- Hong Kong

- /

- Infrastructure

- /

- SEHK:357

Hainan Meilan International Airport (HKG:357) Has Debt But No Earnings; Should You Worry?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hainan Meilan International Airport Company Limited (HKG:357) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Hainan Meilan International Airport

What Is Hainan Meilan International Airport's Net Debt?

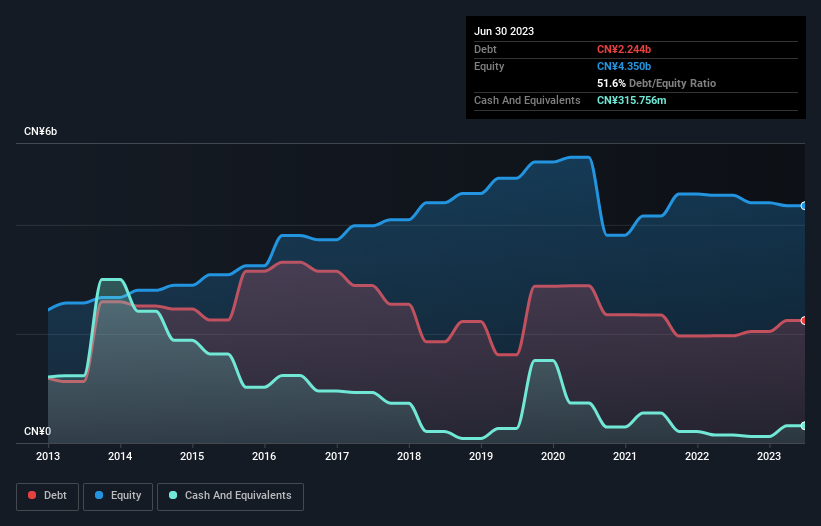

The image below, which you can click on for greater detail, shows that at June 2023 Hainan Meilan International Airport had debt of CN¥2.24b, up from CN¥1.96b in one year. However, it also had CN¥315.8m in cash, and so its net debt is CN¥1.93b.

How Healthy Is Hainan Meilan International Airport's Balance Sheet?

According to the last reported balance sheet, Hainan Meilan International Airport had liabilities of CN¥6.45b due within 12 months, and liabilities of CN¥1.27b due beyond 12 months. Offsetting these obligations, it had cash of CN¥315.8m as well as receivables valued at CN¥433.3m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥6.97b.

The deficiency here weighs heavily on the CN¥2.81b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Hainan Meilan International Airport would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Hainan Meilan International Airport can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Hainan Meilan International Airport wasn't profitable at an EBIT level, but managed to grow its revenue by 19%, to CN¥1.6b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months Hainan Meilan International Airport produced an earnings before interest and tax (EBIT) loss. Indeed, it lost CN¥155m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. For example, we would not want to see a repeat of last year's loss of CN¥194m. In the meantime, we consider the stock to be risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Hainan Meilan International Airport you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Meilan International Airport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:357

Hainan Meilan International Airport

Engages in the aeronautical and non-aeronautical businesses at the Haikou Meilan Airport in the People's Republic of China.

Reasonable growth potential and fair value.

Market Insights

Community Narratives