- Hong Kong

- /

- Infrastructure

- /

- SEHK:548

Potential Upside For Shenzhen Expressway Corporation Limited (HKG:548) Not Without Risk

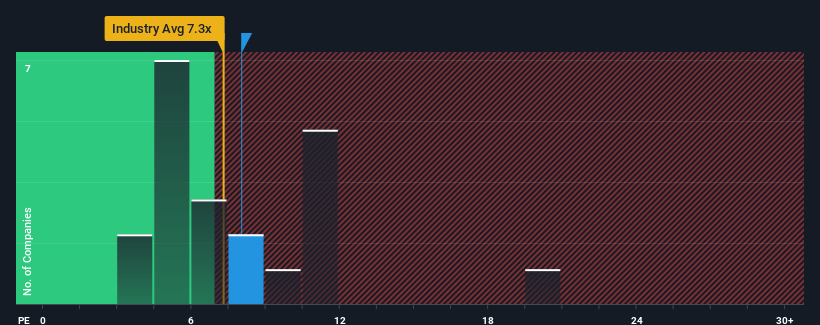

With a median price-to-earnings (or "P/E") ratio of close to 9x in Hong Kong, you could be forgiven for feeling indifferent about Shenzhen Expressway Corporation Limited's (HKG:548) P/E ratio of 8x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Shenzhen Expressway as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Shenzhen Expressway

How Is Shenzhen Expressway's Growth Trending?

Shenzhen Expressway's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 46%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 43% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 83% over the next year. Meanwhile, the rest of the market is forecast to only expand by 22%, which is noticeably less attractive.

With this information, we find it interesting that Shenzhen Expressway is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Expressway's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You need to take note of risks, for example - Shenzhen Expressway has 3 warning signs (and 1 which can't be ignored) we think you should know about.

Of course, you might also be able to find a better stock than Shenzhen Expressway. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:548

Shenzhen Expressway

Primarily invests in, constructs, operates, and manages toll highways and roads, as well as other urban and transportation infrastructure in the People’s Republic of China.

Slight risk second-rate dividend payer.

Market Insights

Community Narratives