- Hong Kong

- /

- Infrastructure

- /

- SEHK:576

Zhejiang Expressway (HKG:576) shareholders YoY returns are lagging the company's 2.6% five-year earnings growth

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Zhejiang Expressway Co., Ltd. (HKG:576), since the last five years saw the share price fall 24%. And the share price decline continued over the last week, dropping some 10%. But this could be related to the soft market, which is down about 4.6% in the same period.

If the past week is anything to go by, investor sentiment for Zhejiang Expressway isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Zhejiang Expressway

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate half decade during which the share price slipped, Zhejiang Expressway actually saw its earnings per share (EPS) improve by 14% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

The steady dividend doesn't really explain why the share price is down. While it's not completely obvious why the share price is down, a closer look at the company's history might help explain it.

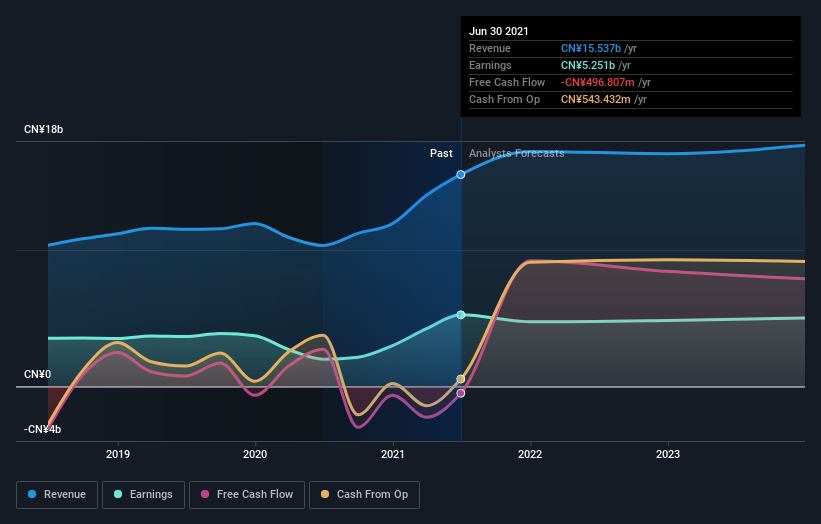

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Zhejiang Expressway has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Zhejiang Expressway will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Zhejiang Expressway the TSR over the last 5 years was 1.6%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Zhejiang Expressway shareholders have received a total shareholder return of 14% over the last year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 0.3%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Zhejiang Expressway that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Expressway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:576

Zhejiang Expressway

An investment holding company, invests, develops, maintains, and operates roads in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives