- Hong Kong

- /

- Infrastructure

- /

- SEHK:6119

Tian Yuan Group Holdings Limited's (HKG:6119) Stock Going Strong But Fundamentals Look Weak: What Implications Could This Have On The Stock?

Tian Yuan Group Holdings' (HKG:6119) stock is up by a considerable 31% over the past three months. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. Specifically, we decided to study Tian Yuan Group Holdings' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Tian Yuan Group Holdings is:

5.2% = CN¥18m ÷ CN¥348m (Based on the trailing twelve months to June 2025).

The 'return' is the income the business earned over the last year. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.05.

See our latest analysis for Tian Yuan Group Holdings

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Tian Yuan Group Holdings' Earnings Growth And 5.2% ROE

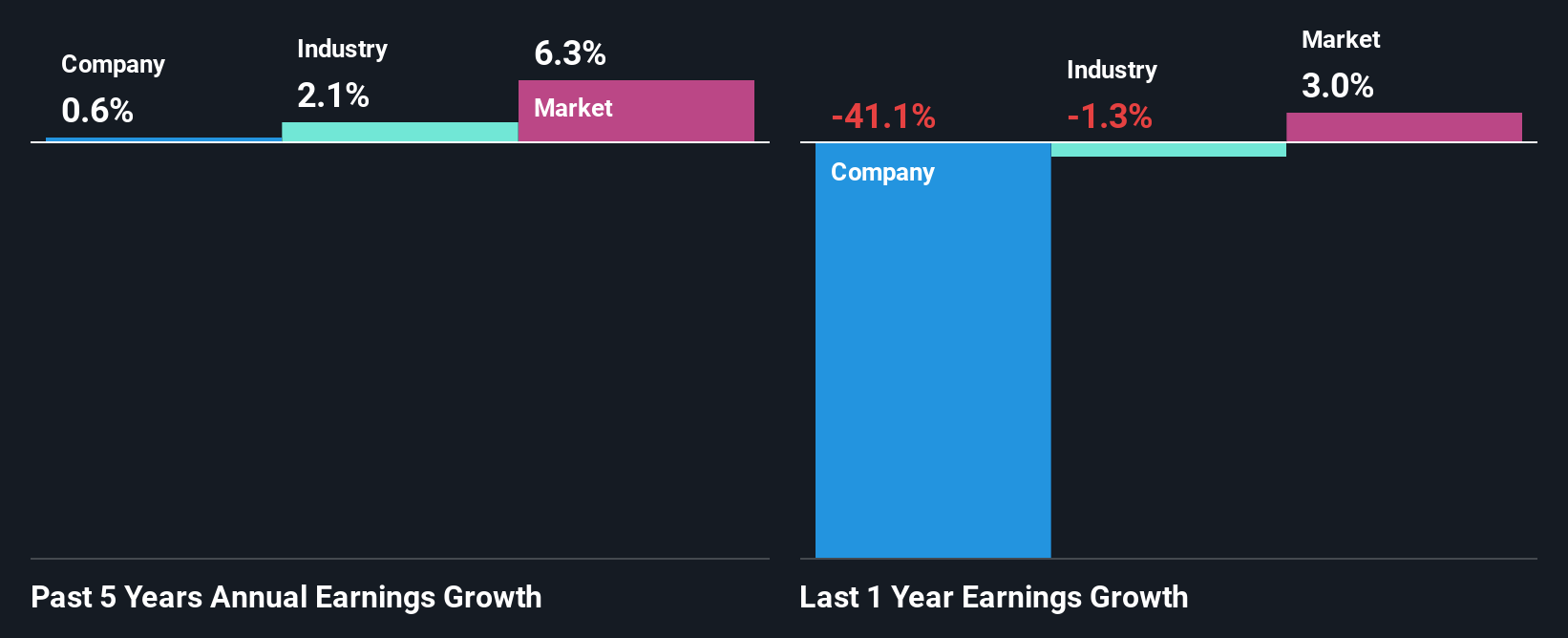

On the face of it, Tian Yuan Group Holdings' ROE is not much to talk about. Next, when compared to the average industry ROE of 6.9%, the company's ROE leaves us feeling even less enthusiastic. Therefore, Tian Yuan Group Holdings' flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

As a next step, we compared Tian Yuan Group Holdings' net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 2.1% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Tian Yuan Group Holdings is trading on a high P/E or a low P/E, relative to its industry.

Is Tian Yuan Group Holdings Efficiently Re-investing Its Profits?

Tian Yuan Group Holdings' very high three-year median payout ratio of 147% suggests that the company is paying its shareholders more than what it is earning. The absence in growth is therefore not surprising. Paying a dividend higher than reported profits is not a sustainable move. That's a huge risk in our books. You can see the 3 risks we have identified for Tian Yuan Group Holdings by visiting our risks dashboard for free on our platform here.

In addition, Tian Yuan Group Holdings has been paying dividends over a period of seven years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth.

Conclusion

Overall, we would be extremely cautious before making any decision on Tian Yuan Group Holdings. Particularly, its ROE is a huge disappointment, not to mention its lack of proper reinvestment into the business. As a result its earnings growth has also been quite disappointing. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Tian Yuan Group Holdings' past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

Valuation is complex, but we're here to simplify it.

Discover if Tian Yuan Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6119

Tian Yuan Group Holdings

An investment holding company, provides bulk and general cargo uploading and unloading, and related ancillary port services in the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026