- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:351

Asia Energy Logistics Group Limited (HKG:351) Shares Slammed 44% But Getting In Cheap Might Be Difficult Regardless

The Asia Energy Logistics Group Limited (HKG:351) share price has fared very poorly over the last month, falling by a substantial 44%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

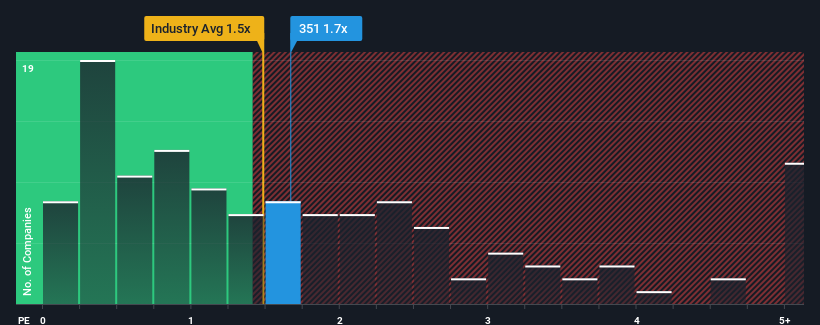

In spite of the heavy fall in price, you could still be forgiven for thinking Asia Energy Logistics Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in Hong Kong's Shipping industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Asia Energy Logistics Group

What Does Asia Energy Logistics Group's Recent Performance Look Like?

Asia Energy Logistics Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Asia Energy Logistics Group's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Asia Energy Logistics Group?

In order to justify its P/S ratio, Asia Energy Logistics Group would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. The latest three year period has also seen an excellent 200% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Asia Energy Logistics Group's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Asia Energy Logistics Group's P/S

Asia Energy Logistics Group's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Asia Energy Logistics Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Asia Energy Logistics Group you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:351

Asia Energy Logistics Group

An investment holding company, provides shipping and logistics services in the People’s Republic of China.

Flawless balance sheet very low.

Market Insights

Community Narratives