- Hong Kong

- /

- Infrastructure

- /

- SEHK:357

Hainan Meilan International Airport Company Limited (HKG:357) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Hainan Meilan International Airport Company Limited (HKG:357) shares have continued their recent momentum with a 27% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

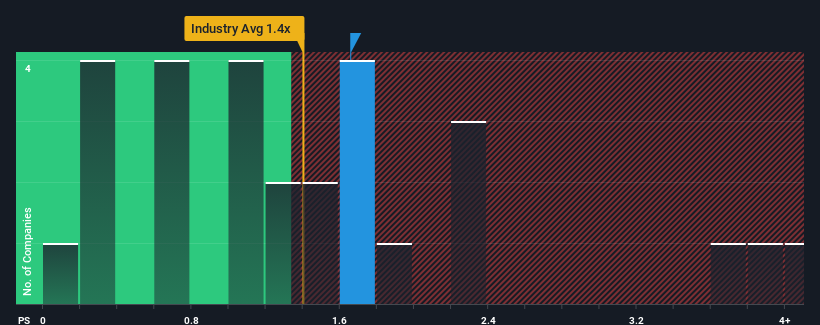

Although its price has surged higher, you could still be forgiven for feeling indifferent about Hainan Meilan International Airport's P/S ratio of 1.7x, since the median price-to-sales (or "P/S") ratio for the Infrastructure industry in Hong Kong is also close to 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Hainan Meilan International Airport

What Does Hainan Meilan International Airport's Recent Performance Look Like?

Hainan Meilan International Airport certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hainan Meilan International Airport.How Is Hainan Meilan International Airport's Revenue Growth Trending?

In order to justify its P/S ratio, Hainan Meilan International Airport would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 83% last year. The strong recent performance means it was also able to grow revenue by 52% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 15% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 13% per year, which is not materially different.

With this information, we can see why Hainan Meilan International Airport is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Hainan Meilan International Airport's P/S Mean For Investors?

Hainan Meilan International Airport appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Hainan Meilan International Airport maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Hainan Meilan International Airport.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Hainan Meilan International Airport, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hainan Meilan International Airport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:357

Hainan Meilan International Airport

Engages in the aeronautical and non-aeronautical businesses at the Haikou Meilan Airport in the People's Republic of China.

Reasonable growth potential and fair value.

Market Insights

Community Narratives