- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:351

Investors Appear Satisfied With Asia Energy Logistics Group Limited's (HKG:351) Prospects

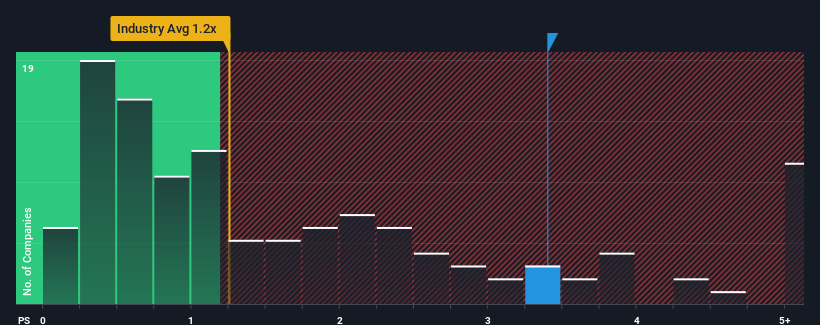

When you see that almost half of the companies in the Shipping industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.7x, Asia Energy Logistics Group Limited (HKG:351) looks to be giving off strong sell signals with its 3.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Asia Energy Logistics Group

How Has Asia Energy Logistics Group Performed Recently?

Asia Energy Logistics Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Asia Energy Logistics Group's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Asia Energy Logistics Group?

Asia Energy Logistics Group's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 100% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 294% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to decline by 19% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we can see why Asia Energy Logistics Group is trading at a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Asia Energy Logistics Group revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Asia Energy Logistics Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:351

Asia Energy Logistics Group

An investment holding company, provides shipping and logistics services in the People’s Republic of China.

Flawless balance sheet very low.

Market Insights

Community Narratives