- Hong Kong

- /

- Infrastructure

- /

- SEHK:357

The Hainan Meilan International Airport (HKG:357) Share Price Is Up 670% And Shareholders Are Delighted

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, Hainan Meilan International Airport Company Limited (HKG:357) has generated a beautiful 670% return in just a single year. And in the last month, the share price has gained 4.5%. It is also impressive that the stock is up 453% over three years, adding to the sense that it is a real winner.

It really delights us to see such great share price performance for investors.

See our latest analysis for Hainan Meilan International Airport

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, Hainan Meilan International Airport actually shrank its EPS by 28%.

Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Unfortunately Hainan Meilan International Airport's fell 14% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

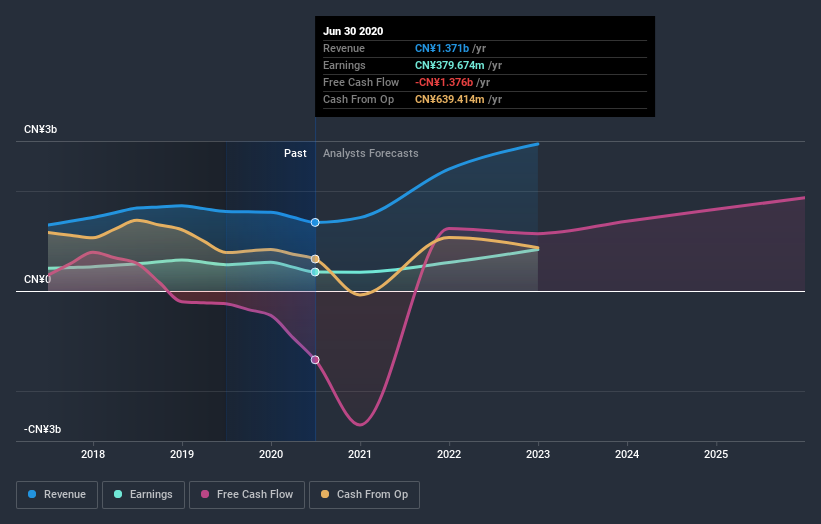

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that Hainan Meilan International Airport shareholders have received a total shareholder return of 670% over one year. That's better than the annualised return of 40% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Hainan Meilan International Airport has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Hainan Meilan International Airport, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Hainan Meilan International Airport, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hainan Meilan International Airport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:357

Hainan Meilan International Airport

Engages in the aeronautical and non-aeronautical businesses at the Haikou Meilan Airport in the People's Republic of China.

Reasonable growth potential and fair value.

Market Insights

Community Narratives