- Hong Kong

- /

- Infrastructure

- /

- SEHK:357

Cautious Investors Not Rewarding Hainan Meilan International Airport Company Limited's (HKG:357) Performance Completely

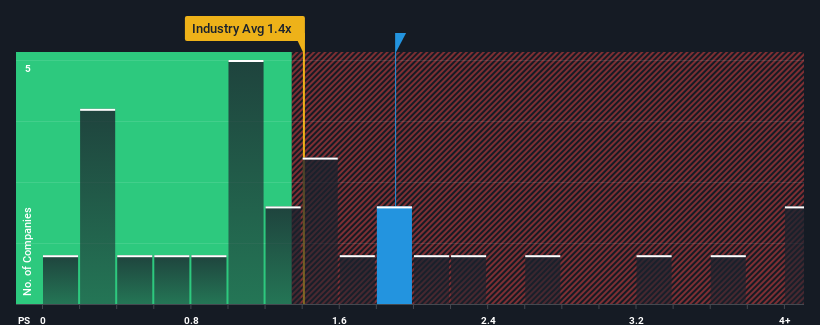

It's not a stretch to say that Hainan Meilan International Airport Company Limited's (HKG:357) price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" for companies in the Infrastructure industry in Hong Kong, where the median P/S ratio is around 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Hainan Meilan International Airport

What Does Hainan Meilan International Airport's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Hainan Meilan International Airport has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Hainan Meilan International Airport's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hainan Meilan International Airport's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The latest three year period has also seen a 16% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 55% during the coming year according to the six analysts following the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Hainan Meilan International Airport's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Hainan Meilan International Airport's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hainan Meilan International Airport currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 1 warning sign for Hainan Meilan International Airport that you should be aware of.

If you're unsure about the strength of Hainan Meilan International Airport's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Hainan Meilan International Airport, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hainan Meilan International Airport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:357

Hainan Meilan International Airport

Engages in the aeronautical and non-aeronautical businesses at the Haikou Meilan Airport in the People's Republic of China.

Reasonable growth potential and fair value.

Market Insights

Community Narratives