHK:694

Some Shareholders May Object To A Pay Rise For Beijing Capital International Airport Company Limited's (HKG:694) CEO This Year

Performance at Beijing Capital International Airport Company Limited (HKG:694) has not been particularly rosy recently and shareholders will likely be holding CEO Zhiliang Han and the board accountable for this. At the upcoming AGM on 23 June 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for Beijing Capital International Airport

How Does Total Compensation For Zhiliang Han Compare With Other Companies In The Industry?

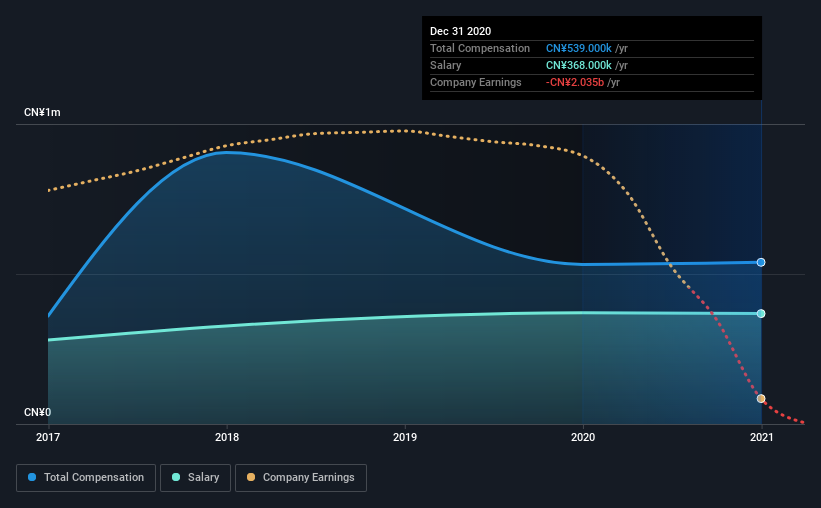

At the time of writing, our data shows that Beijing Capital International Airport Company Limited has a market capitalization of HK$24b, and reported total annual CEO compensation of CN¥539k for the year to December 2020. That's mostly flat as compared to the prior year's compensation. In particular, the salary of CN¥368.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from HK$16b to HK$50b, we found that the median CEO total compensation was CN¥1.4m. That is to say, Zhiliang Han is paid under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥368k | CN¥371k | 68% |

| Other | CN¥171k | CN¥161k | 32% |

| Total Compensation | CN¥539k | CN¥532k | 100% |

Talking in terms of the industry, salary represented approximately 78% of total compensation out of all the companies we analyzed, while other remuneration made up 22% of the pie. Beijing Capital International Airport sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Beijing Capital International Airport Company Limited's Growth Numbers

Over the last three years, Beijing Capital International Airport Company Limited has shrunk its earnings per share by 80% per year. Its revenue is down 72% over the previous year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Beijing Capital International Airport Company Limited Been A Good Investment?

With a total shareholder return of -34% over three years, Beijing Capital International Airport Company Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Beijing Capital International Airport that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Beijing Capital International Airport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:694

Beijing Capital International Airport

Engages in the aeronautical and non-aeronautical businesses at the Beijing Capital Airport in the People’s Republic of China.

Reasonable growth potential minimal.